ETFs in Focus as Singapore GDP Exceeds Expectations

Singapore’s GDP grew 3.6% year over year in the fourth quarter of 2017, below 5.5% growth registered in the previous quarter. The latest revised figure however surpassed the initial reading of 3.1% issued by the Ministry of Trade and Industry (MTI).

Singapore’s economy grew 2.1% sequentially, above a Bloomberg survey forecast of 2% but lower than the initial estimate of 2.8%. Moreover, the South East Asian nation grew 3.6% in 2017 compared with 2.4% in the prior year.

What’s Driving Growth?

Given that Singapore’s economy is largely trade dependent, improvement in manufacturing sector significantly contributed to GDP growth. Moreover, trade and finance are expected to receive a significant boost from global recovery. Global economic activity seems to be picking up as the International Monetary Fund (IMF) estimates 3.9% growth in 2018 and 2019.

Singapore’s manufacturing data has been strong for 2017, driven by strong expansion in the electronics sector owing to demand for semiconductors. On a year-over-year basis, the manufacturing sector grew 10.1% in 2017 compared with 3.7% in the prior year. However, Q4 manufacturing data showed clear signs of slowing down, as it expanded 4.8% year over year compared with 19.1% in the prior quarter.

Accounting for around two-thirds of the Singapore economy, the services sector grew 2.8% in 2017 compared with 1.4% in the prior year. However, the construction sector slowed down on a decline in private residential and industrial work. It contracted 8.4% in 2017 against 1.9% growth in the prior year.

Monetary Policy and Wall Street Impact

Although the global exports boom has benefited the city state, rising protectionism across the world might weigh on the trade outlook. Moreover, faster-than-expected rate increases by the Federal Reserve might prompt the Monetary Authority of Singapore (MAS) to change monetary policy.

The MAS decides on the monetary policy by managing the trade-weighted exchange rate index. It is the only country in the developed world that does not rely on short-term interest rate changes to conduct monetary policy changes.

Having eased three times since January 2015, the MAS adopted a neutral stance on the monetary policy in its last meeting in October. Jacqueline Loh, deputy managing director of the MAS stated that inflation forecasts have not changed since the last MAS meeting and the stance on monetary policy remains same.

We will now discuss a few ETFs providing exposure to Singapore (see all the Asia Pacific ETFs here).

IShares MSCI Singapore Capped ETF EWS

This fund focuses on Singapore equities and is the most popular option for exposure to the economy.

The fund has AUM of $683.1 million and charges 49 basis points in fees per year. Financials, Industrials and Real Estate are the top three sectors of the fund, with 42.8%, 19.1% and 17.0% allocation, respectively (as of Feb 12, 2018). DBS Group Holdings Ltd, Oversea-Chinese Banking Ltd and United Overseas Bank Ltd are the top three holdings of the fund, with 16.4%, 12.5% and 11.2% allocation, respectively (as of Feb 12, 2018). The fund has returned 18.9% in a year. EWS has a Zacks ETF Rank 3 (Hold) with a Low risk outlook.

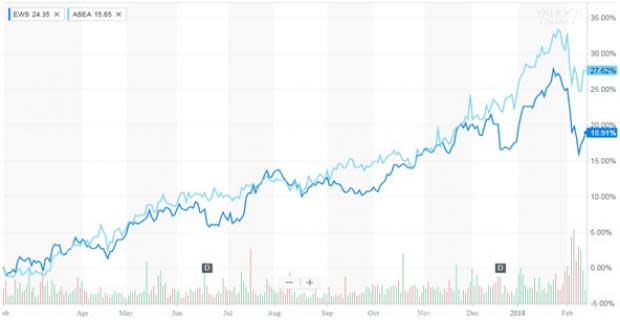

We will now compare the performance of EWS to a broader South East Asian ETF, ASEA.

Global X Southeast Asia ETF ASEA

This fund provides broad exposure to the five members of the Association of Southeast Asian Nations, namely, Singapore, Indonesia, Malaysia, Thailand and the Philippines. It is appropriate for investors looking for diversified exposure to South East Asia.

ASEA is less popular with AUM of $18.9 million and charges a fee of 65 basis points a year. From a geographical perspective, the fund has 30.7% exposure to Singapore, 22.3% to Thailand, 21.4% to Malaysia, 19.1% to Indonesia and 6.5% to the Philippines (as of Dec 31, 2017). Financials, Telecommunication Services and Consumer Staples are the top three sectors of the fund, with a 47.9%, 13.7% and 7.9% allocation, respectively (as of Dec 31, 2017). DBS Group Holdings Ltd, Oversea-Chinese Banking Ltd and United Overseas Bank Ltd are the top three holdings of the fund, with an allocation of 8.7%, 7.2% and 6.0%, respectively (as of Feb 12, 2018). The fund has returned 27.6% in a year. ASEA has a Zacks ETF Rank #3 with a Medium risk outlook.

Below is a chart comparing the one-year performance of the two funds.

Source: Yahoo Finance

Want key ETF info delivered straight to your inbox?

Zacks’ free Fund Newsletter will brief you on top news and analysis, as well as top-performing ETFs, each week. Get it free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ISHRS-MS SNGPRE (EWS): ETF Research Reports

GLBL-X SE ASIA (ASEA): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Yahoo Finance

Yahoo Finance