All About ’em Cheques – How Can You Protect Yourself

Ever received a huge windfall in cheque and felt like you almost as vulnerable as holding cash?

Someone in our #SeedlyCommunity was actually one of the First Prize winners of the recent $12 million TOTO Hongbao Draw, bagging about $6 million home! Imagine picking up the cheque from the Headquarters, how vulnerable must he have felt?

Read More: We wanted to hack the TOTO Hong Bao Draw with statistics. Here’s what we found out!

*Editor’s Note: Singapore Pools does take their own precaution by printing “A/C payee only”, therefore, only the named person can receive payment.

Maybe we are not all that lucky but some of us do receive our payslip or payment from clients in cheque-form so in order to protect ourselves,

Here are some tips on how you can read and write your cheque!

Some terminology that you should familiarise yourself with first:

Encash – changing the cheque for cash over the counter.

Bounce – cannot be processed and returned to you by the bank.

A/C – short-form for ‘Account’.

How to write a cheque / Issue a cheque

Like every (serious) form that is required of you to fill up, requires you to:

Write in non-erasable blue or black ink;

Write legibly, in CAPITAL letters (preferably)

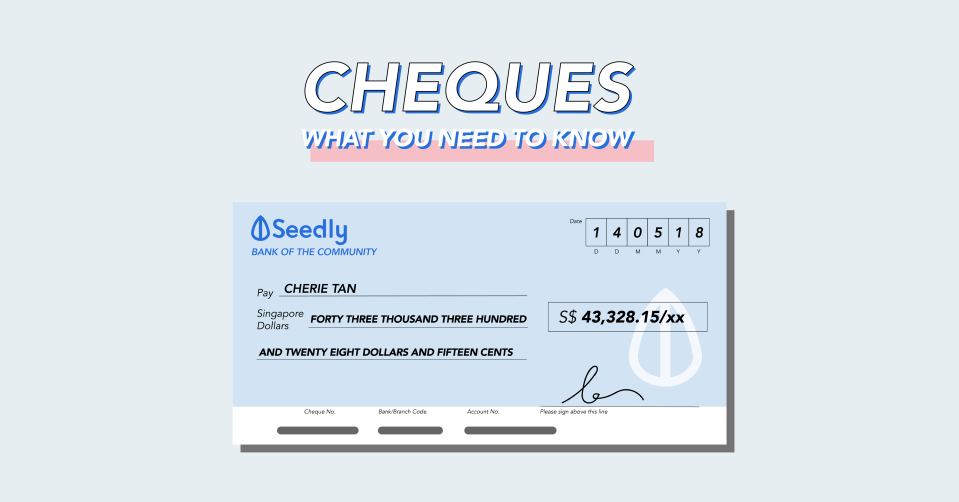

One: “Pay”

Write the full name of the person you are paying to as per their bank records.

Two: “Or Bearer”

Cross out: If payment is meant for the named person in One (above) only.

Don’t cross out: Any person holding the cheque is able to encash the cheque by presenting the cheque to the counter.

Three: “Singapore Dollars”

Spell out the amount in words, clearly and correctly. It is Forty, not Fourty.

Write “only” at the end of it after spelling it all out.

e.g. Forty Thousand Three Hundred and Twenty-Eight Dollars and Fifteen Cents Only

Four: “S$” box

The amount in numbers.

Use commas when dealing with large numbers.

e.g. $43,328.15 /xx

The amount in part three and four must be the same. If not the cheque will bounce – cannot be processed and returned to you by the bank.

Five: Crossed cheque

Cross your cheque at the top-left hand corner if you do not want your cheque to be encashed, meaning exchanged for cash at the counter.

If you want it to be non-transferrable, add “A/C payee only” or “Account payee only”.

Six: Date

Day Month Year, in the boxes provided

Do not write a future date, else your cheque will bounce.

Seven: Signature

Sign the cheque with the same signature in your bank records.

Sign your signature above the line provided.

Important: If you have made any mistakes on your cheque, cancel it neatly (with a line) and sign your full signature next to it.

Issue a CASH cheque

At One: On the Pay line, write Cash.

Do not cross the cheque or cancel the “or bearer”.

Insufficient Fund Charges

Bounced cheque sounds fun but it really isn’t for both the issuer and the recipient.

According to POSB, returned cheque fees are imposed on:

Overdraft interest will be charged for:

Insufficient Funds

Effects Not Cleared

Exceeds Arrangement

Awaiting Banker’s Confirmation

Different banks might charge you for insufficient funds differently, it is very important to double even triple check!

How To Deposit Your Cheque

Ok, we should all know this! If you don’t no worries, we all started off not knowing. Some details you need:

Full name, as per your bank’s records

Bank account number

Your Contact number

Write them in the space provided at the back of the cheque before depositing them.

How Can You Protect Yourself?

If you don’t want to give the holder of the cheque the liberty to encash the cheque or the cheque is only meant for the named person,

You should:

Cross the cheque by drawing two parallel lines across the top-left corner; and

Cancel the words “or bearer”; and

Add “A/C Payee Only”.

If the cheque is crossed without canceling “or bearer”, the cheque can be deposited into anyone’s bank account but cannot be encashed.

Doing so protects yourself if you were to lose your cheque or have your cheque stolen. The person that found or stole your cheque will be unable to encash it for themselves!

If you are the next TOTO HongBao Draw winner or your own version of TOTO winnings in cheque, do take note of these tips to protect that jackpot.

*Editor’s Note: Singapore Pools does take their own precaution by printing “A/C payee only”, therefore, only the named person can receive payment.

The post All About ’em Cheques – How Can You Protect Yourself appeared first on Seedly - Get Rich Or Die Tryin'

Yahoo Finance

Yahoo Finance