Decoding Juniper Networks Inc (JNPR): A Strategic SWOT Insight

Juniper Networks Inc faces a challenging market environment with a decline in product revenues.

Despite a decrease in net income, the company maintains a strong service revenue stream.

Juniper Networks Inc's commitment to innovation and customer service remains a key strategic focus.

Recent restructuring and merger-related charges indicate a period of significant transition for the company.

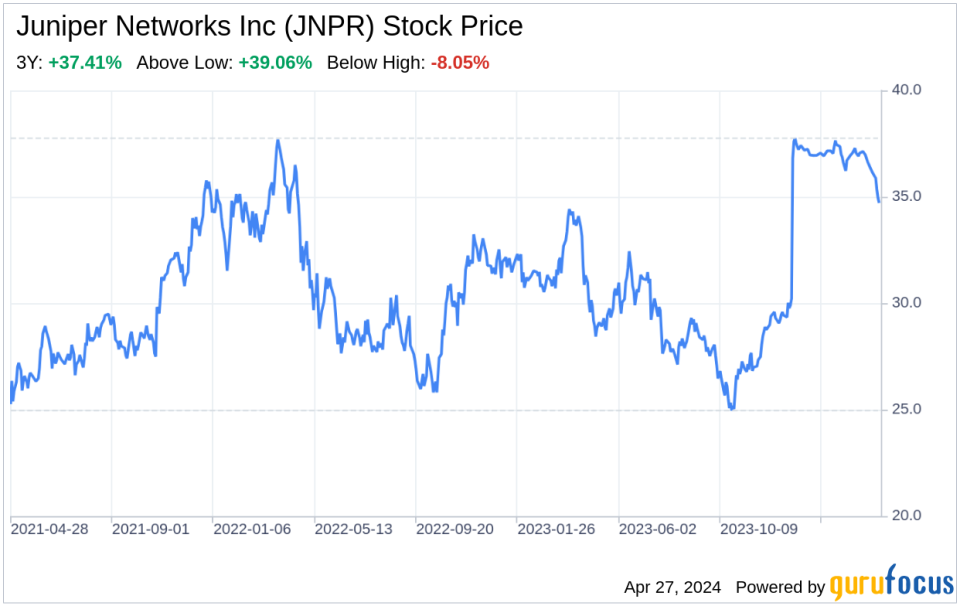

Juniper Networks Inc (NYSE:JNPR), a leader in high-performance network solutions, has recently filed its 10-Q report on April 26, 2024. The filing reveals a mixed financial performance, with total net revenues decreasing from $1,371.8 million in Q1 2023 to $1,148.9 million in Q1 2024. This decline is primarily due to a significant drop in product revenues from $912.6 million to $651.9 million. However, service revenues have seen a slight increase, indicating a resilient demand for Juniper's customer services. The company's gross margin has also experienced a dip, from $771.2 million to $680.9 million. Operating expenses have risen, leading to an operating loss of $14.2 million, a stark contrast to the operating income of $115.7 million in the previous year. The net loss for the quarter stands at $0.8 million, compared to a net income of $85.4 million in Q1 2023. These figures set the stage for a detailed SWOT analysis, providing investors with a comprehensive understanding of Juniper Networks Inc's current market position and future prospects.

Strengths

Robust Service Revenue Stream: Despite the overall decline in net revenues, Juniper Networks Inc's service segment has demonstrated resilience, increasing from $459.2 million in Q1 2023 to $497.0 million in Q1 2024. This strength indicates a reliable and growing demand for the company's maintenance, support, and professional services. The consistent service revenue underscores Juniper's ability to foster long-term customer relationships and recurring revenue streams, which are crucial for stability in the volatile tech industry.

Commitment to Innovation: Juniper Networks Inc continues to invest heavily in research and development, with expenses rising from $284.8 million to $296.6 million year-over-year. This commitment to innovation is a testament to the company's dedication to staying at the forefront of network technology, including AI and SDN. By prioritizing R&D, Juniper is well-positioned to maintain its competitive edge and offer cutting-edge solutions that meet evolving customer needs.

Weaknesses

Declining Product Revenue: The significant drop in product revenue, from $912.6 million to $651.9 million, is a concerning weakness for Juniper Networks Inc. This decline reflects challenges in the market or potential shifts in customer preferences. It may also indicate increased competition or pricing pressures that could impact the company's market share and profitability if not addressed promptly.

Operating Losses and Restructuring: The recent operating loss and restructuring charges, including merger-related expenses totaling $28.3 million, suggest that Juniper Networks Inc is undergoing a period of transition and realignment. While these changes may position the company for future growth, they currently represent a weakness by impacting short-term financial performance and potentially causing internal disruptions.

Opportunities

Expansion of Service Offerings: The growth in service revenues presents an opportunity for Juniper Networks Inc to further expand its service offerings, including SaaS and AIOps. By capitalizing on the demand for these services, Juniper can diversify its revenue streams and reduce reliance on product sales, which have shown volatility.

Strategic Mergers and Acquisitions: The filing indicates merger-related charges, which could signal strategic moves to acquire new technologies or enter new markets. These initiatives could provide Juniper Networks Inc with opportunities to enhance its product portfolio, enter new verticals, and gain a competitive advantage in the high-performance networking space.

Threats

Intense Market Competition: Juniper Networks Inc operates in a highly competitive industry where rapid technological advancements and aggressive pricing strategies are common. The decline in product revenues could be exacerbated by competitors' actions, making it imperative for Juniper to continuously innovate and adapt its strategies to maintain its market position.

Economic and Market Uncertainties: The global economic landscape poses a threat to Juniper Networks Inc, as fluctuations in demand for networking solutions can be influenced by broader economic conditions. Additionally, supply chain disruptions and geopolitical tensions can impact operational efficiency and cost structures, posing risks to the company's performance.

In conclusion, Juniper Networks Inc (NYSE:JNPR) faces a challenging period marked by declining product revenues and operating losses. However, the company's strengths in service revenue and commitment to innovation provide a solid foundation for future growth. Opportunities in expanding service offerings and strategic mergers could propel Juniper forward, but it must navigate threats from intense competition and market uncertainties. As Juniper Networks Inc continues to adapt and evolve, its ability to leverage its strengths and seize opportunities while mitigating weaknesses and threats will be critical to its long-term success.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance