EMCOR Group Inc (EME) Q1 2024 Earnings Surpass Analyst Expectations with Strong Revenue and EPS ...

Quarterly Revenue: Reported at $3.43 billion, marking an 18.7% increase year-over-year, surpassing the estimate of $3.223 billion.

Diluted EPS: Achieved $4.17, representing a 79.7% increase from the previous year, significantly exceeding the estimated $2.84.

Net Income: Reached $197.1 million, substantially higher than the estimated $134.12 million.

Operating Income: Recorded at $260.0 million, or 7.6% of revenues, improving from $154.9 million or 5.4% of revenues in the prior year.

2024 Revenue Guidance: Increased to a range of $14.0 billion to $14.5 billion, up from the previous forecast of $13.5 billion to $14.0 billion.

2024 EPS Guidance: Raised to $15.50 - $16.50, from the earlier range of $14.00 - $15.00.

Remaining Performance Obligations: Grew to a record $9.18 billion, up 16.5% year-over-year, indicating strong future revenue potential.

On April 25, 2024, EMCOR Group Inc (NYSE:EME), a leading provider of construction and facilities services, released its first-quarter earnings for 2024, significantly outperforming analyst estimates. The detailed financial results are available in the company's recent 8-K filing.

Company Overview

EMCOR Group Inc is a specialty contractor in the United States, providing a wide range of construction and facilities services. These include electrical and mechanical construction, building services, and industrial services, primarily to commercial, industrial, utility, and institutional customers. The company operates through its numerous subsidiaries across various segments, with the majority of its revenue generated within the United States.

Financial Performance Highlights

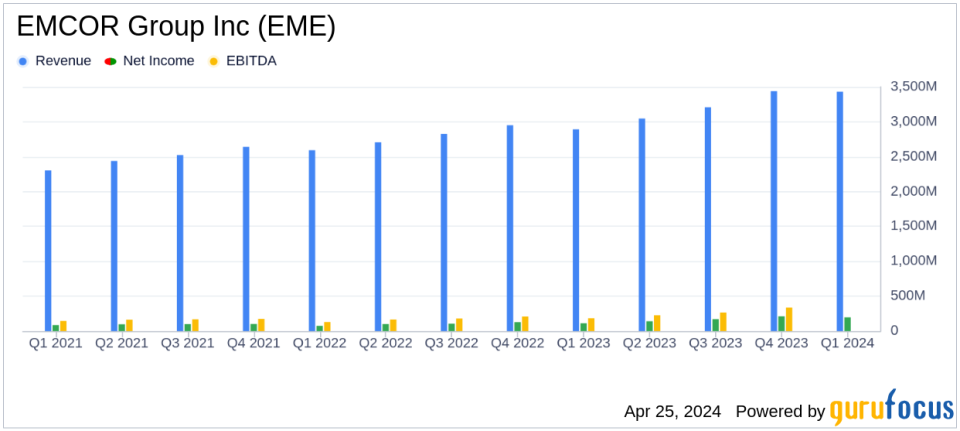

For Q1 2024, EMCOR reported revenues of $3.43 billion, marking an 18.7% increase from $2.89 billion in the same quarter the previous year. This performance notably exceeded the analyst revenue estimate of $3.22 billion. Diluted earnings per share (EPS) for the quarter stood at $4.17, up 79.7% year-over-year and surpassing the estimated EPS of $2.84.

Net income for the quarter was $197.1 million, significantly higher than the estimated $134.12 million. The company also reported an operating income of $260.0 million or 7.6% of revenues, improving from $154.9 million or 5.4% of revenues in Q1 2023. These figures reflect strong operational efficiency and profitability.

Strategic Achievements and Market Position

EMCOR's robust quarter was supported by record performance in its Electrical and Mechanical Construction segments, with notable revenue growth and operating margins. The company's Remaining Performance Obligations grew by 16.5% year-over-year to $9.18 billion, providing solid visibility for future revenues.

CEO Tony Guzzi highlighted the exceptional start to the year, driven by sustained momentum and significant increases in key financial and operational metrics. Guzzi's confidence in the company's trajectory is evident in the upward revision of the full-year 2024 revenue guidance to $14.0 billion - $14.5 billion and EPS guidance to $15.50 - $16.50.

"The Company had an exceptional start to the year, sustaining momentum throughout the first quarter and setting new records in key financial and operational metrics. Our confidence is reinforced by the significant year-over-year increase in our remaining performance obligations and a healthy project pipeline," stated Tony Guzzi, Chairman, President, and CEO of EMCOR.

Operational and Segment Analysis

The Electrical Construction segment saw an 18.6% revenue growth with a 12.0% operating margin, while the Mechanical Construction segment experienced a remarkable 32.4% organic growth, achieving a record first-quarter operating margin of 10.6%. The Industrial Services business also reported its best quarter post-pandemic, reflecting improved demand and successful project executions.

Financial Statements and Future Outlook

EMCOR's balance sheet remains strong with total assets of $6.69 billion as of March 31, 2024. The company continues to focus on balanced capital allocation, as demonstrated by recent acquisitions, share repurchases, and an increased dividend. Looking ahead, EMCOR is well-positioned to capitalize on market opportunities and deliver sustained value to its shareholders.

EMCOR's first-quarter performance sets a positive tone for 2024, underpinned by strategic growth initiatives and robust market demand. Investors and stakeholders can anticipate continued operational excellence and financial growth from the company in the upcoming quarters.

For more detailed information, investors are encouraged to review the full earnings report and listen to the earnings call, accessible through EMCOR's website at www.emcorgroup.com.

Explore the complete 8-K earnings release (here) from EMCOR Group Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance