The election did not change the story for the U.S. economy

The rocky month for the stock market and a bitter midterm election cycle did not shake U.S. consumers.

These events also did not change the biggest story for the U.S. economy as we approach 2019, which is that amid concerns over higher rates, stock market volatility, and the negative impacts from tariffs, consumer spending should remain solid. And when consumers are in good shape, it is hard for the economy to roll over.

On Friday, the University of Michigan released its latest reading on consumer sentiment, which included some responses gathered the day after this week’s midterm elections; responses collected after the election were in-line with those gathered beforehand, indicating a consensus election results did not move consumers to change their economic outlook.

“The unchanged data meant that the Sentiment Index remained higher thus far in 2018 (98.4) than in any prior year since 2000,” said Richard Curtin, chief economist for the survey. “The stability of consumer sentiment at high levels acts to mask some important underlying shifts. Income expectations have improved and consumers anticipate continued robust growth in employment, but consumers also anticipate rising inflation and higher interest rates.” (Emphasis ours.)

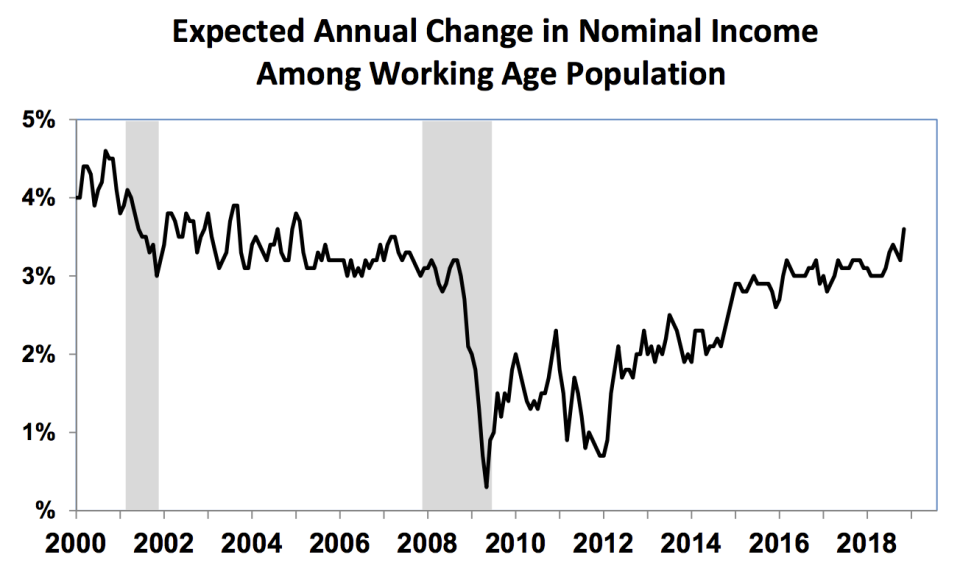

Friday’s data from the University of Michigan notably showed that expectations for wage increases over the next year from the working-age population, which covers those between the ages of 25 and 54, are now at their highest level since February 2005. More money in pockets of consumers means more money spent by consumers. A positive for overall economic growth.

In October, average hourly earnings growth hit 3.1%, the fastest pace of wage gains for workers since 2009. And with survey data suggesting that consumers remain both confident overall and expect their wages to rise, the consumer spending engine that accounts for 70% of overall GDP growth would appear likely to remain in good shape.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Yahoo Finance

Yahoo Finance