Dow (DOW) And DOE Partner on Sustainable EV Battery Production

Dow Inc. DOW declared its intention to invest in ethylene derivatives capacity on the U.S. Gulf Coast, focusing on producing carbonate solvents, essential components in the supply chain for lithium-ion batteries. This move aims to support the expansion of the domestic electric vehicle and energy storage markets, building upon Dow's successful history of growth projects. Dow's recent global alkoxylation capacity expansions, set to be operational in the next two years in the U.S. Gulf Coast and Europe, underline this commitment to growth.

In collaboration with the U.S. Department of Energy (DOE) Office of Clean Energy Demonstrations (OCED), Dow has been selected for award negotiations to establish a significant carbonate solvents production facility for lithium-ion battery manufacturing on the U.S. Gulf Coast. This initiative is bolstered by agreements with customers, including prominent EV original equipment manufacturers and electrolyte manufacturers.

The facility will prioritize sustainability by capturing more than 90% of the carbon dioxide from the ethylene oxide manufacturing process and utilizing it to produce carbonate solvents crucial for vehicle electrification and strengthening the U.S. power grid through energy storage. This investment aligns with Dow's and the U.S. government's objectives to reduce greenhouse gas emissions in the transportation sector and enhance supply chain resilience for domestic battery and EV manufacturing.

Dow Inc. Price and Consensus

Dow Inc. price-consensus-chart | Dow Inc. Quote

The announcement highlights Dow's dedication to its Decarbonize & Grow strategy, reinforced by its MobilityScience capabilities and unwavering commitment to a sustainable future for the automotive industry. The crucial support from the DOE is pivotal in driving forward this project, facilitating the local production of low-carbon value-added products. This not only propels the clean energy transition but also accelerates the decarbonization of Dow’s operations.

Carbonate solvents play a crucial role in the electrolyte composition of lithium-ion batteries, contributing to improved battery performance and lifespan, thereby promoting the advancement and adoption of electric vehicle technology. This investment expands Dow's robust MobilityScience portfolio, addressing challenges in the mobility industry, such as decarbonization and enhancing EV performance.

As part of this investment, Dow is committed to fostering community growth. It plans to collaborate with new and existing partners to promote diversity in suppliers, develop the workforce, support education, stimulate economic growth and address infrastructure needs at local and state levels.

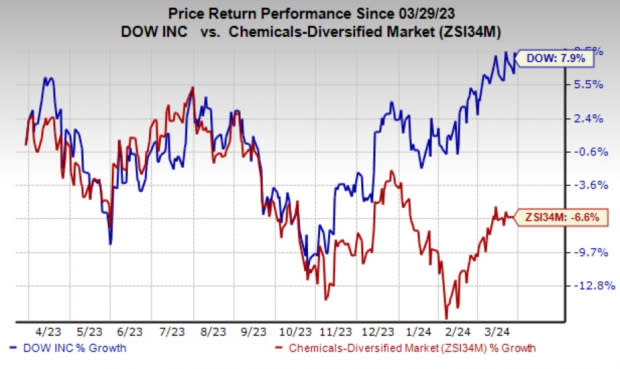

Dow’s shares have gained 7.9% in the past year against the industry's 6.6% decline in the same period.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Dow currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Basic Materials space are Carpenter Technology Corporation CRS and Ecolab Inc. ECL, each sporting a Zacks Rank #1 (Strong Buy), and Hawkins, Inc. HWKN, carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for CRS’ current fiscal year earnings is pegged at $4 per share, indicating a year-over-year surge of 250.9%. CRS beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 12.2%. The company’s shares have increased 62.7% in the past year.

Ecolab has a projected earnings growth rate of 22.65% for the current year. The Zacks Consensus Estimate for ECL’s current-year earnings has been revised upward by 5.4% in the past 60 days. ECL topped the consensus estimate in each of the last four quarters, with the average earnings surprise being 1.7%. The company’s shares have rallied 42.9% in the past year.

The consensus estimate for HWKN’s current fiscal year earnings is pegged at $3.61 per share, indicating a 26% year-over-year rise. HWKN beat the consensus estimate in each of the last four quarters, with the average earnings surprise being 30.6%. The company’s shares have surged 77.3% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Dow Inc. (DOW) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance