Eni (E) Begins Vegetable Oil Export From Kenya's Agri-hub

Eni SPA E began exporting its first set of vegetable oil for bio-refining, enhancing the possibilities of its production center in Makueni.

The company shipped the cargo to its Gela bio-refinery in Sicily. Production from the refinery is expected to reach 2,500 tons by the end of this year, with a target to rapidly expand production to 20,000 tons by 2023.

In July, Eni started producing the first vegetable oil from its Makueni agri-hub for bio-refineries in Kenya. The agri-hub processes castor, croton and cottonseeds to extract vegetable oil for biofuel production.

Biofuels have biodegradable substances like vegetable oils mixed with fuels such as diesel to reduce pollution. Biofuel production is part of the global transition to cleaner energy amid the urgency to reduce emissions that have significantly polluted the environment. Hence, biorefining is a crucial component in the company’s path to net-zero emissions by 2050.

Eni also began exporting the Used Cooking Oil (“UCO”) obtained from hotel chains, restaurants and bars in Nairobi through an ongoing project. The project supports the recycling culture, promoting awareness of the environment and health benefits, and generating income from waste.

Eni intends to cover 35% of its biorefineries’ supply by 2025 due to the vertical integration of the agri-feedstock, and waste and residue chain. This will allow the company to obtain volumes of vegetable oil amid the challenging circumstances based on prices, rising energy demand and availability of sustainable oils.

Eni has been contributing to Kenya’s growth since 2013 with offshore exploration activities in the Lamu Basin. The latest shipment demonstrates the testing phase of Kenya’s bid to produce aviation fuel and hydrogenated vegetable oil diesel, and reduce its dependence on fossil fuels.

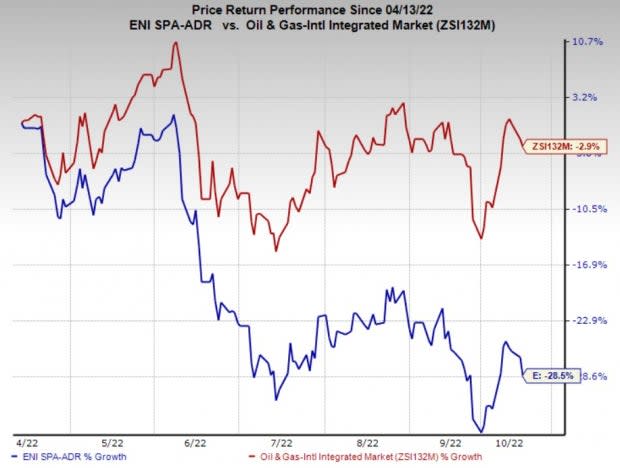

Price Performance

Shares of Eni have underperformed the industry in the past six months. The stock has lost 28.5% compared with the industry’s 2.9% decline.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Eni currently carries a Zack Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that presently flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Exxon Mobil Corporation XOM is one of the leading integrated energy companies in the world. At the end of second-quarter 2022, XOM’s total cash and cash equivalents were $18.9 billion, and long-term debt was $39.5 billion. The firm has significantly lower debt exposure than other integrated majors.

ExxonMobil has witnessed upward earnings estimate revisions for 2022 and 2023 in the past 30 days. The company has a Zacks Style Score of A for Value, Growth and Momentum. XOM is expected to see earnings growth of 144.2% for 2022.

Cactus Inc. WHD is involved in manufacturing, designing and selling wellhead and pressure-control equipment. At the second-quarter end, Cactus had cash and cash equivalents of $311.7 million, which can provide it with immense financial flexibility. WHD has a strong balance sheet. Per the company, it had no bank debt outstanding as of Jun 30, 2022.

Cactus has witnessed upward earnings estimate revisions for 2022 and 2023 in the past 30 days. The company beat the Zacks Consensus Estimate for earnings in the prior three quarters and met the same once, delivering an earnings surprise of 12.7%. WHD is expected to see earnings growth of 143% in 2022.

Valero Energy Corporation VLO is the largest independent refiner and marketer of petroleum products in the United States. Valero is best placed to reap profits from solid refining margins, mainly owing to the strategic refinery structure that enables it to use cheaper oil for more than half of its needs.

Valero has witnessed upward earnings estimate revisions for 2022 and 2023 in the past 30 days. The company currently has a Zacks Style Score of A for Value, Growth and Momentum. VLO is expected to see earnings growth of 880.4% for 2022.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Eni SpA (E) : Free Stock Analysis Report

Valero Energy Corporation (VLO) : Free Stock Analysis Report

Cactus, Inc. (WHD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance