DexCom Inc (DXCM) Surpasses Analyst Revenue Forecasts with Strong Q1 2024 Performance

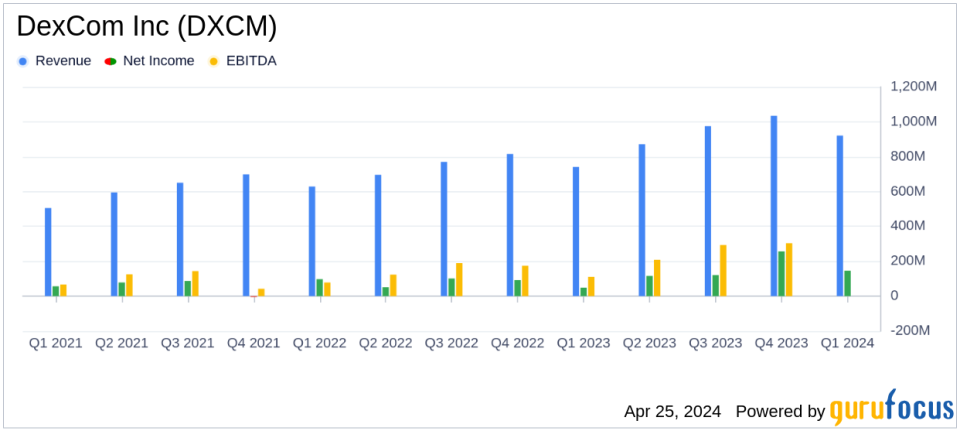

Revenue: Reached $921.0 million, marking a 24% increase year-over-year, surpassing the estimate of $909.24 million.

Net Income: GAAP net income stood at $146.4 million, significantly exceeding the estimated $112.09 million.

Earnings Per Share (EPS): GAAP EPS was $0.36, surpassing the estimated $0.27.

Operating Income: GAAP operating income rose to $101.1 million from $47.2 million in the prior year, reflecting improved operational efficiency.

Gross Profit Margin: GAAP gross profit margin was 61.0%, slightly below the previous year's 62.4%.

Cash Position: Held $2.90 billion in cash, cash equivalents, and marketable securities, providing substantial financial flexibility.

Strategic Developments: Received FDA clearance for new CGM systems and launched products in multiple European countries, enhancing market presence.

DexCom Inc (NASDAQ:DXCM) released its 8-K filing on April 25, 2024, revealing a robust financial performance for the first quarter ended March 31, 2024. The company reported a significant 24% year-over-year increase in revenue, reaching $921.0 million, surpassing the analyst's expectation of $909.24 million. This growth was driven by strong volume increases and new customer additions, highlighting the rising demand for real-time continuous glucose monitoring (CGM) systems.

DexCom, headquartered in San Diego, California, is a pioneer in diabetes care technology, specializing in the development and commercialization of CGM systems. These systems offer a vital alternative to traditional blood glucose meters, providing real-time glucose readings that enhance the management of diabetes. DexCom's CGM systems are increasingly integrated with insulin pumps from major manufacturers like Insulet and Tandem, facilitating automatic insulin delivery.

Financial and Strategic Highlights

The first quarter of 2024 saw not only revenue growth but also significant improvements in operational efficiency. GAAP operating income stood at $101.1 million, or 11.0% of revenue, marking a substantial increase from the previous year. Non-GAAP operating income also rose impressively to $140.2 million, or 15.2% of reported revenue. This financial strength is underpinned by strategic advancements, including the FDA clearance of Stelo, DexComs new CGM system for type 2 diabetes, and the launch of Dexcom ONE+ in Europe.

Net income on a GAAP basis was reported at $146.4 million, or $0.36 per diluted share, significantly higher than the $48.6 million, or $0.12 per diluted share, recorded in the first quarter of 2023. This performance exceeded the analyst's net income estimate of $112.09 million for the quarter. Non-GAAP net income was also robust at $128.2 million, or $0.32 per diluted share.

Operational and Market Expansion

DexCom's operational success is reflected in its strong balance sheet. As of March 31, 2024, the company held $2.90 billion in cash, cash equivalents, and marketable securities. This financial health supports DexComs ongoing expansion in production capacity and exploration of new market opportunities. Additionally, the company's commitment to sustainability and healthcare accessibility was evident in its latest annual Sustainability Report.

Looking forward, DexCom has updated its fiscal year 2024 guidance, projecting revenue between $4.20 billion and $4.35 billion, indicating an organic growth rate of 17% to 21%. The company also expects to maintain robust margins, with Non-GAAP Gross Profit Margin anticipated to be between 63% and 64%, and an Adjusted EBITDA Margin of approximately 29%.

Analysis and Future Outlook

The first quarter results of 2024 underscore DexComs strong position in the medical devices and instruments sector, particularly in the diabetes care technology market. The companys ability to exceed revenue expectations and achieve significant net income gains reflects its operational efficiency and strategic foresight. With ongoing product innovations and market expansions, DexCom is well-positioned to sustain its growth trajectory and continue delivering value to its stakeholders.

Investors and market watchers will likely keep a close eye on DexCom's ability to maintain its momentum in a competitive landscape, especially with new product rollouts and geographic expansions on the horizon. The companys robust financial position and strategic initiatives are expected to support its ambitious growth targets for the coming periods.

Explore the complete 8-K earnings release (here) from DexCom Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance