DiaMedica (DMAC) Up as Stroke Study Dosing Begins Post Relaunch

DiaMedica Therapeutics Inc. DMAC announced that it has dosed the first patient in the relaunch of its mid to late-stage stage pivotal study evaluating the safety and efficacy of its lead product candidate, DM199, to treat acute ischemic stroke (AIS). The company’s shares gained 9.7% on Apr 17, following the encouraging news.

DM199 is DiaMedica’s recombinant (synthetic) form of human tissue kallikrein-1, which will be developed in the pivotal phase II/III ReMEDy2 study for AIS patients. The investigational candidate’s novel mechanism of action aims at enhancing collateral blood flow in the brain tissues affected by the stroke.

In 2022, the FDA placed a clinical hold on DiaMedica’s ReMEDy2 study of DM199 based on three reports of serious treatment-related adverse events. It was observed that those three AIS patients experienced clinically significant transient hypotension (low blood pressure), shortly after initiation of the intravenous (IV) dose of DM199.

Additionally, the blood pressure levels of the three patients recovered back to their baseline blood pressure within minutes after the IV infusion was stopped.

Eventually, the clinical hold on the pivotal phase II/III ReMEDy2 study of DM199 for AIS was lifted by the FDA in 2023.

The decision was taken after a thorough review of DiaMedica’s ReMEDy2 study protocol modifications, which were expected to address the adverse events, the rationale behind it and data supporting the protocol modifications.

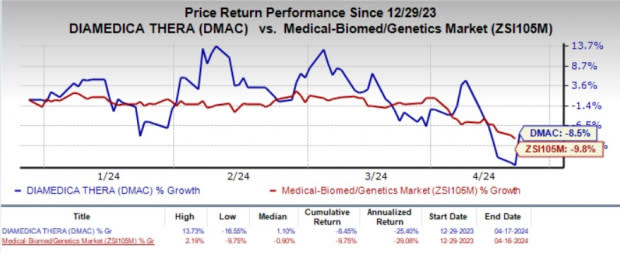

Year to date, shares of DiaMedica have lost 8.5% compared with the industry’s 9.8% decline.

Image Source: Zacks Investment Research

The pivotal phase II/III ReMEDy2 study of DM199 for AIS is expected to enroll approximately 350 patients across up to 100 sites globally. The treatment duration of the study is three weeks. Enrolled patients will be divided into two groups, receiving either DM199 or placebo, beginning within 24 hours of the onset of AIS symptoms, with the final follow-up at 90 days.

DiaMedica expects to activate most of its DM199 study sites in the United States by the end of the third quarter of 2024. AIS study sites in Canada and Australia are expected to be activated in the third and fourth quarter of 2024, respectively.

Apart from the neurology indication, DiaMedica is simultaneously evaluating DM199 for treating chronic kidney disease. The company plans to announce the next steps for its cardio-renal disease program later in 2024.

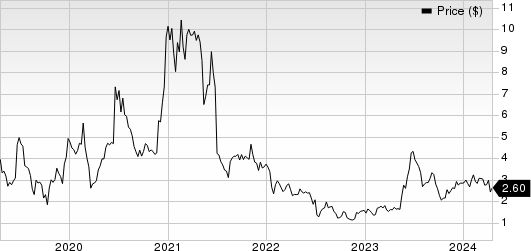

DiaMedica Therapeutics, Inc. Price

DiaMedica Therapeutics, Inc. price | DiaMedica Therapeutics, Inc. Quote

Zacks Rank & Other Stocks to Consider

DiaMedica currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks from the drug/biotech industry worth mentioning are ADMA Biologics ADMA, FibroGen FGEN and Annovis Bio ANVS. While ADMA sports a Zacks Rank #1 (Strong Buy), FGEN and ANVS carry a Zacks Rank #2 each at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 30 days, the Zacks Consensus Estimate for ADMA Biologics’ 2024 earnings per share (EPS) has remained constant at 30 cents. During the same period, the estimate for ADMA’s 2025 EPS has remained constant at 50 cents. Year to date, shares of ADMA have soared 33.6%.

ADMA beat estimates in three of the trailing four quarters and matched in one, delivering an average earnings surprise of 85%.

In the past 30 days, the Zacks Consensus Estimate for FibroGen’s 2024 loss per share has remained constant at $1.09. During the same period, the estimate for FibroGen’s 2025 loss per share has remained constant at 6 cents. Year to date, shares of FGEN have rallied 43.3%.

FGEN beat estimates in two of the trailing four quarters, missing the mark on the other two occasions, delivering an average negative surprise of 2.26%.

In the past 30 days, the Zacks Consensus Estimate for Annovis’ 2024 loss per share has narrowed from $3.49 to $3.35. The estimate for Annovis’ 2025 loss per share is currently pegged at $2.82. Year to date, shares of ANVS have plunged 51.9%.

ANVS beat estimates in two of the trailing four quarters and missed the mark on the other two occasions, delivering an average negative surprise of 15.70%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report

FibroGen, Inc (FGEN) : Free Stock Analysis Report

DiaMedica Therapeutics, Inc. (DMAC) : Free Stock Analysis Report

Annovis Bio, Inc. (ANVS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance