Euro slides and Renzi resigns as the future ahead of Italy remains unclear

Italian Prime Minister, Matteo Renzi, publicly announced his commitment to his vow to resign after suffering a heavy defeat in his constitutional referendum on Sunday.

Meanwhile, the event created turbulence in the markets and the Euro slid to a 20-month low against the U.S. currency. Some even argued that this political event could be even larger than Brexit.

Source: Call Levels

A constitutional referendum central to Renzi’s vision for Italy

What is the referendum about and why is Renzi putting in such a high stake?

Soon after he was sworn into office in 2014, he pledged a reform to the 1948 constitution, under which both chambers in Italy – Chamber of Deputies and the Senate – have equal powers under “perfect bicameralism”.

This constitution requires every proposed legislation and policy to be agreed upon by both chambers before it can be passed.

Source: Call Levels

Albeit a democratic system, Renzi faced large difficulties in pushing things through and essential policies took a significant amount of time to be passed.

Analysts pointed out an example where a legislation, granting children born out of wedlock the same legal entitlement as children of married parents, took close to 43 months to be approved.

Renzi proposed to cut the number of Senators from 315 to 100, essentially slashing the power of the Senate, who would then have deciding power only in major events such as constitutional reforms and changes to the European Union (EU) agreements.

He declared a referendum on this proposed reform and vowed to resign if he loses the vote. Experts, however, cautioned that this could grant Renzi much more power in office.

A priority on his list and a big reason why he pushed for such a reform is his rescue plan for the Italian economy and banks.

The Italian economy, being the third largest in the euro-zone had deteriorated largely after the recent recession.

Analysts noted that the 14 largest banks in Italy are laden with 286 billion Euros worth of what the European Central Bank calls “non-performing exposure” and collectively, they require at least 20 billion Euros to prevent potential defaults and bankruptcy. A “no” vote would hence terminate this grand plan of his.

“Extraordinary clear” defeat

Source: Call Levels

“I have lost and I say it out loud.”

“I assume all the responsibility of the defeat”

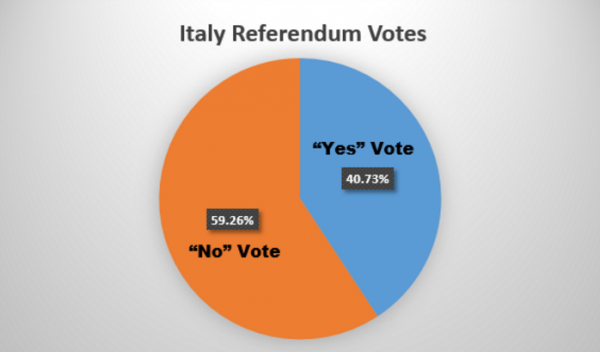

Finally, the Italians took their vote yesterday. 59.26% of citizens voted against Renzi and his proposed reforms. Earlier yesterday, Renzi spoke to the news conference and confirmed that he would tender his resignation today.

Sliding Euro and bank stocks

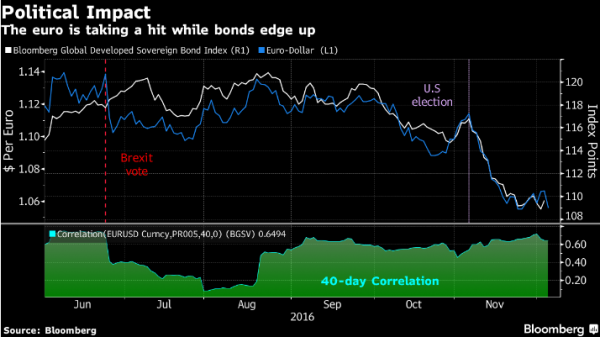

This news shook the national and international markets instantly. In fact, the Italy stock index has been declining in November, with investors expecting Renzi’s defeat.

The Euro dropped severely during the course of the referendum. Analysts from Bloomberg reported that the Euro has plummeted by 1.1% to $1.0552 as of 1:50 p.m. in Tokyo to its lowest level since March 2016. It has also weakened against other major currencies including the Sterling Pound and Japanese Yen.

Source: Call Levels

Italian banks were among the biggest losers as the ‘No’ vote disrupted Renzi’s plan to save them from the banking crisis. Banca Monte dei Paschi di Siena, Italy’s third largest and world’s oldest operating bank is looking to raise 5 billion Euros to prevent default.

However, sceptical investors may be less willing to fork out money in light of the political and economic instability in Italy. In fact, its stock has declined by 80% this year.

Economy Minister Pier Carlo Padoan correctly predicted that there would be “48 hours of turbulence“. The government is in the midst of discussion with the European commission on a possibility of a bailout. Otherwise, the banks may collapse entirely.

What is in store for Italy?

The future ahead for Italy is uncertain. Sergio Mattarella, Italy’s President, could either form a new government with the current parliamentary members or call for premature general elections to appoint the next Premier.

In any case, Five Star Movement Party (M5S), the political party that has aggressively campaigned for the “No” vote, would be expected to gain a large advantage in the political arena of Italy.

Generally considered as populist and Eurosceptic, Beppe Grillo, the comedian turned politician who founded the party, has also been a strong advocate for leaving the EU.

Analysts reported that a referendum similar to the one that led to Brexit would be called if Grillo takes office in the elections. This would further weaken the EU and spark off another round of instability and reforms in Italy and within the region.

The strengthening of the U.S. dollar has also almost confirmed the speculation that the Federal Reserve would raise interest rates this month.

However, the current instability in Italy that could spread regionally and internationally may paint a pessimistic picture for the global economy.

Just like how the Fed had delayed their increase in rates earlier this year in response to Brexit, the referendum might very well lead to a delay in the federal rate hike once again – adding on to the list of black swan events this year.

A wave of populism sweeping across top economies

After Brexit and Donald Trump’s election victory, many have argued that Renzi’s loss is largely expected. When Renzi was first elected, he made many glorious promises and proposed many ambitious reforms.

His failure to materialise them have caused many Italians to lose faith and this could be another reason why they voted against Renzi.

Source: Call Levels

People around the world are clearly disgruntled and dissatisfied. They have casted their votes and spoke up in protest.

This phenomenon has led to three major black swan events this year – Brexit, Trump’s victory and Renzi’s defeat – all of which have created a wave of instability in the global economy, especially in the Euro currency.

What might happen next for Italy is anybody’s guess.

Visit Call Levels website at https://www.call-levels.com/.

(By Call Levels)

Related Articles

- How Trump as president-elect will affect Singapore’s economy

- Will Brexit Affect Singapore’s Economy?

- How can ASEAN cope with a slowing Chinese economy?

Yahoo Finance

Yahoo Finance