DAX Index Daily Fundamental Forecast – March 19, 2018

The DAX index continues to trade near the highs of its range as the risk sentiment continues to be high around the globe. It is a pity that the DAX has not been able to mount a serious bull run over the last few months despite the US stock indices moving to highs regularly. The end of the QE is pretty near and that is clearly weighing on the index.

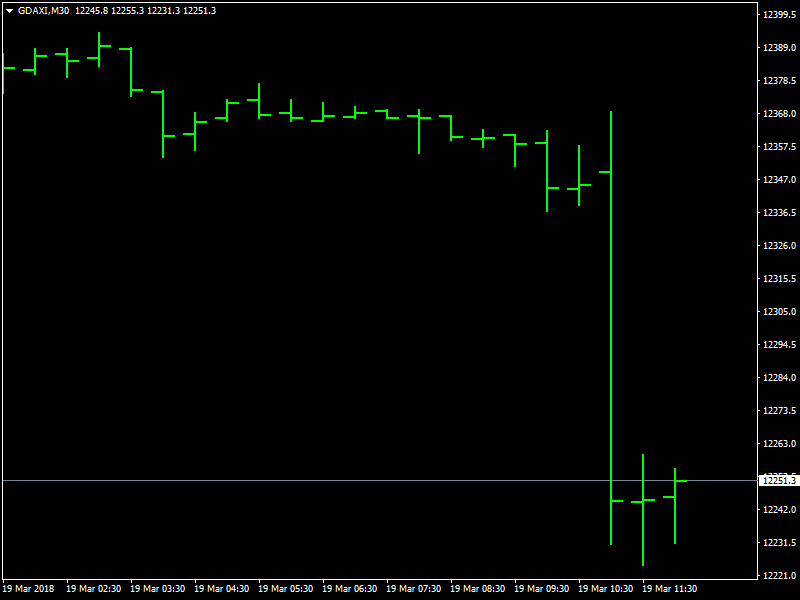

DAX In Range

The DAX bulls have been struggling to make any kind of a dent on the bear trend and irrespective of what is happening in the different parts of the world and also that is the reason why they have been unable to stage a breakout from the range since the fall in the prices that we saw a few weeks back. The index has been trading and consolidating within this range ever since that time and kind of a move higher has been promptly beaten back during this time. We believe that this is likely to continue in the medium term.

The DAX is unlikely to make any sort of a return to the bullish trend in the medium term as the QE tapering and the end would be enough to keep the index under wraps for the time being. The investors and the traders are not yet very convinced about the ability of the index to move higher under such a situation and that is why we have been seeing the buy side under pressure as the demand is very less.

Looking ahead to the rest of the day, we do not have any major news from Germany or the Eurozone for the day as it is the first day of the week. So, we can see some consolidation but as the DAX is near the highs of its range, the consolidation is likely to have a bearish bias.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance