EMA Accepts Rocket (RCKT) Gene Therapy Filing for Fanconi Anemia

Rocket Pharmaceuticals RCKT announced that the EMA accepted the marketing authorization application (MAA), seeking approval for RP-L102, an investigational gene therapy for fanconi anemia (FA).

FA is a rare genetic disorder that mainly affects the bone marrow. It is also marked by cancer predisposition and congenital malformations.

The MAA acceptance is based on data from a phase I/II study wherein FA patients treated with RP-L102 achieved sustained genetic and comprehensive phenotypic corrections combined with hematologic stabilization. The therapy was well-tolerated in study participants.

Rocket also reiterated its plans to submit a similar filing for RP-L102 with the FDA based on the above study. It expects to submit it by first-half 2024.

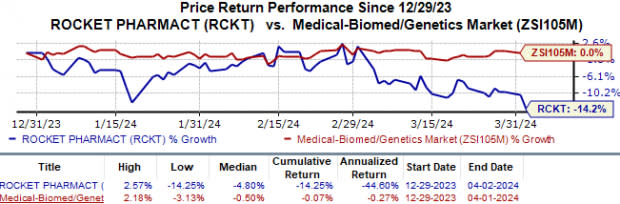

Year to date, Rocket’s shares have lost 14.3% compared with the industry’s 0.1% fall.

Image Source: Zacks Investment Research

Currently, the most effective form of treatment for FA is allogeneic hematopoietic stem cell transplant (HSCT). This risky procedure carries multiple side effects and also requires the use of chemotherapy. In the absence of allogeneic HSCT, the primary cause of death is bone marrow failure (BMF), which typically occurs during the first decade of life.

Devoid of marketed products, Rocket is entirely dependent on its pipeline development for growth. The company is focused on developing its gene therapy pipeline, which is targeted at multiple cardiovascular (CV) and hematology indications.

Apart from RP-L102, the company is nearing the PDUFA date of Jun 30 set by the FDA for the BLA filing seeking approval for Kresladi as a potential gene therapy for severe leukocyte adhesion deficiency-I (LAD-I).

Apart from Kresladi and RP-L102, Rocket is also evaluating a third gene therapy candidate in hematology, namely RP-L301. Management is in the process of starting a pivotal mid-stage study on RP-L301 in patients with pyruvate kinase deficiency (PKD).

With regard to CV indications, Rocket is also developing adeno-associated virus (AAV) gene therapies to target mutations or defects in different genes. The most advanced AAV-based candidate in the company’s pipeline is RP-A501, which is in a mid-stage study to treat Danon disease (DD).

Another AAV-based gene therapy candidate is RP-A601, which is in early-stage development for arrhythmogenic cardiomyopathy (ACM). Rocket also plans to start clinical studies on a new gene therapy candidate for treating dilated cardiomyopathy (DCM) later this year.

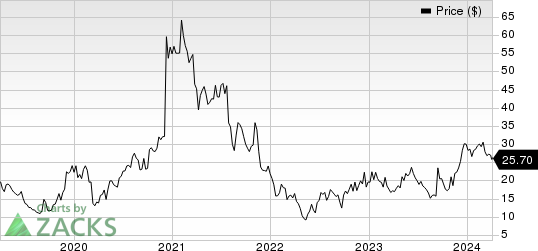

Rocket Pharmaceuticals, Inc. Price

Rocket Pharmaceuticals, Inc. price | Rocket Pharmaceuticals, Inc. Quote

Zacks Rank & Key Picks

Rocket currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the overall healthcare sector include ADMA Biologics ADMA, ANI Pharmaceuticals ANIP and Ligand Pharmaceuticals LGND,each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for ADMA Biologics’ 2024 earnings per share (EPS) have risen from 22 cents to 30 cents. During the same period, EPS estimates for 2025 have improved from 32 cents to 50 cents. Year to date, shares of ADMA have risen 42.5%.

Earnings of ADMA Biologics beat estimates in three of the last four quarters while meeting the same on one occasion. ADMA delivered a four-quarter average earnings surprise of 85.00%.

In the past 60 days, estimates for ANI Pharmaceuticals’ 2024 EPS have risen from $4.06 to $4.43. Meanwhile, during the same period, EPS estimates for 2025 have improved from $4.80 to $5.04. Year to date, shares of ANIP have risen 21.0%.

Earnings of ANI Pharmaceuticals beat estimates in each of the last four quarters. ANI delivered a four-quarter average earnings surprise of 109.06%.

In the past 60 days, Ligand Pharmaceuticals’ earnings estimates per share for 2024 have increased from $4.42 to $4.56. During the same period, earnings estimates for 2025 have risen from $5.11 to $5.20. Year to date, shares of Ligand Pharmaceuticals have gained 2.5%.

Ligand Pharmaceuticals’ earnings beat estimates in each of the trailing four quarters. On average, LGND’s four-quarter earnings surprise was 84.81%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

ANI Pharmaceuticals, Inc. (ANIP) : Free Stock Analysis Report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report

Rocket Pharmaceuticals, Inc. (RCKT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance