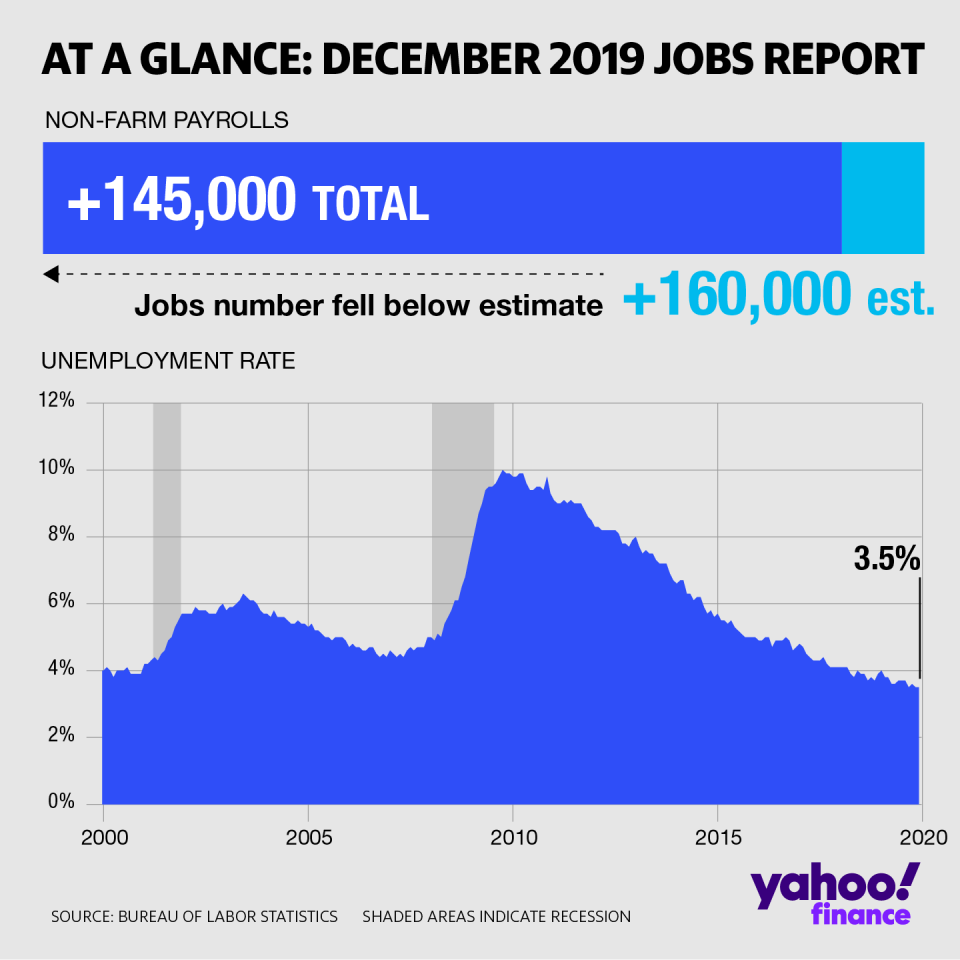

Jobs report: U.S. economy adds 145,000 jobs in December, unemployment rate holds at 3.5%

The U.S. labor market capped off 2019 with fewer than expected job gains and decelerating wage growth. The joblessness rate, however, held at a 50-year low.

Here were the main results from the Department of Labor’s report Friday compared to consensus estimates compiled by Bloomberg:

Change in non-farm payrolls: +145,000 vs. +160,000 expected and +256,000 in November

Unemployment rate: 3.5% vs. 3.5% expected and 3.5% in November

Average hourly earnings, month on month: +0.1% vs. +0.3% expected and +0.3% in November

Average hourly earnings, year on year: +2.9% vs. +3.1% expected and +3.1% in November

The latest jobs report included downward revisions to both October and November’s payroll gains. New jobs in October totaled 152,000, down 4,000 from the previous estimate. And payrolls in November were revised down by 10,000 to 256,000.

Ahead of the report, most economists expected that payrolls gains would decrease in December after surging in November, when General Motors (GM) employees striking between September and October returned to work and pushed up results. But the end of the strike only accounted for a net revised 39,300 of November’s payroll gains in motor vehicles and parts industries – meaning underlying job growth in November was still above the one-year trend even aside from the one-time effect.

Most of the December employment gains came from service industries, extending a trend present throughout 2019 amid broad-based softness in the manufacturing sector.

Within the services sector, retail trade added 41,200 jobs in December, more than reversing the decline of 14,100 from November. Education and health-services was another major job gainer, adding 36,000 positions in December. However, this was just half the additions as seen in November.

Goods-producing industries lost a net 1,000 jobs in December, after adding 52,000 positions in November. Manufacturing lost 12,000 jobs, versus the gain of 58,000 in November boosted by the conclusion of the GM strike.

Inclusive of revisions, payrolls increased by 2.1 million overall in 2019 and averaged about 176,000 per month, representing the slowest pace of job additions since 2011. In 2018, job gains had averaged a227,000 per month.

However, the unemployment rate also ticked lower in 2019, with December’s 3.5% joblessness rate matching November’s rate for the lowest level in 50 years. The lowest unemployment rate in 2018 had been 3.7%.

And in December, the closely watched U-6 underemployment rate – which also includes discouraged workers no longer seeking jobs and part-time employees seeking full-time work – fell to 6.7%. This level was lower than any point since at least 1994, or as far back as Bloomberg data tracks. Peter Tchir, head of macro strategy for Academy Securities, called this “the one impressive number” in Friday’s report.

But the decades-low unemployment rate has translated to just meager wage gains. December’s year on year average hourly wage gain of 2.9% marked the first time this measure has dipped below 3% since July 2018.

“The truly disappointing wage growth trends of the past few months continued in December,” Nick Bunker, Indeed Hiring Lab research director, said in an email Friday. “While we shouldn't overreact to one month of data, the fact that a variety of wage growth metrics show wage growth not picking up with 3.5 percent unemployment should be a topic of discussion.”

But other economists were less fazed by December’s print on wage gains.

“The softness in AHE (average hourly earnings) in Dec. – and downward revisions to prior data – is disappointing, but we expect a revival over the next few months,” Ian Shepherdson, chief economist for Pantheon Macroeconomics, wrote in a note Friday. “Wage gains are still too low to prompt meaningful inflation risk, but the Dec number is an outlier – the smallest m/m increase in non-supervisory and production wages since Oct 2017 – and an upward revision seems a decent bet.”

Markets were little changed immediately following the December jobs report. The S&P 500 ticked up to open at a fresh record high. Crude oil and gold prices edged lower and Treasury yields rose across the curve.

—

Emily McCormick is a reporter for Yahoo Finance. Follow her on Twitter: @emily_mcck

Read more from Emily:

Here are the biggest stories that will drive the stock market in 2020

Stock market 2020: Most experts predict gains, some expect losses

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Find live stock market quotes and the latest business and finance news

Yahoo Finance

Yahoo Finance