Digital Realty (DLR) to Offer Liquid-to-Chip Cooling Technology

To revolutionize the digital infrastructure landscape, Digital Realty Trust DLR has taken a significant stride by announcing the availability of groundbreaking liquid-to-chip cooling technology, which supports high-density deployment.

This innovative breakthrough marks a significant step forward in solving the evolving challenges of handling high-density workloads, notably in the fields of artificial intelligence (AI) and data-intensive applications.

Digital Realty's new offering introduces direct liquid cooling (”DLC”). This offering brings liquid directly to customers' infrastructure, providing additional relevance and flexibility to meet the growing demand for AI.

This approach allows businesses to deploy high-density configurations across a shared environment adjacent to the cloud, network, and AI service providers while supporting the unique requirements of individual setups, giving customers additional flexibility.

Moreover, Digital Realty's recently released Private AI Exchange provides new data exchange options in support of these DLC-enabled solutions.

The ability to use a wide range of mechanical solutions, such as rear door heat exchangers (RDHx) and DLC, to efficiently manage power densities from 30 to 150 kilowatts per rack and beyond is a key feature of Digital Realty's advanced high-density deployment support. The combination of RDHx and DLC allows businesses to cope with the growing demand for modern IT infrastructure and accelerate the adoption of AI by enterprises.

Per Chris Sharp, chief technology officer of Digital Realty, "We're proud to align with our customers in evolving their infrastructure to support this cutting-edge liquid-to-chip technology, enabling them to land and expand their deployments efficiently and redefine what's possible in the digital age."

The company’s new offering, which builds upon its standardized high-density colocation offering, has deployment options available in more than half of Digital Realty's data centers worldwide. It further plans to expand support to additional sites and to leverage existing infrastructure to meet emerging AI requirements.

Digital Realty has a high-quality, diversified customer base comprising tenants from the cloud, content, information technology, network and other enterprise and financial industries.

The demand for high-performing data centers is likely to increase in the coming years amid high growth in cloud computing, the Internet of Things (IoT), big data and elevated requirements for third-party IT infrastructure.

Growth in AI, autonomous vehicles and virtual/augmented reality markets is expected to escalate over the next five to six years. DLR’s global data center portfolio remains well-poised to capitalize on this upbeat trend, which bodes well for long-term growth.

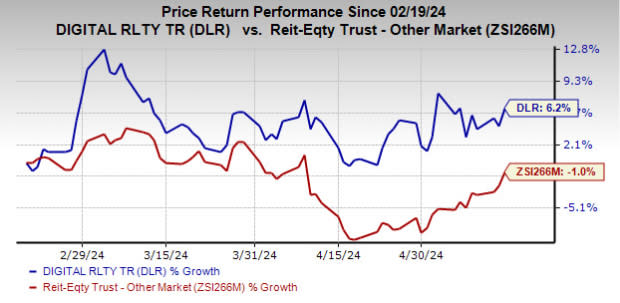

Over the past three months, shares of this Zacks Rank #3 (Hold) company have rallied 6.2% against the industry’s decline of 1%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the REIT sector are Healthpeak Properties DOC and SL Green Realty SLG, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The consensus estimate for DOC’s current-year FFO per share has moved marginally northward over the past week to $1.78.

The Zacks Consensus Estimate for SLG’s 2024 FFO per share has been raised 20.8% over the past month to $7.33.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Digital Realty Trust, Inc. (DLR) : Free Stock Analysis Report

SL Green Realty Corporation (SLG) : Free Stock Analysis Report

Healthpeak Properties, Inc. (DOC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance