Empire State Realty Trust Inc. (ESRT) Q1 2024 Earnings: Aligns with Analyst Projections

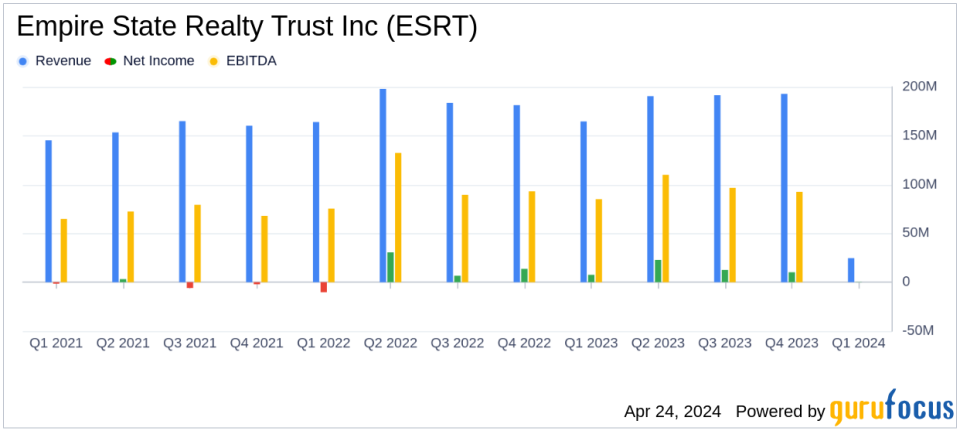

Net Income: Reported at $5.66 million for Q1 2024, which exceeded the estimated $0.65 million.

Revenue: Reached $181.18 million, surpassing the quarterly estimate of $174.38 million.

Earnings Per Share (EPS): Achieved $0.03 per fully diluted share, aligning with disclosed figures.

Occupancy Rates: Commercial portfolio occupancy increased to 87.6% from 86.3% at the end of the previous quarter.

Leasing Activity: Signed leases for 248,000 rentable square feet, indicating robust demand for space.

Observatory Revenue: Grew to $24.6 million with a 13% year-over-year increase in net operating income (NOI).

Liquidity and Debt: Maintained strong liquidity at $834 million and closed a new $715 million credit facility, enhancing financial stability.

On April 24, 2024, Empire State Realty Trust Inc. (NYSE:ESRT) disclosed its first-quarter financial results through an 8-K filing. The New York City-focused real estate investment trust (REIT), renowned for its iconic Empire State Building, reported a net income of $5.66 million, translating to $0.03 per fully diluted share, aligning closely with analyst expectations of $0.65 million in net income for the quarter.

Empire State Realty Trust operates approximately 8.6 million rentable square feet of office space and 0.7 million rentable square feet of retail space, along with 727 residential units. The company emphasizes energy efficiency and indoor environmental quality in its portfolio, which is about 80% located in Manhattan.

Operational and Financial Highlights

The company's total revenue for the quarter stood at $181.18 million, surpassing the estimated $174.38 million, driven by robust rental and observatory revenues. Rental revenue increased to $153.88 million from $140.09 million in the previous year, and observatory revenue rose to $24.60 million, up from $22.15 million. This performance reflects a continued recovery in visitor numbers and tenant activities.

Empire State Realty Trust also reported significant leasing activity, signing 23 leases for a total of 248,108 square feet. Notably, the Manhattan office portfolio saw a lease execution of 235,664 square feet, indicating strong demand for premium office spaces. The companys total commercial portfolio occupancy increased to 87.6% from 86.3% year-over-year, showcasing effective property management and marketing strategies.

Strategic Financial Management

The company's balance sheet remains robust with $834 million in total liquidity, including $334 million in cash and $500 million available under a revolving credit facility. Notably, ESRT has no exposure to floating rate debt, which fortifies its financial stability against interest rate fluctuations. The company also strategically managed its debt portfolio, closing a new $715 million credit facility and entering into a private placement to issue $225 million of green senior unsecured notes.

Furthermore, ESRT continued its shareholder-friendly initiatives, paying a quarterly dividend of $0.035 per share and reaffirming its 2024 earnings outlook with a Core FFO per fully diluted share projected between $0.90 and $0.94.

Looking Ahead

Empire State Realty Trust reaffirmed its 2024 guidance, expecting steady growth in core FFO and maintaining robust occupancy rates. The company anticipates a net income attributable to common stockholders between $0.24 and $0.28 per share for the year. These projections reflect managements confidence in the companys operational strategy and market positioning.

Investors and stakeholders can access further details on the company's performance and strategic outlook in the updated investor presentation available on the ESRT website, and are invited to join the upcoming webcast and conference call to discuss these results.

Empire State Realty Trusts consistent performance, strategic financial maneuvers, and strong market presence in New York City make it a notable entity in the REIT sector, providing stability and potential growth opportunities for investors.

Explore the complete 8-K earnings release (here) from Empire State Realty Trust Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance