Early retirement in Singapore: important things to know

Persistence in framing your plan for an early retirement strategy is essential: that way, you'll stick to it and actually raise your chances of retiring earlier.

Look at who came before you and retired already, or who still struggles to do so—study the current state of retirement affairs and come up with a calculated plan, much like a business plan.

Don't think of 'saving' for early retirement as a static, linear process of working more or cutting expenses—rather, see it as investment moves.

Be confident in your fundamental reasons for early retirement—be it more time with your family, friends and loved ones, or travelling around the world.

KUALA LUMPUR, MALAYSIA - Media OutReach - 10 July 2023 - The retirement age in Singapore is 63. However, monthly payouts from the savings Singaporeans have with CPF (Central Provident Fund Board) begin at age 65. Naturally, many people would often like to retire earlier than that, if their finances allow them to. The first impulse—not only in Singapore—is to save for early retirement well in advance. While this is a classic and powerful way to go about it, instead of only putting away certain amounts of your hard-earned money from your monthly pay cheque for savings, you could also uncover some avenues of additional income sources.

It recently transpired that Singaporeans started investing in safe-haven instruments more because of the recent concerns about global recession. However, such investment strategies as trading Forex have also been increasing in popularity. All this would make sense, since according to the international brokerage service OctaFX, early retirement is the second most popular motivation among Forex traders in Singapore.

Effective strategies to save for early retirement

Right from the start, set up a savings account alongside a piggy bank, for good measure. Assuming you are wise enough to start early enough in pursuing early retirement—these are three powerful strategies:

1. Multiple side jobs

Depending on your work ethic and motivation, secondary jobs alongside your main occupation will naturally increase your monthly earnings. This demands a conscious approach—set saving goals beforehand and do not overextend them too much in the process, even if you think you can take the overexposure. You should know when to pause this high-frequency lifestyle. Think in the long-term. Work-life balance as a modern cultural concept exists for a reason. Reach the saving goals you initially had for that year and take a break to return to your default earning routine.

2. Smart bookkeeping

Having a good and detailed overview of your monthly needs and wants might come in handy to dramatically cut down on avoidable or even useless expenses. If you are interested in early retirement anyway, cutting down a bit on your luxury items, restaurant visits, or cab rides might already go a long way. Not eliminating them entirely—just set a monthly quota for such consumption and activity to see a positive impact on your ongoing budget. Take fashion items, for example: just by choosing a less popular colour, this can get you a discount of up to 40 per cent.

Nobody is asking you to cut down on drinking water, a healthy diet, a promising education for your children, or a nice, warm bed—but be honest, smart, and attentive with your needs and wants. Higher saving rates will follow.

3. Investing

Don't just leave the already saved amounts of money somewhere motionless in the dust. Put some specific amount of it to work for you. Use the five per cent rule for each investment asset as to not overextend your portfolio and to keep an organic state of diversification. If you put all your savings into one stock, you will be in for a world of pain. So a well-thought-out investment strategy and plan is a must. You can invest in precious metal like gold, novel assets like cryptocurrencies, classics like reserve currencies, or promising stocks and bonds. You can also educate and train yourself in the craft of trading. For instance, all the just mentioned assets can be traded as pairs on the Foreign Exchange with OctaFX. If done correctly, accompanied by a tailor-made investment plan, you might see some bright results, impacting your journey towards early retirement.

Here's how much you need to retire early in Singapore

Of course, Singaporeans are by default affiliated with the nation's social security system and its main pillar—the Central Provident Fund (CPF). But when planning for early retirement, it's important to remember that the CPF LIFE payouts only start at age 65. What you can do is secure an earlier retirement yourself through sufficient savings.

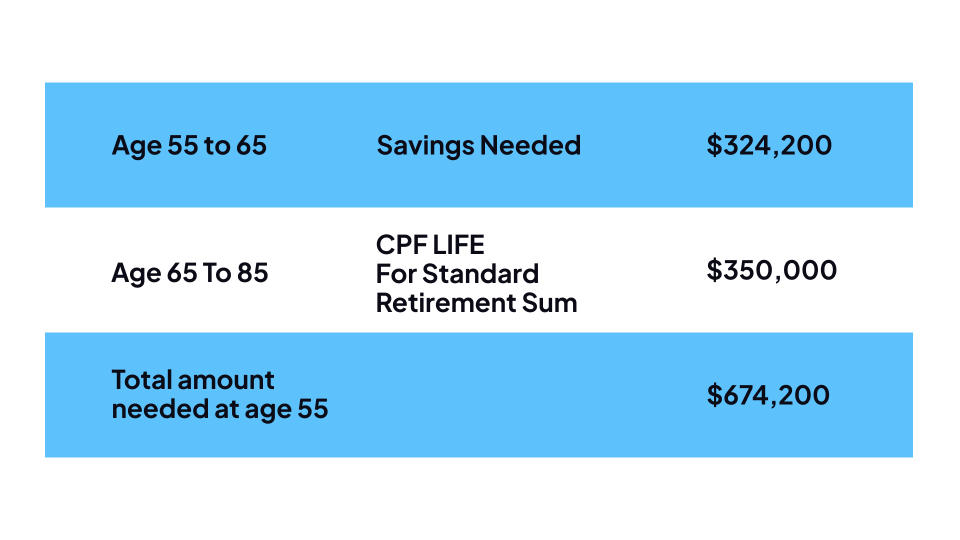

Let's suppose you are now living on—and plan to continue living on—around $2700 a month, which is $300 higher than the average income in Singapore. In that case, you would need to have $350,000 in your retirement account by age 55 in order to start receiving your desired monthly CPF payments from the standard plan at age 65. But to retire right away at 55, you would need another $324,200 in personal savings to ensure your desired standard of living for those 10 years until your CPF payments start.

It turns out that you need to have a total of $674,200 by the age of 55 to ensure an early retirement.

Total amount of money needed to retire early in Singapore

To ease your journey to early retirement, additional sources of income are essential. For example, buying real estate and renting it out as living or working space. Another one we already mentioned is investing—like Forex trading. This comes as an especially powerful option—if handled under a comprehensive and smart umbrella of risk management.

Coming up with your individual early retirement plan

You have to take everything that was stated above and apply it to your specific situation and unique profile. How much you earn at the peak of your abilities is a crucial variable. Take your specific potential for further occupational growth and earnings in the years to come into account. It might just be that before you reach the actual age you aim for to enter early retirement, you'll earn even more than when you first calculated this. If you have a spouse with similar goals and who earns a separate living—this instantly increases chances of early retirement. Determine your monthly family budget and delegate resources to start saving money the classical way as well. Discuss 'optional expenses' with each family member on a constructive basis.

Start planning your early retirement now

According to OCBC Financial Wellness Index 2022, building retirement funds is the number one motivation to generally engage in investing among Singaporeans aged 50–65. However, the earlier you start, the brighter the outlook, at least generally speaking. To pursue additional income strategies in the domain of investments can significantly increase your opportunities—and your odds, in case you started late. But be aware of the risk involved. Then again, no matter what you do, even if you do nothing at all, there will always be risks involved in losing it all.

The issuer is solely responsible for the content of this announcement.

Yahoo Finance

Yahoo Finance