How does the ABSD affect home purchases by SC/PR or SC/Foreigner buyers?

Buying property can be daunting and complicated, especially if it’s your first time. On the finances side, it’s not just the home loan that you need to take note of. There are also other (often hidden) things to take into account, such as the stamp duty and property tax.

For Singaporeans, if it’s their first home, they’re exempted from paying the Additional Buyer’s Stamp Duty (ABSD).

But it’s a different story for those buying with a PR or foreigner. Even if it’s their first residential property, they’re still subjected to the ABSD.

What is ABSD?

The Additional Buyer’s Stamp Duty (ABSD) is a stamp duty paid on top of the Buyer’s Stamp Duty (BSD). The payable rate depends on the residential status of the buyer and the number of residential properties under their name. How much you’ll need to pay is then computed based on either the property price or valuation, whichever is higher.

It’s a form of cooling measure designed to bring down property prices and make housing more affordable for Singaporeans. So the ABSD rates are higher for non-Singaporeans and those with more than one residential property.

The latest change in the rates took effect on 27 April 2023, almost 1.5 years after the previous hike in December 2021. The ABSD rate for Singaporeans was increased from 17% to 20% for their second residential property.

ABSD rate from 16 Dec 2021 to 26 Apr 2023 | ABSD rate from 27 Apr 2023 | Increased by | ||

Singapore citizens | First residential property | 0% | 0% | – |

Second residential property | 17% | 20% | 3% | |

Third and subsequent residential property | 25% | 30% | 5% | |

Permanent Residents (PR) | First residential property | 5% | 5% | – |

Second residential property | 25% | 30% | 5% | |

Third and subsequent residential property | 30% | 35% | 5% | |

Foreigners^ | Any residential property | 30% | 60% | 30% |

Entities | Any residential property | 35% | 65% | 30% |

Trustees | Any residential property | 35%* | 65% | 30% |

Housing developers | Any residential property | 35% (remittable) + 5% (non-remittable) | 35% (remittable) + 5% (non-remittable) | – |

*The ABSD rate for trustees was from 9 May 2022 to 26 April 2023.

^Excluding Nationals and Permanent Residents of Iceland, Liechtenstein, Norway and Switzerland, and Nationals of the United States of America, who will be subject to the same stamp duty rate as Singaporeans.

For PRs buying their second residential property, the increase was even higher from 25% to 30%. It’s even steeper for foreigners, as the ABSD rate has been doubled from 30% to 60%.

The thing about the ABSD is that if you’re buying with another person with a different profile (that is, based on the number of residential properties owned and residency status), the ABSD payable will be based on the profile with the higher ABSD rate.

The exception to this is for buyers who are:

Nationals or Permanent Residents of Iceland, Liechtenstein, Norway or Switzerland

Nationals of the United States of America

Under the respective Free Trade Agreements (FTAs), they will enjoy the same stamp duty rate as Singaporeans. They can apply for the remission via the e-Stamping Portal.

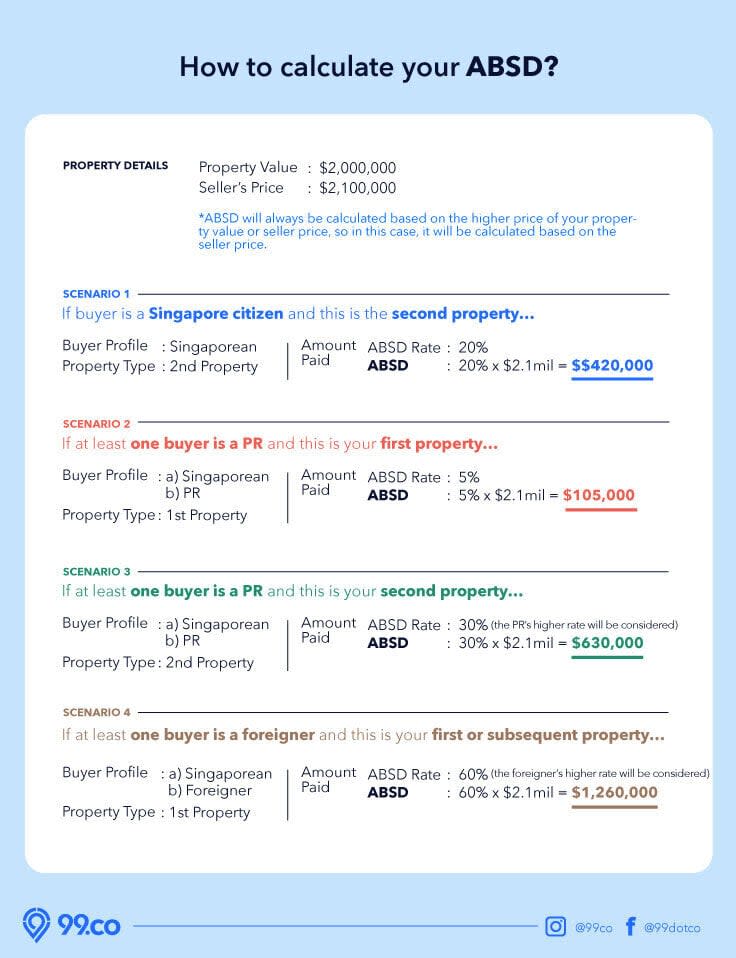

Here’s a breakdown on how the ABSD can affect your home purchase.

SC/PR buyers

Buying first house together

For PRs, whether or not they’re buying their first residential property on their own or jointly with a Singapore Citizen (SC), they’ll need to pay 5% ABSD.

So if you’re a Singaporean planning to buy a house with a PR, and this is the first residential property for both of you, you’ll need to pay the 5% ABSD.

Let’s say you’re buying a S$2.1 million condo. The ABSD to be paid will be 5% ⨉ S$2.1 million = S$105,000.

SC owns one house before joint purchase

In the case where the SC already has a house, the joint purchase with the PR will be considered to be the SC’s second home purchase.

This means that the SC’s ABSD rate will be 20%, while the PR’s ABSD rate is 5%.

The ABSD payable will be the higher rate, which is the SC’s rate at 20%. This translates to an ABSD of S$420,000 for a S$2.1 million condo.

Use 99.co’s stamp duty calculator to calculate how much ABSD to pay!

PR owns one house before joint purchase

On the contrary, if it’s the PR that already has a house, the joint purchase will be the PR’s second home purchase. So they’re subject to the 30% rate.

For a S$2.1 million condo, the SC-PR buyer will have to pay an ABSD of S$630,000.

Condos for sale at S$2.5m and below

10 Evelyn

10 Evelyn Rd · D11

2

2

753 sqft

$2,052,000

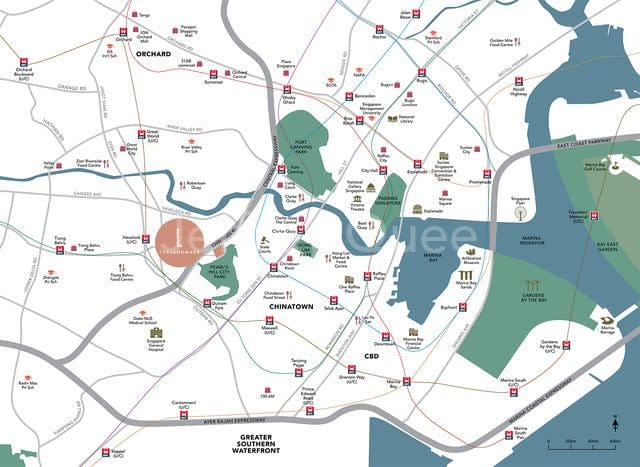

The Landmark

173 Chin Swee Rd · D3

2

2

764 sqft

$1,940,160

The Landmark

173 Chin Swee Rd · D3

2

1

678 sqft

$1,904,888

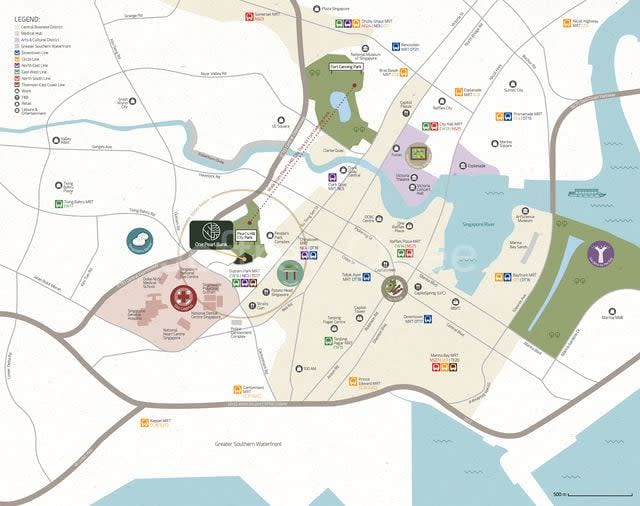

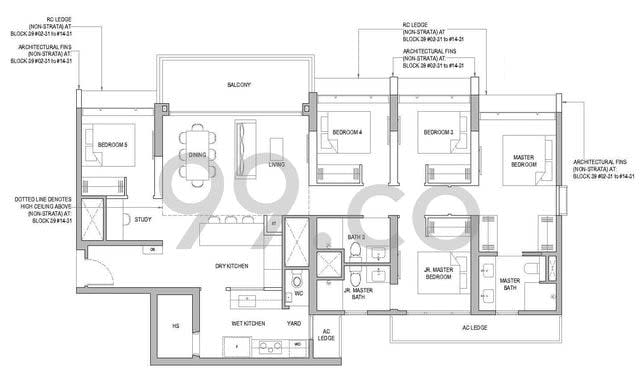

One Pearl Bank

1 Pearl Bank · D3

2

1

700 sqft

$2,036,000

The Landmark

173 Chin Swee Rd · D3

1

1

517 sqft

$1,390,080

The Atelier

2 Makeway Ave · D9

2

2

872 sqft

$2,198,000

The Atelier

2 Makeway Ave · D9

1

1

549 sqft

$1,430,000

Lentor Modern

3 Lentor Ctrl · D26

3

3

1,130 sqft

$2,205,600

Sceneca Residence / Sceneca Square

26 Tanah Merah Kechil Link · D16

3

2

904 sqft

$1,845,000

Kopar At Newton

6 Makeway Ave · D9

2

2

689 sqft

$1,800,000

Lentor Modern

3 Lentor Ctrl · D26

1

1

527 sqft

$1,344,000

The Botany At Dairy Farm

3 Dairy Farm Walk · D23

2

2

829 sqft

$1,572,000

The Botany At Dairy Farm

3 Dairy Farm Walk · D23

3

2

883 sqft

$1,793,000

The Botany At Dairy Farm

3 Dairy Farm Walk · D23

4

3

1,270 sqft

$2,390,000

Sky Eden@Bedok

1 Bedok Ctrl · D16

3

2

1,087 sqft

$2,199,000

Sceneca Residence / Sceneca Square

26 Tanah Merah Kechil Link · D16

3

3

1,163 sqft

$2,326,000

Sky Eden@Bedok

1 Bedok Ctrl · D16

3

3

1,087 sqft

$2,240,000

North Gaia

45 Yishun Cl · D27

3

3

1,076 sqft

$1,200,000

The Commodore

65 Canberra Dr · D27

4

2

1,184 sqft

$1,818,000

Perfect Ten

323 Bt Timah Rd · D10

2

2

786 sqft

$2,200,000

Ikigai

38 Shrewsbury Rd · D11

2

2

969 sqft

$2,158,000

Pasir Ris 8 / Pasir Ris Mall

14 Pasir Ris Dr 8 · D18

2

1

710 sqft

$1,474,000

North Gaia

45 Yishun Cl · D27

4

3

1,313 sqft

$1,600,000

Kopar At Newton

4 Makeway Ave · D9

1

1

517 sqft

$1,400,000

Kopar At Newton

4 Makeway Ave · D9

2

1

614 sqft

$1,700,000

The Landmark

173 Chin Swee Rd · D3

1

1

517 sqft

$1,291,000

Pullman Residences Newton

18 Dunearn Rd · D11

1

1

463 sqft

$1,517,000

The Avenir

8 River Valley Cl · D9

1

1

527 sqft

$1,618,000

The Atelier

2 Makeway Ave · D9

2

2

872 sqft

$2,324,000

The Atelier

2 Makeway Ave · D9

1

1

549 sqft

$1,524,000

The Avenir

8 River Valley Cl · D9

1

1

527 sqft

$1,608,000

Terra Hill

18A Yew Siang Rd · D5

3

2

904 sqft

$2,292,000

The Landmark

173 Chin Swee Rd · D3

2

2

678 sqft

$1,904,888

One Bernam

1 Bernam St · D2

2

2

732 sqft

$1,918,000

The M

30 Middle Rd · D7

2

1

667 sqft

$1,977,000

Kandis Residence

8 Kandis Link · D27

2

2

776 sqft

$1,300,000

Casa Aerata

9 Lor 26 Geylang · D14

1

1

420 sqft

$700,000

Mayfair Gardens

14 Rifle Range Rd · D21

1

1

635 sqft

$1,350,000

Mackenzie 88

88 Mackenzie Rd · D9

2

2

840 sqft

$1,600,000

River Isles

64 Edgedale Plains · D19

4

3

1,206 sqft

$1,688,000

Knox View

21 Lor M Telok Kurau · D15

3

2

1,183 sqft

$2,000,000

Foresque Residences

101 Petir Rd · D23

2

2

743 sqft

$1,290,000

Merawoods

136 Hillview Ave · D23

2

2

1,001 sqft

$1,580,000

Ris Grandeur

21 Elias Rd · D18

2

2

1,066 sqft

$1,590,000

Carissa Park Condominium

2 Flora Dr · D17

3

3

1,647 sqft

$2,050,000

Q Bay Residences

11 Tampines St 86 · D18

3

2

1,076 sqft

$1,500,000

Eastpoint Green

5 Simei St 3 · D18

2

2

1,259 sqft

$1,390,000

Hedges Park Condominium

71 Flora Dr · D17

3

3

1,076 sqft

$1,345,000

Dorsett Residences

331 New Bridge Rd · D2

2

2

689 sqft

$1,488,888

Alex Residences

28 Alexandra View · D3

2

2

657 sqft

$1,450,000

Stirling Residences

25 Stirling Rd · D3

2

1

657 sqft

$1,420,000

Suites At Orchard

38 Handy Rd · D9

1

1

560 sqft

$1,198,000

Novena Hill

51 Jln Novena · D11

2

1

710 sqft

$1,200,000

The Navian

178 Jln Eunos · D14

2

2

656 sqft

$1,250,000

Sandy Eight

8 Sandy Lane · D15

2

1

678 sqft

$1,370,000

The Minton

10C Hougang St 11 · D19

1

1

614 sqft

$938,000

Highline Residences

7 Kim Tian Rd · D3

1

1

506 sqft

$1,280,000

Whistler Grand

107 West Coast Vale · D5

2

1

613 sqft

$1,258,888

Stellar Rv

408 River Valley Rd · D10

2

1

527 sqft

$1,100,000

The Scala

134 Serangoon Ave 3 · D19

1

1

474 sqft

$830,000

Sol Acres

20 Choa Chu Kang Grove · D23

3

2

926 sqft

$1,249,999

The Aristo @ Amber

23 Amber Rd · D15

2

1

710 sqft

$1,500,000

Citylights

90 Jellicoe Rd · D8

2

2

926 sqft

$1,750,000

8 Farrer Suites

8 Sing Joo Walk · D8

2

3

624 sqft

$1,089,999

Skypark Residences

1 Sembawang Cres · D27

4

3

1,313 sqft

$1,700,000

Kent Ridge Hill Residences

66A Sth Buona Vista Rd · D5

2

2

797 sqft

$1,738,000

Eon Shenton

70 Shenton Way · D2

2

1

538 sqft

$1,300,000

Kandis Residence

6 Kandis Link · D27

2

2

732 sqft

$1,280,000

High Park Residences

29 Fernvale Rd · D28

2

2

667 sqft

$1,080,000

Twin Waterfalls

102 Punggol Walk · D19

3

3

1,109 sqft

$1,450,000

Buying second house together

Let’s say both you and another person (a PR) have a residential property on your own, and plan to buy another house together.

As of 27 April 2023, the ABSD for SCs buying a second home is 20%. For PRs buying a second home, it’s 30%.

In this case, the payable rate will follow the PR’s rate, which is 30%.

So for a S$2.1 million condo, the ABSD rate payable is 30% ⨉ S$2.1 million = S$630,000.

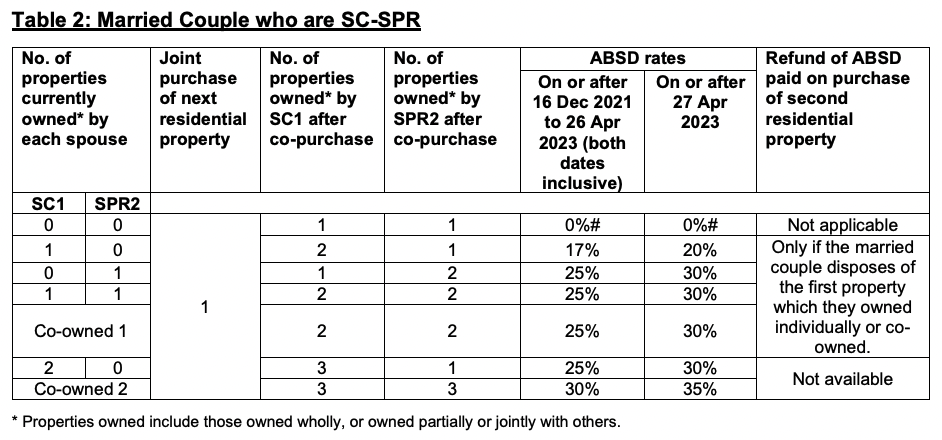

This table from IRAS summarises the ABSD rate to follow for SC/PR buyers, based on the number of residential properties owned and residency status.

SC/Foreigner buyers

Regardless of whether it’s the first home purchase or not, foreigners have to pay a 60% ABSD, as of 27 April 2023. This is an increase from 30%.

On top of that, since the highest ABSD rate for SCs is 30% (for the third and subsequent home purchase), the ABSD rate payable for a joint purchase with a foreigner will follow the foreigner’s rate of 60%.

This means for a S$2.1 million condo, the ABSD payable is 60% ⨉ S$2.1 million = S$1,260,000.

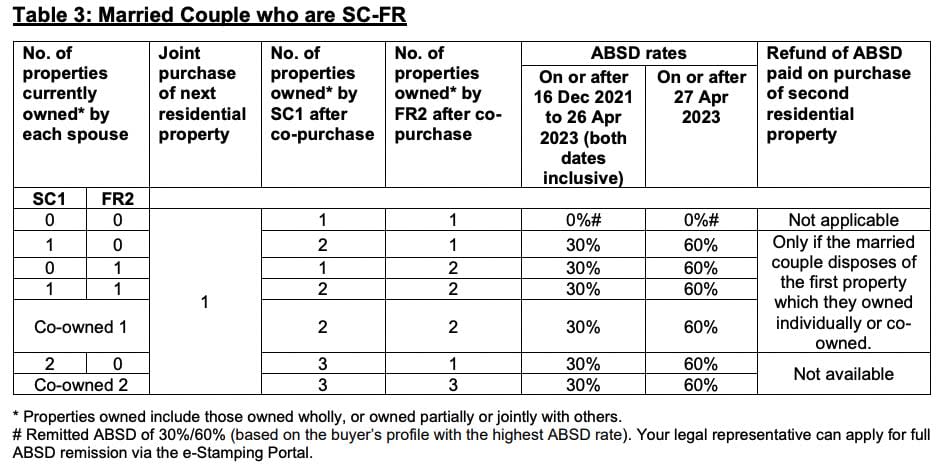

This table summarises the ABSD rate to follow for SC/foreigner buyers, based on the number of residential properties owned and residency status.

The good news is that if you’re buying as a married couple, you may be eligible for the ABSD remission.

ABSD remission for married couples

With the ABSD remission, you don’t have to pay the ABSD. But you’ll need to meet certain criteria. The main thing is that the house has to be:

Bought jointly by a married couple

Married couple comprises at least one Singaporean

Buying first home together

Let’s say you’re a Singaporean and your spouse is a non-Singaporean (either a PR or foreigner). If both you and your spouse don’t have any other residential properties, you can apply for the ABSD remission. So you don’t have to pay the ABSD.

You can apply for the ABSD remission via the e-Stamping Portal.

But the main thing is that the house must be jointly bought by both of you.

Buying second house to upgrade

If you and your non-Singaporean spouse are buying a second house together to upgrade (for instance, from an HDB flat to a condo), you’ll be subjected to a higher ABSD rate.

This will be 30% on the second house if your spouse is a PR, or 60% if they’re a foreigner.

You’ll have to pay the ABSD first, even if you plan on selling the first home.

If you manage to sell it within six months from

the date of purchase for a completed property (eg. a resale condo), or

the TOP or CSC date (whichever is earlier) for an uncompleted property (eg. new launch condo)

you may be eligible for the ABSD remission to get a refund.

Likewise, to be eligible for the remission, the second residential property must be purchased under both names.

You can apply for the remission through the e-Stamping portal. For more information on the refund application for the ABSD remission, you can also refer to IRAS’ guide.

What else to take note about the ABSD remission?

Not applicable for HDB flats and new ECs

Take note that this ABSD remission doesn’t apply if you’re upgrading from an HDB flat to another HDB flat, eg. from a 4-room to a 5-room flat. Or if you’re upgrading to a new EC bought from the developer.

After all, for public housing and ECs bought from developers, you’ll have to dispose of your old flat within six months of the sale completion of the flat (i.e. getting the keys to the flat).

New launch ECs for sale

North Gaia

45 Yishun Cl · D27

3

3

1,076 sqft

$1,200,000

North Gaia

45 Yishun Cl · D27

4

3

1,313 sqft

$1,600,000

North Gaia

25 Yishun Cl · D27

3

2

980 sqft

$1,210,000

North Gaia

39 Yishun Cl · D27

4

4

1,593 sqft

$2,070,000

North Gaia

31 Yishun Cl · D27

4

3

1,313 sqft

$1,600,000

North Gaia

39 Yishun Cl · D27

3

2

969 sqft

$1,140,000

North Gaia

45 Yishun Cl · D27

5

4

1,593 sqft

$1,900,000

North Gaia

45 Yishun Cl · D27

3

2

1,001 sqft

$1,100,000

Tenet

91 Tampines St 62 · D18

5

4

1,572 sqft

$2,200,000

Tenet

77 Tampines St 62 · D18

5

4

1,572 sqft

$2,130,000

Not applicable for third property onwards

The ABSD remission is only for buying the first property, or the second property if you sell the existing property.

So if you’re buying a third property together, you’ll have to pay the ABSD and won’t be able to get a refund.

For an SC/PR couple, the ABSD rate will be 35%. On the other hand, SC/foreigner couples will be subject to the 60% ABSD rate.

Only for married couples

Even if you’re engaged, you won’t be eligible for the ABSD remission.

The ABSD has to be paid within 14 days of signing the Option to Purchase (or Sale and Purchase Agreement if no OTP is issued). So if you want to qualify for the ABSD remission, you’ll have to register your marriage beforehand.

This also means that if you’re planning to buy a house with your parents or siblings, you won’t be able to qualify for the remission.

Only for married couples with at least one SC

This is one of the first things we mentioned about the ABSD remission earlier, but we thought we should highlight it here again.

The ABSD remission is only applicable for those with at least one Singaporean spouse. So it’s not applicable for PR-foreigner couples.

And given that the ABSD rate to pay will be based on the profile with the higher rate, regardless if this is the first residential property together or the third one together, the ABSD payable will be 60%.

Planning to sell your house soon? Let us help you get the right price by connecting you with a premier property agent.

If you found this article helpful, 99.co recommends Additional Buyer’s Stamp Duty (ABSD) in Singapore, explained (2023) and Buying a property in Singapore as a foreigner.

The post How does the ABSD affect home purchases by SC/PR or SC/Foreigner buyers? appeared first on .

Yahoo Finance

Yahoo Finance