Disrupting the microfinancing space: Turnkey Lender

Microfinancing in Asia Pacific accounts for about 30% of the global industry. According to the Sanabel Network’s market outlook on the microfinancing industry, 71% of the experts interviewed for the study believe that technology plays a key role in microfinancing.

That is why it is an opportune time for startups like Turnkey Lender to enter the market and disrupt the multi billion-dollar industry.

Hailing from Europe, Elena Ionenko, Business Development Director for Turnkey Lender, says that this model has taken off in Eastern Europe as well as the United States. But she’s always had her eye on this part of the world.

So, when The FinLab’s acceleration programme gave Elena the opportunity to expand into Southeast Asia, it was an opportunity not to be passed up.

Meet Turnkey Lender, a decision-making tool for non-bank lenders

Source: The FinLab

Turnkey Lender is a technology platform for non-bank lenders, online lenders and anyone who provides loans.

“These companies still want the same levels of intelligence, decision automation and security as in large banks, but they do not have the budget,” explains Elena. “Automation of decision-making is important as lenders would have to make many decisions in very short amount of time. At the same time, they want to enter into the market as soon as possible.”

Before Turnkey Lender, Elena spent over a decade in a software company, building similar solutions within the conventional space. “We know how banking technology is operated and how the industry works. The existing software companies who work with banks offer solutions targeted at separate departments within a bank. But this is expensive,” Elena explains.

With Turnkey Lender, all these solutions are consolidated into one comprehensive platform and offered to alternative lenders like peer-to-peer lenders, niche lenders and other microfinancing businesses.

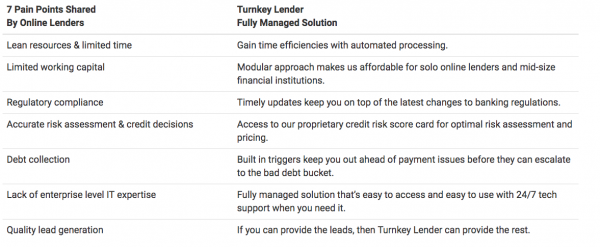

Source: Turnkey Lender

“We took the best practices from the banking industry and put it into one platform. There is no need to engage anyone apart from us and that is our unique value proposition. Best part is, we offer it at an affordable price since it is priced as software as a service,” she adds.

The fully automated system saves lenders time and money, as well as close more loans with fewer Full-time Equivalent (FTE).

It optimises approval rates, loan processing capacity and loan management efficiencies. The software also has an adjustable set of proprietary credit scoring models and rules to improve credit decisions, enable risk-based pricing, as well as minimise portfolio risk profiles and write-offs.

With this software, lenders will be using an alternative data source, which can verify information about their borrowers in seconds as compared to banks that would typically take hours or days.

A competitive edge

“Our idea behind this company is to automate lending for lenders and dramatically reducing the cost of lending. The non-bank lenders are then able to compete with big bank companies without forking out large sums of money,” Elena says.

The current focus is on developing countries, such as Indonesia and Philippines, where there is little or no technology to automate and manage the money lending business. “Right now, these are largely done manually. While large banks possess a special smart software, this is very expensive and not affordable to smaller businesses,” Elena adds.

So they took the same line of technology that the big banks use and brought it to non-bank lenders.

“We charge an affordable monthly fee. This fee depends on the lender’s volume or number of loans they issue, allowing lenders to enjoy the same level of automation and credit risk management,” she says.

On top of that, Turnkey Lender operates on a success-sharing model. “Clients pay us a monthly fee for active loans in our system. But if a loan turns out to be bad, we forgo this fee. Clients appreciate this success sharing model, because we share their risk. Our system is meant to help assess credit risks and help these lenders deal with good loans.”

Not without its fair share of challenges

Though there are no direct competitors in the industry at the time of the interview, Elena admits that there has been one major challenge.

Fundraising to scale Turnkey Lender’s business into the region is this challenge. “The market is huge in Indonesia, Philippines and other Southeast Asian markets but funding is the only thing that is holding me back from rapid growth.”

“There is a need to invest in marketing and sales now,” she continues.

Otherwise, the 2 year-old company which already operates in 17 countries, doesn’t see the technology aspect of the business to be something of concern.

Source: Turnkey Lender

“There may be strong competitors in the United States but their systems don’t allow for the flexibility that ours does. Given our unique design, Turnkey Lender’s solution can be easily and quickly adapted to different markets and environments,” she adds.

When asked if regulators would pose an issue to her growth, Elena is confident that they can only boost Turnkey Lender up to greater heights.

“Governments are looking at putting limitations on peer-to-peer lending and these regulations will force small lenders to conduct compliance checks. This will benefit us greatly,” she adds.

They also have the added advantage of being an early entrant. “We are able to secure a key distribution channel in Indonesia by having an exclusive partnership with the local credit bureau there.

And since we are their exclusive technology provider, the only way small lenders can get credit bureau reports from them will be through us, putting Turnkey Lender in a very strong market position,” Elena shares.

Source: Turnkey Lender

Even if another player decides to enter the market, Elena believes this will be little threat to them. “The smaller lenders are very careful when choosing their technology provider since their entire business is reliant on technology.

Once chosen, they tend to stick with them for long-term because switching costs are high and migration to another platform could take months.”

Up and running in the region because of The FinLab

Source: The FinLab

So far, all feedback from Indonesia regarding Turnkey Lender’s platform and levels of customer service has been extremely positive.

“We can clearly see the potential within this region and understand the difficulties bringing our business into a foreign country without any local support,” says Elena. That is why Turnkey Lender is very grateful for the partnership with The FinLab and UOB.

“They helped us get our Employment Passes, open bank accounts and other formalities. This really helped us start our business here very quickly,” she admits.

“The FinLab also shared their wide business and investor networks with us. We were able to tap the knowledge and advice of these networks to quickly assess and decide our approach because we had no knowledge about the local markets when we first got here. UOB also helped us to better understand the lending industry here.”

“They could also provide us credit risk assessment advice. We believe we are well-positioned in the ASEAN market because of this partnership,” she says.

Turnkey Lender was recently shortlisted as one of the top 40 start-ups in the MAS Fintech Awards during the Singapore Fintech Festival from 14th – 18th November 2016. They subsequently won 2 prizes in the Singapore SME category.

Source: Turnkey Lender

For more information, please visit http://turnkey-lender.com/.

(By Sarah Voon)

Related Articles

- Nickel: changing the remittance game for individuals and SMEs

- Payment with benefits: CardUp’s game-changing product

- Legally bound: E-signing on the dotted line with Attores

Yahoo Finance

Yahoo Finance