Decoding Eversource Energy (ES): A Strategic SWOT Insight

Robust financial performance with increased net income and comprehensive income.

Strategic divestment from offshore wind investments to focus on core operations.

Regulatory environment and market dynamics present both opportunities and challenges.

Commitment to sustainable energy supply and infrastructure development.

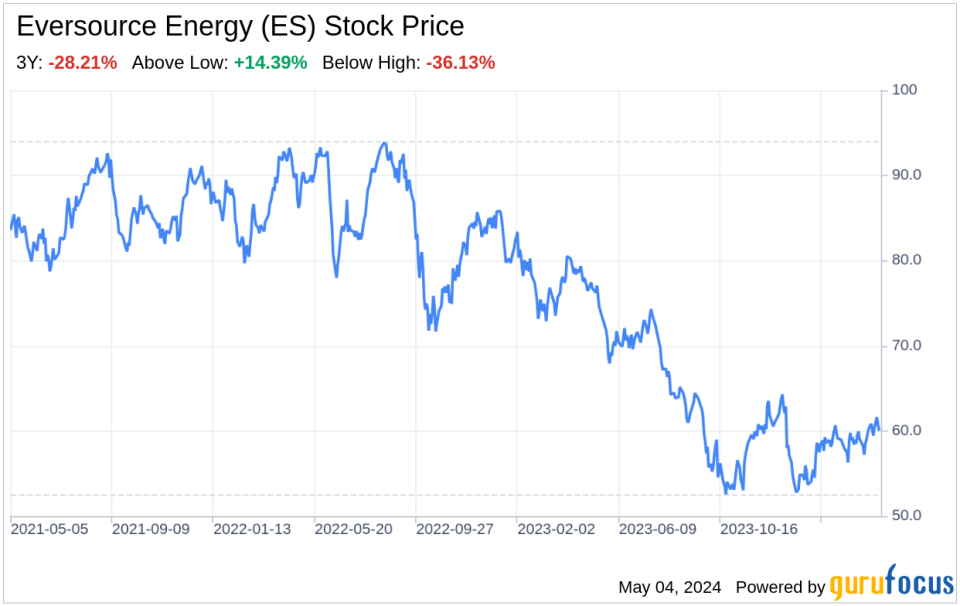

On May 3, 2024, Eversource Energy (NYSE:ES), a leading provider of electric, gas, and water distribution services in the Northeast U.S., filed its 10-Q report, revealing a comprehensive financial performance for the first quarter of 2024. The company reported operating revenues of $3.33 billion, a decrease from the previous year's $3.79 billion. Despite this, Eversource Energy saw a rise in net income, from $493 million in 2023 to $524 million in 2024, and a basic and diluted earnings per common share increase from $1.41 to $1.49. These figures reflect the company's ability to maintain profitability and shareholder value amidst dynamic market conditions.

Strengths

Financial Resilience and Regulatory Advantage: Eversource Energy's financial resilience is evident in its increased net income and earnings per share, despite a slight dip in operating revenues. The company's rate-regulated business model provides a stable revenue stream, as evidenced by the consistent performance across its electric, gas, and water distribution segments. The regulatory environment in which Eversource operates allows for predictable cost recovery and investment returns, contributing to its financial stability and attractiveness to investors.

Strategic Asset Optimization: The company's strategic divestment from its offshore wind investments, including the sale of its 50% interest in an uncommitted lease area to rsted for $625 million, demonstrates a focus on optimizing its asset portfolio. This move not only generated significant cash proceeds but also allowed Eversource to concentrate on its core regulated businesses, which are key drivers of its financial strength.

Weaknesses

Dependence on Regulatory Compliance: Eversource Energy's dependence on regulatory compliance for rate adjustments and cost recovery can be a double-edged sword. While it provides revenue stability, it also exposes the company to regulatory risks. Changes in regulations or unfavorable regulatory outcomes could impact the company's financial performance and growth prospects.

Operational and Maintenance Costs: The company's operations and maintenance costs have seen a slight increase, which could signal rising expenses in maintaining its extensive distribution network. As infrastructure ages, Eversource may face higher costs to ensure reliability and safety, potentially affecting its operating margins.

Opportunities

Infrastructure Development and Modernization: Eversource Energy has the opportunity to invest in infrastructure development and modernization, which is critical for future growth. The company's commitment to enhancing its distribution systems and adopting new technologies can lead to improved efficiency, customer satisfaction, and compliance with evolving regulatory standards.

Renewable Energy Initiatives: With the global shift towards sustainable energy, Eversource has the opportunity to expand its renewable energy portfolio. The company's experience in managing large-scale energy projects positions it well to capitalize on this trend and meet the increasing demand for clean energy solutions.

Threats

Market and Regulatory Challenges: Eversource Energy operates in a highly regulated industry, where shifts in energy policies and market dynamics pose potential threats. The company must navigate complex regulatory landscapes and adapt to changes in environmental laws, which could impact its operations and financial performance.

Competition and Technological Disruption: The energy sector is becoming increasingly competitive with the entry of new players and the rise of alternative energy sources. Technological advancements may disrupt traditional business models, requiring Eversource to innovate and adapt to maintain its market position.

In conclusion, Eversource Energy (NYSE:ES) exhibits a strong financial foundation and strategic focus on its core operations, which are bolstered by a stable regulatory framework. However, the company must address the challenges of regulatory dependence and rising operational costs. Opportunities for growth lie in infrastructure modernization and renewable energy initiatives, while market volatility and regulatory changes remain potential threats. Eversource's ability to leverage its strengths and opportunities while effectively managing its weaknesses and threats will be crucial in sustaining its competitive edge and ensuring long-term success.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance