EURUSD Scalp Levels Heading Into ECB, NFP- Longs Favored Above 1.1065

DailyFX.com -

Talking Points

EURUSD posts 2% rally into initial resistance zone

Updated targets & invalidation levels heading into ECB / June trade

EUR/USD Daily

Chart Created Using FXCM Marketscope 2.0

Technical Outlook

EURUSD breaches above ML resistance- Now tracking confluence resistance into 1.12

Today’s 2% rally marks 2nd largest daily advance since July 1st2010- bullish

Breach higher targets confluence resistance at 1.1312

Subsequent topside objectives at 1.1376/90 & 1.1466/74

Support 1.1065 backed by MLP extending off April low ~1.0920/30 (broader bullish invalidating)

Daily RSI reversal ahead of 40- close today above 50- constructive

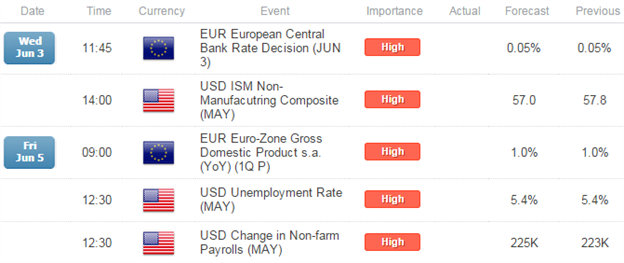

Key Event Risk Ahead: ECB,US ADP Employment & ISM Non-Manufacturing tomorrow, Eurozone1Q GDP & Non-Farm Payrolls on Friday

EUR/USD 30min

Notes:The EURUSD made a break of the weekly opening range high at 1.0992 with the breach taking out a median-line (ML) dating back to the April highs before completing a full 1.618% extension off the lows into 1.1189. Near-term resistance extends into the 1.1218 (bearish invalidation) with a breach above targeting the ML extending off yearly lows & 1.1313/23.

Interim support rests at 1.1130 with our near-term bullish invalidation level set at the highlighted region into 1.1065. A break below this mark shifts the focus back to the short-side targeting 1.0993 & the weekly lows / MLP support.

Bottom line: looking to buy pullbacks / resistance triggers while above 1.1065 with a breach above 1.1218 targeting subsequent resistance objectives. Look for more volatility heading into the close of the week with the ECB interest rate decision & U.S. Non-Farm Payrolls highlighting the economic docket.

For updates on this scalp and more setups throughout the week subscribe to SB Trade Desk

Relevant Data Releases

Other Setups in Play:

Scalp Webinar: Key Levels on USD Crosses in Focus Ahead of NFP

USDJPY Breakout Testing Initial Resistance Ahead of U.S. GDP

AUDUSD Testing Key Support- Short Scalps Vulnerable Above 7680

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex,contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFXat 12:30 GMT (8:30ET)

Interested in learning about Fibonacci? Watch this Video

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance