Deckers' (DECK) Q1 Earnings Beat, HOKA Brand a Key Driver

Deckers Outdoor Corporation DECK reported better-than-expected first-quarter fiscal 2023 results. Strength in HOKA ONE ONE brand contributed to the company’s performance. While the top line grew year over year, the bottom line declined from the prior-year period.

Shares of this Zacks Rank #3 (Hold) company gained 5.1% during the after-market trading session on Jul 28. In the past three months, shares of Deckers have risen 5.2% against the industry’s decline of 10.2%.

Let’s Delve Deeper

Deckers posted quarterly earnings of $1.66 per share that comfortably surpassed the Zacks Consensus Estimate of $1.33. However, the reported figure decreased 2.9% from the year-ago earnings of $1.71 per share. Higher SG&A expenses and margin contraction hurt the bottom-line results.

Net sales of this Goleta, CA-based company rose 21.8% year over year to $614.5 million and outpaced the Zacks Consensus Estimate of $575.3 million. On a constant currency basis, net sales grew 23.5%. Top-line growth was driven by HOKA ONE ONE and Teva brands.

We note that gross margin contracted 360 basis points to 48% during the quarter, owing to higher freight costs and impacts from unfavorable foreign currency exchange rates. SG&A expenses climbed 20% year over year to $238.4 million. As a percentage of net sales, SG&A expenses decreased 60 basis points to 38.8%.

The company posted an operating income of $56.3 million, down from $61.8 million reported in the year-ago quarter. Again, the operating margin shrunk 310 basis points to 9.2%.

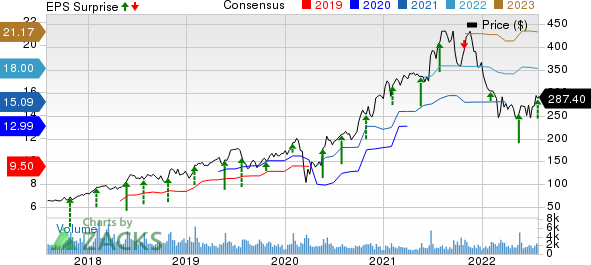

Deckers Outdoor Corporation Price, Consensus and EPS Surprise

Deckers Outdoor Corporation price-consensus-eps-surprise-chart | Deckers Outdoor Corporation Quote

Brand Wise Discussion

HOKA ONE ONE brand net sales surged 54.9% to $330 million and beat the Zacks Consensus Estimate of $287.7 million. UGG brand net sales declined 2.4% to $207.9 million, however, the number came ahead of the consensus mark of $206.7 million. Teva brand net sales increased 2% to $59.6 million and beat the consensus mark of $59.1 million.

Net sales for the Sanuk brand declined 5.9% to $14.2 million and fell short of the consensus estimate of $15 million. Net sales for the Other brands, mainly comprising Koolaburra, fell 45.3% to $2.7 million and came below the consensus mark of $5.3 million.

Other Financial Aspects

Cash and cash equivalents stood at $695.2 million as of Jun 30, 2022, compared with $956.7 million as of Jun 30, 2021. The company ended the quarter with total stockholders’ equity of $1,472.4 million. There were no outstanding borrowings.

During the quarter, the company repurchased about 384 thousand shares for $100 million. As of Jun 30, 2022, the company had $354 million remaining under its share repurchase authorization. The company’s board of directors approved an additional share repurchase authorization of $1.2 billion, which brings the total authorization to about $1.5 billion.

A Sneak Peek into Outlook

Deckers continues to envision fiscal 2023 net sales in the range of $3.45 billion to $3.50 billion. This suggests an increase from $3.150 billion reported in fiscal 2022.

The company now expects fiscal 2023 earnings in the band of $17.50-$18.35 per share, up from the prior estimate of $17.40-$18.25 per share. The current view compares favorably with earnings of $16.26 per share reported last fiscal.

Gross margin is anticipated to be approximately 51.5%. SG&A expenses, as a percentage of sales, are projected to be about 34%, with operating margin expected to be in the bracket of 17.5-18%.

3 Solid Picks

Here we have highlighted three better-ranked stocks, namely, Designer Brands DBI, G-III Apparel GIII and Capri Holdings CPRI.

Designer Brands designs, manufactures and retails footwear and accessories. The stock currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Designer Brands’ current financial year revenues and EPS suggests growth of 6.9% and 16.5%, respectively, from the year-ago reported figure. DBI has a trailing four-quarter earnings surprise of 102.5%, on average.

G-III Apparel designs, sources and markets apparel and accessories under owned, licensed and private label brands. The stock currently flaunts a Zacks Rank #1.

The Zacks Consensus Estimate for G-III Apparel’s current financial year revenues and EPS suggests growth of 13.8% and 8.2%, respectively, from the year-ago reported figure. G-III Apparel has a trailing four-quarter earnings surprise of 97.5%, on average.

Capri Holdings, a global fashion luxury group consisting of iconic brands Versace, Jimmy Choo and Michael Kors, carries a Zacks Rank #2 (Buy). CPRI has an expected EPS growth rate of 11.3% for three-five years.

The Zacks Consensus Estimate for Capri Holdings’ current financial year sales and EPS suggests growth of 3% and 9.8%, respectively, from the year-ago period.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Deckers Outdoor Corporation (DECK) : Free Stock Analysis Report

GIII Apparel Group, LTD. (GIII) : Free Stock Analysis Report

Capri Holdings Limited (CPRI) : Free Stock Analysis Report

Designer Brands Inc. (DBI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance