DBS: 2 Telco Stocks to Consider Upon 4th Telco’s Entry

Earlier this month, the forerunner for the 4th telecommunication (telco) company had all the current telcos in a frenzy—the new level of low in prices proposed by MyRepublic has M1, StarHub (STH) and Singapore Telecommunications (ST) slashing prices in anticipation of the competition. As a consumer, this is a great news but is it good for investors too?

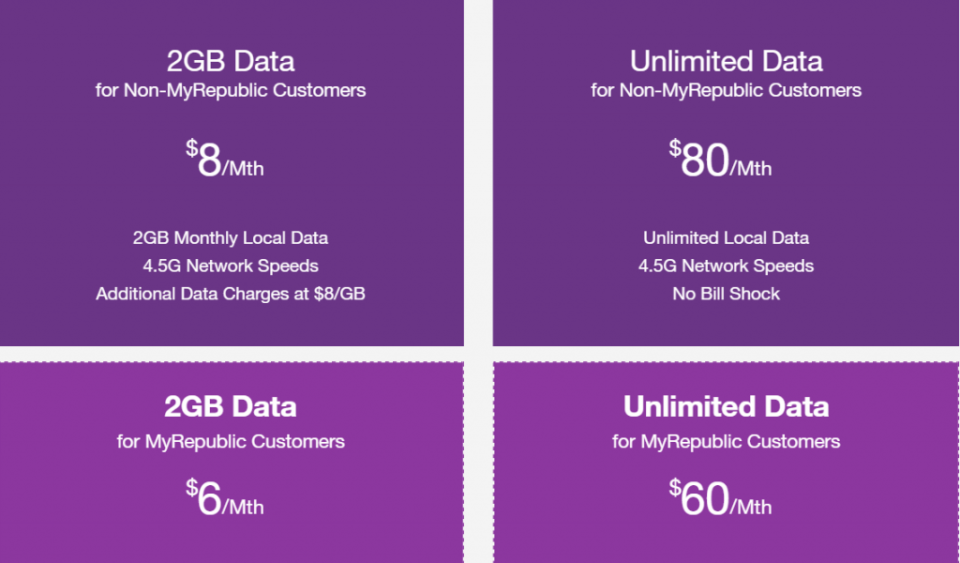

What Is MyRepublic Offering?

Source: Proposed Price Plan for Singapore’s 4th Telco, MyRepublic

Given the structure of its plans, MyRepublic’s main clientele will be the low-end and high-end users. To be specific, low-end users are those whose date usage falls below 2GB per month. For mid-end, it will be between 3GB to 5GB per month. For high-end, it will be above 5GB to unlimited.

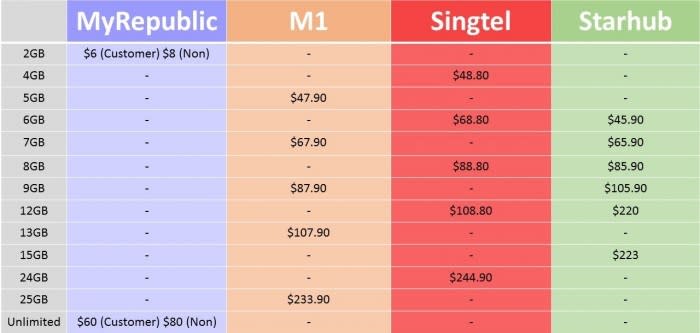

Here is a table created by MustShareNews, to give you an idea of the price war among the four telcos, and where MyRepublic stands.

Source: https://vulcanpost.com

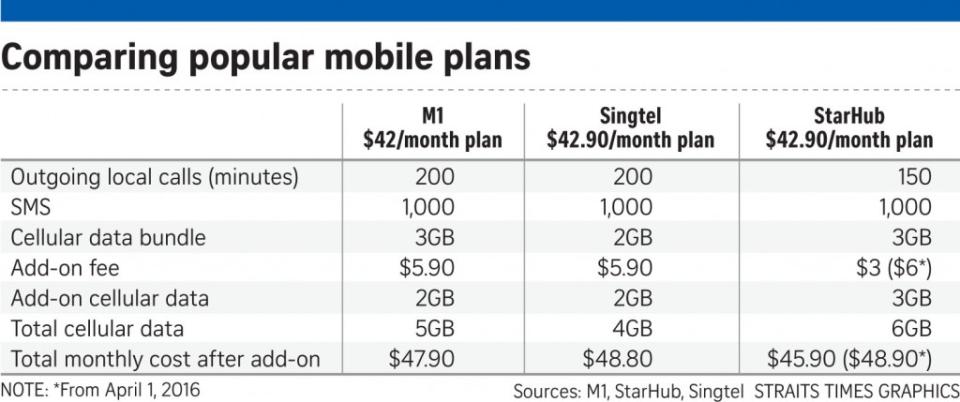

How Much Will The Return Be Affected?

To defend their market shares, the other telcos have significantly slashed their prices. Based on research from DBS, M1’s mid-tier plan with 5GB data has been reduced from $63.40 to $47.90 which translates to an approximate discount of 25 percent. The main impact will be from the high-tier plans which saw a reduction of more than 50 percent.

As the competition will be in the SIM-only plans, the telcos are expected to cut handset subsidies. Using the latest price, earnings for STH is estimated to be lowered by 5 percent to 8 percent while revenue for M1 is expected to decline by 2 percent to 4 percent this year.

What Happens When There Is A 4th Telco?

In the scenario of the entry of MyRepublic as the 4th telco, the other telcos will likely have to slash prices again to be more competitive. With the assumption of a 10 percent market share in the first five years of its launch, MyRepublic is estimated to have an EBITDA margin standing at 20 percent, according to analysts from DBS Research.

If the telcos engage in a price war, it is expected for their revenues to decrease strongly and margin would have to be slashed by half to meet MyRepublic’s competition.

Investors’ Takeaway

At the current moment, investors should look forward to 3Q16 when evaluating their investments in telco. The action of the 4G spectrum will be the key to whether there will be a new entrant to the market. Analysts from DBS Research has evaluated the scenario of a new entrant and its effect on the market.

M1

Source: 5 Year Price of M1, Bloomberg

M1 is currently trading at $2.59 which is fairly priced based on the base case target price of $2.60. If MyRepublic enters the market, M1 will have a potential downside of 15.1 percent. If there is no 4th telco in the picture, there will be a potential upside estimated at 31.1 percent.

StarHub

Source: 5 Year Price of StarHub, Bloomberg

STH is trading slightly above the base case target price of $3.30, but has a lower deviation given its closer trading price in bear and bull scenario in comparison to M1. In the event of a 4th telco, STH has a target price of $3.00. Its target price will be $4.10 if there is no new competitor.

Yahoo Finance

Yahoo Finance