How a DCF Analysis Supports the Bull Case for Apple

Apple Inc. (NASDAQ:AAPL) has not been receiving quite as much love from investors as it usually does. The stock is down 9% so far in 2024 against the S&P 500's (SPY) 7% gains through mid-April.

Some of the recent bearishness toward the Cupertino, California-based tech company is founded on short-term concerns. For instance, iPhone sales in the important China market seemed to be under pressure at the start of the year. Others worry more about the core of Apple's business. For example, the company's ecosystem remains under the scrutiny of regulatory agencies around the world. In addition, some fear that Apple may have missed the boat on artificial intelligence.

The bulls, however, may have good reason to cheer the recent pullback as an opportunity to buy the stock at more attractive levels. A discounted cash flow analysis may help to put numbers around the optimism.

To the benefit of those unfamiliar, DCF is an intrinsic valuation methodology in which future free cash flows produced by a company can be discounted to present value to arrive at a fair value of the stock. Because Apple runs two interdependent but largely dissimilar business segments, namely products and services, I like to think of the stock's value as two separate pieces.

How much is Apple's products business worth?

Products is a segment that includes primarily the iPhone, representing roughly half of Apple's total revenues, but also the Mac, iPad as well as wearable and home devices. The products segment featured relatively low margins of 37% in fiscal 2023 compared to the services segment's nearly 71%.

In isolation, products is an inferior business to services not only because of the lower margins, but also because of less predictability around future revenue, earnings and cash flow. Still, I think is it reasonable to expect Apple's product sales to rise by an average of 5% per year through the next five years, albeit not without year-to-year ebbs and flows.

The segment would benefit from the iPhone's competitive advantages and brand loyalty, and the full-scale launch of mixed-reality devices. I see this growth rate declining to 3.50% for the next five years before normalizing at a perpetuity growth rate of 2%.

Regarding profitability, I think it is prudent to assume that Ebit margins will level out, despite them having risen lately due to a heavier mix of pricier devices like the iPhone Pro and Pro Max and the margin gains driven by Apple's M-family of chips. On working capital, I also conservatively assume that the company will not produce any additional cash flow, despite having done so in the past several years through tight inventory and payables management.

Lastly, I think it is reasonable to discount Apple's future product cash flows at a rate of 12.50%. While this rate seems too high for the company at large, it better reflects the lower growth and higher risk profile of the device business. Using the assumptions above, I estimate the fair value of Apple's product segment is roughly $1.14 trillion.

How much is Apple's services business worth?

In my view, the majority of the market value created by Apple comes from the relatively smaller services business. This segment, which represented only 22% of total revenue in fiscal 2023, is much more profitable and produces cash flows more predictably.

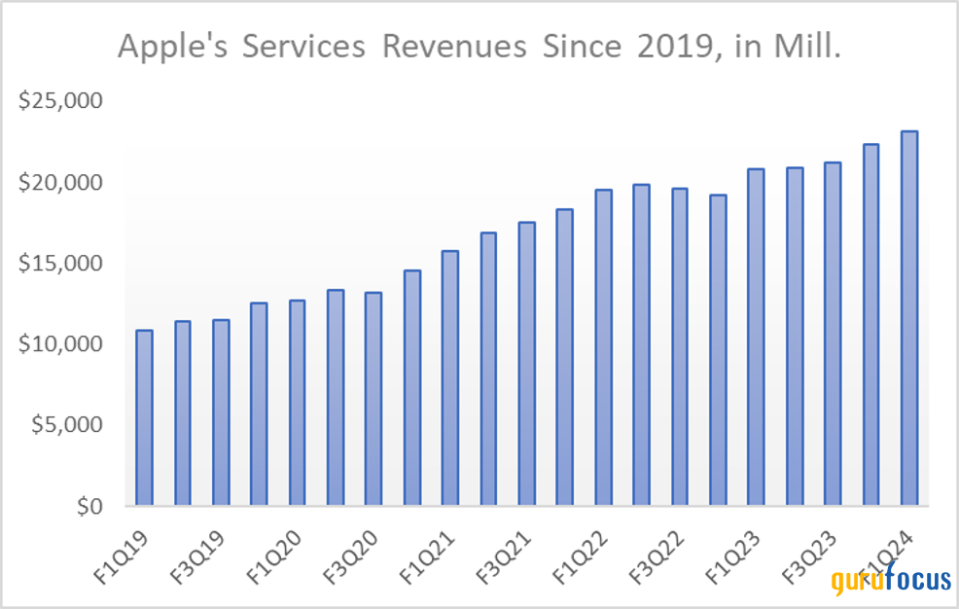

On the first point, services like the App Store and Apple TV+ tend to be highly scalable. While either may generate substantial costs to operate, each marginal dollar in revenue tends to flow straight to operating income, as it produces relatively little in marginal costs. On the latter point, much of Apple's service revenues are either derived from subscriptions or locked in by contract (think about Apple Care as an example). It is no wonder that service revenues have been remarkably stable over time, as the chart below depicts.

For the next five years, I assume services will grow sales at an annual rate of 12%, which is consistent with recent history, although conservative relative to how fast service revenue used to grow before last year. On Ebit margins, I assume an expansion of 100 basis points per year through 2028 due to the scale factor mentioned above. I think free cash flow growth then slows down from an average of 12% per year between 2023 and 2028 to 8% between 2029 and 2033, before settling at a much lower perpetuity growth rate of 2% beyond the next decade.

The discount rate used for services should logically be much lower than that used for Apple's products business. This is the case because of the higher margins, better scalability and lower volatility of future cash flows, as mentioned above. Therefore, I think a discount rate of 7.50% for the services segment, which is three percentage points higher than the 10-year treasury yield, is appropriate.

Using the assumptions above, I arrive at a fair value of $1.93 trillion for the services segment. Added to products' $1.14 trillion and $51 billion in net cash, Apple stock should then be worth roughly $3.10 trillion or $200 per share, which represents 14% of upside potential to the current price.

Recent dip adds to the margin of safety

Of course, a DCF analysis is only as good as the assumptions that go into it. For instance, I could project that services will grow at 3% per year in perpetuity beyond 2033, and that would give me a fair value on Apple shares of $217.50 for 24% upside potential. Instead, if I assume the discount rate applied to the services business should be 10% instead of 7.50%, then Apple shares would be worth only about $160 for a 10% downside potential.

The more important point, however, is this year's 9% decline in Apple stock price and 11% pullback since the December 2023 all-time high provides investors with a wider margin of error. Assuming I am right about Apple shares being worth $200, having bought them a mere four months ago would have been a bad move. Buying now instead could produce decent double-digit gains, which I believe will materialize in the next 12 months.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance