Ecolab (ECL) Q1 Earnings Surpass Estimates, Margins Rise

Ecolab Inc. ECL reported first-quarter 2024 adjusted earnings per share (EPS) of $1.34, up 52.3% year over year. The bottom line exceeded the Zacks Consensus Estimate by 0.8%.

GAAP EPS for the quarter was $1.43, up 74.4% year over year.

Revenue Details

Revenues grossed $3.75 billion in the reported quarter, up 5% year over year. The metric topped the Zacks Consensus Estimate by 0.1%.

Ecolab’s organic sales increased 4.5% from the prior-year period’s level.

The year-over-year uptick in the first-quarter organic sales was driven by strong growth in the Institutional & Specialty and Pest Elimination segments and modest growth in the Industrial segment.

Segmental Analysis

Effective in the first quarter of 2024, Ecolab has modified its segment reporting, where Global Pest Elimination is now a standalone reportable segment. This is expected to provide improved transparency on this high-growth and high-margin business.

Also, Ecolab has reached a definitive agreement to sell its global surgical solutions business to Medline. The sale is expected to close in the second half of 2024, subject to regulatory clearances and other customary closing conditions. However, Ecolab will continue to serve hospitals through its infection prevention and instrument reprocessing businesses.

The Global Industrial segment’s fixed currency sales of $1.84 billion reflect 1.9% reported growth year over year. Organic sales increased 1.2% year over year, as modest growth in Food & Beverage and Water (despite unfavorable year-over-year comparisons in mining) more than offset the expected short-term decline in Paper sales.

The Global Institutional & Specialty arm’s fixed currency sales of $1.27 billion reflect reported growth of 12.3%. Organic sales increased 10.7% year over year, with double-digit growth in both the Institutional and Specialty divisions.

The Global Healthcare and Life Sciences arm’s fixed currency sales of $382.9 million declined 0.8% both on a reported and organic basis. Per management, year-over-year organic sales declined as lower Healthcare sales were partially offset by growth in Life Sciences. Life Sciences’ performance improved and more than offset continued soft short-term industry trends.

The Global Pest Elimination segment’s fixed currency sales of $266.8 million improved 9.1% both on a reported and organic basis. Organic sales growth was driven by robust growth in food & beverage, restaurants, and food retail.

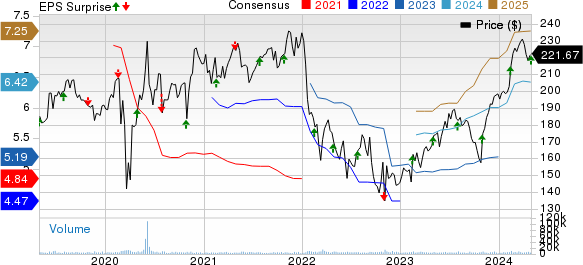

Ecolab Inc. Price, Consensus and EPS Surprise

Ecolab Inc. price-consensus-eps-surprise-chart | Ecolab Inc. Quote

Margin Analysis

In the quarter under review, Ecolab’s gross profit improved 18.8% to $1.62 billion. The gross margin expanded 502 basis points (bps) to 43.3%.

Selling, general and administrative expenses rose 8.8% to $1.08 billion year over year.

Adjusted operating profit totaled $546.1 million, increasing 45.2% from the prior-year quarter’s level. Adjusted operating margin in the quarter also expanded 403 bps to 14.6%.

Financial Position

Ecolab exited first-quarter 2024 with cash and cash equivalents of $479.9 million compared with $919.5 million at the end of 2023. Total debt at the end of first-quarter 2024 was $7.54 billion compared with $8.18 billion at 2023-end.

Net cash provided by operating activities at the end of first-quarter 2024 was $649.4 million compared with $198.2 million a year ago.

Meanwhile, Ecolab has a consistent dividend-paying history, with a five-year annualized dividend growth of 4.44%.

Guidance

Ecolab has provided its adjusted EPS outlook for the second quarter of 2024 and upped its outlook for the full year.

The company expects its adjusted EPS for the second quarter to be in the range of $1.62-$1.72, up 31-39% from the year-ago period. The Zacks Consensus Estimate for second-quarter EPS is currently pegged at $1.52.

For 2024, Ecolab now expects its adjusted EPS in the range of $6.40-$6.70 (reflecting an uptick of 23-29% from the comparable 2023 period), up from the previous outlook of $6.10-$6.50 (reflecting an uptick of 17-25% from the comparable 2023 period). The Zacks Consensus Estimate is currently pegged at $6.42 per share.

Our Take

Ecolab exited the first quarter of 2024 with better-than-expected results. The company registered a robust year-over-year uptick in its top and bottom lines, along with solid performances across the majority of its segments. Lower delivered product costs, value-based pricing and volume growth during the quarter were encouraging. New business wins were also promising for the stock.

Ecolab’s decision to sell its Global Surgical Solutions business to transform its Global Healthcare business also raises our optimism. The expansion of both margins bodes well for the stock.

However, Ecolab’s soft Paper sales were disappointing. The decline in Global Healthcare and Life Sciences arm’s revenues was also discouraging. The company expects to face continued soft macro demand, raising our apprehension.

Zacks Rank and Other Key Picks

Ecolab currently carries a Zacks Rank #2 (Buy).

A few other top-ranked stocks in the broader medical space that have announced quarterly results are Align Technology, Inc. ALGN, DexCom, Inc. DXCM and Boston Scientific Corporation BSX.

Align Technology, carrying a Zacks Rank of 2, reported first-quarter 2024 adjusted EPS of $2.14, beating the Zacks Consensus Estimate by 8.1%. Revenues of $997.4 million outpaced the consensus mark by 2.6%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Align Technology has a long-term estimated growth rate of 6.9%. ALGN’s earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 5.9%.

DexCom reported first-quarter 2024 adjusted EPS of 32 cents, beating the Zacks Consensus Estimate by 18.5%. Revenues of $921 million surpassed the Zacks Consensus Estimate by 1.1%. It currently carries a Zacks Rank #2.

DexCom has a long-term estimated growth rate of 33.1%. DXCM’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 34.1%.

Boston Scientific reported first-quarter 2024 adjusted EPS of 56 cents, beating the Zacks Consensus Estimate by 9.8%. Revenues of $3.86 billion surpassed the Zacks Consensus Estimate by 4.9%. It currently carries a Zacks Rank #2.

Boston Scientific has a long-term estimated growth rate of 12.5%. BSX’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 7.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance