Economists pan Trump trade policy as 'terrible,' risks ending economic expansion

U.S. President Donald Trump’s latest trade tariff proposals have some economists questioning whether the president and his team understand economics.

Trump doubled down Friday on his proposal to add a 25% tariff on steel imports and a 10% tariff on aluminum imported to the United States from other countries, a move that prompted a sell-off in U.S. equities and the dollar after it was announced on Thursday.

“This is a clear demonstration that the Trump administration does not understand trade economics,” said Bernard Baumohl, managing director and chief global economist at the Economic Outlook Group, in a phone interview. “These tariffs when they’ve been imposed in the past have done more harm than good. The problem is that politicians have an ahistorical memory that goes back sometimes to breakfast.”

The European Union, Canada and other nations have already declared they will retaliate if the tariffs become law. One EU official even called the proposals a “declaration of war.”

The proposal has generally been panned by economists and market analysts who see this latest endeavor as Trump playing politics rather than boost the economy.

“I think it will be ineffective in the long run,” Thomas Simons, money market economist at Jefferies & Co. told Yahoo Finance. “Trump has a point about having smart trade relationships and not being put in extremely disadvantageous position but this is more of a blunt way of going about it than would be effective.”

Job losses could be much worse than job gains

Economists have also noted that in the United States there are substantially more industries and workers that rely on steel as an input than are actual manufacturers of the metal.

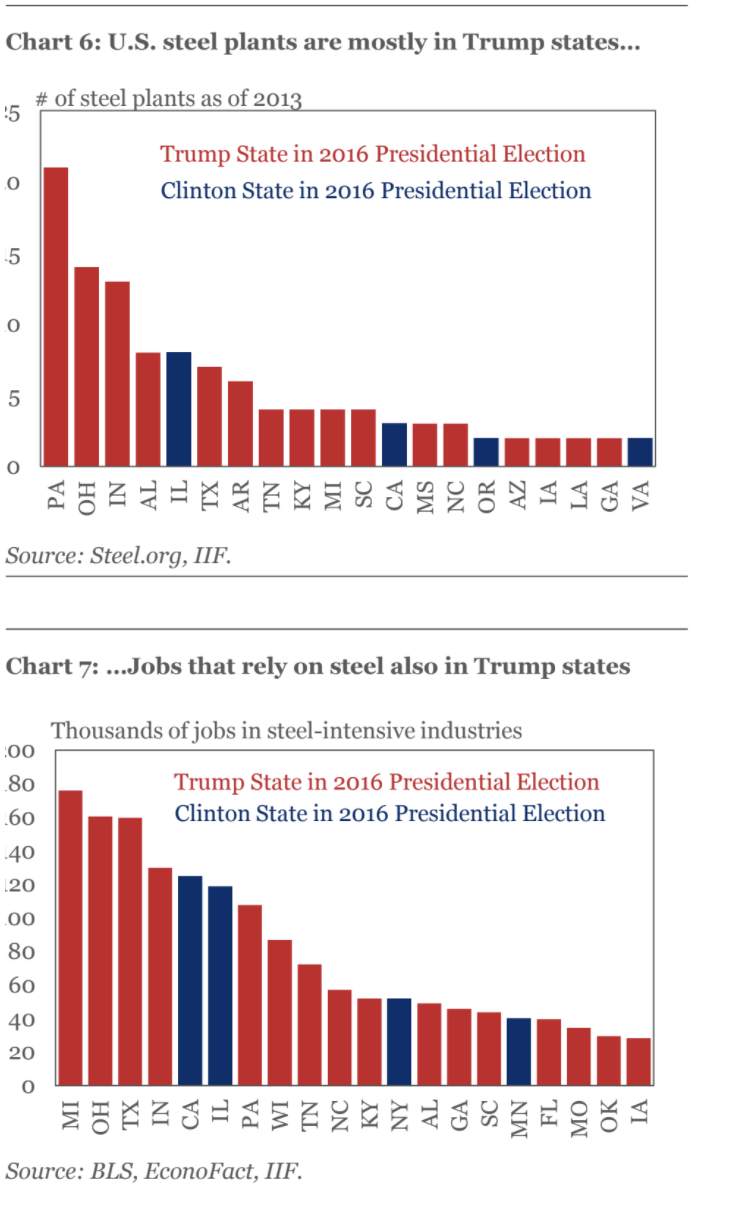

The Institute of International Finance points out that, as with many manufacturing industries, technology has been replacing human jobs in metal production for years. They estimate the steel and aluminum manufacturing sectors only account for about 150,000 jobs. On the other hand, there are nearly 2 million jobs across the country in steel-intensive industries where steel is at least 5% of input requirements, including the auto sector, construction, appliance and machinery manufacturing. Those will see input costs rise.

“Companies may be forced to maintain costs via job cuts, putting jobs located in Trump states at risk,” IIF Managing Director Kristen Silverberg and Senior Analyst, Political Risk Scott Farnham wrote in a policy note.

Tom Porcelli, chief U.S. economist at RBC Capital Markets, separately estimates that the steel industry employs more people – about 415,000 – in primary metal manufacturing and the metal ore mining businesses. However, he also estimates that consumers of steel, or companies that use and buy steel as a function of their business employ 16 times as many workers.

While he notes that the negative impact from these tariffs on so-called downstream industries is difficult to predict, he says it is “rather obvious” that the ratio of winners to losers in a scenario where the price of steel and aluminum rise is extremely skewed to the downside for the broader economy.

“In plain language these tariffs are a terrible idea,” Porcelli said in a note to clients. “In fact it is such a terrible idea that there was talk amongst the GOP today about pulling some of the President’s unilateral trade authority.”

Worse than just hitting individual employees and select industries, Baumohl, the Economics Outlook Group economist, argues that it could jeopardize the economy as a whole.

“Ultimately,” Baumohl said, “what this policy does is put the entire economic expansion at risk.”

But maybe that’s exactly what the President and his administration want to do.

“If you want to rein in the third-longest economic expansion since the end of WWII, crimp profits at a time when stock market valuations have been called into question by rising interest rates, force consumers to withstand price increases and put millions of metals-reliant and other jobs at risk, the president’s stated intention of placing costly tarriffs on imported steel and aluminum is an effective way to start,” Bankrate economist Mark Hamrick said.

—

Dion Rabouin is a markets reporter for Yahoo Finance. Follow him on Twitter: @DionRabouin.

Follow Yahoo Finance on Facebook, Twitter, Instagram, and LinkedIn.

Yahoo Finance

Yahoo Finance