Discounted Real Estate Stock Picks

The real estate sector performs relatively in-line with the wider economy. Prosperous periods bring about high growth and inflation, leading to strong returns in real estate investments. CWG International and Hiap Hoe are real estate companies that are currently trading below what they’re actually worth. There’s a few ways you can determine how much a cyclical company is actually worth. The most popular methods include discounting the company’s cash flows it is expected to create in the future, or comparing its price to its peers or the value of its assets. The discrepancy between the price and value means investors have an opportunity to buy shares at a discount. Below are the stocks I believe are undervalued on all criteria, based on their latest financial data.

CWG International Ltd. (SGX:ACW)

CWG International Ltd. engages in the development of real estate properties. Established in 2002, and currently run by Jianrong Qian, the company employs 479 people and with the market cap of SGD SGD128.44M, it falls under the small-cap category.

ACW’s shares are now trading at -97% lower than its actual value of ¥5.84, at a price of S$0.19, according to my discounted cash flow model. This difference in price and value gives us a chance to buy low. Also, ACW’s PE ratio stands at 3.07x relative to its Real Estate peer level of, 9.71x meaning that relative to its comparable company group, ACW’s stock can be bought at a cheaper price. ACW is also in great financial shape, with short-term assets covering liabilities in the near future as well as in the long run.

Continue research on CWG International here.

Hiap Hoe Limited (SGX:5JK)

Hiap Hoe Limited, an investment holding company, develops luxury and mid-tier residential, and hotel-cum-commercial properties in Australia and Singapore. Hiap Hoe was founded in 1994 and with the stock’s market cap sitting at SGD SGD418.80M, it comes under the small-cap stocks category.

5JK’s stock is currently trading at -65% less than its real value of $2.58, at a price of S$0.89, based on my discounted cash flow model. This difference in price and value gives us a chance to buy low. Moreover, 5JK’s PE ratio is trading at 5.81x while its Real Estate peer level trades at, 9.71x suggesting that relative to its comparable company group, 5JK’s shares can be purchased for a lower price. 5JK is also a financially robust company, as near-term assets sufficiently cover liabilities in the near future as well as in the long run.

Dig deeper into Hiap Hoe here.

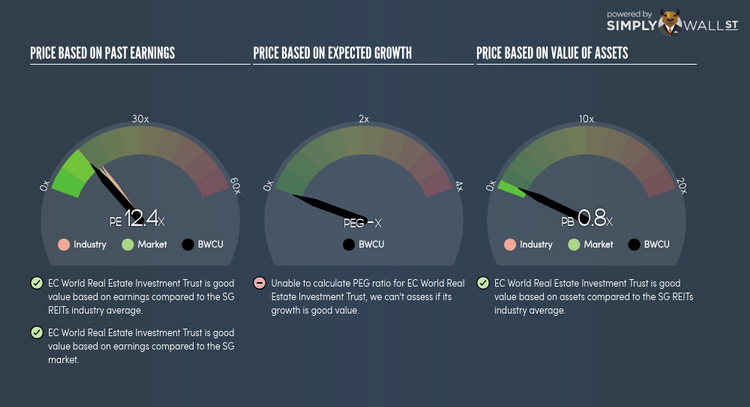

EC World Real Estate Investment Trust (SGX:BWCU)

Listed on 28 July 2016, EC World REIT is the first Chinese specialised logistics and e-commerce logistics REIT listed on Singapore Exchange Securities Trading Limited (“SGX-ST”). The company was established in 2015 and has a market cap of SGD SGD570.50M, putting it in the small-cap group.

BWCU’s shares are currently hovering at around -57% under its intrinsic value of $1.68, at a price of S$0.72, based on its expected future cash flows. This price and value mismatch indicates a potential opportunity to buy the stock at a low price. What’s even more appeal is that BWCU’s PE ratio is trading at 12.37x against its its REITs peer level of, 14.98x suggesting that relative to its comparable set of companies, BWCU’s stock can be bought at a cheaper price. BWCU is also robust in terms of financial health, as near-term assets sufficiently cover liabilities in the near future as well as in the long run.

Continue research on EC World Real Estate Investment Trust here.

For more financially sound, undervalued companies to add to your portfolio, explore this interactive list of undervalued stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance