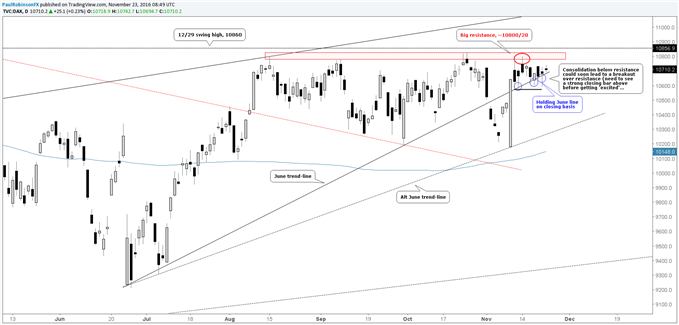

DAX: Consolidating Below Major Resistance

DailyFX.com -

What’s inside:

The DAX continues to chop around between support and resistance

General risk appetite helping keep Europe buoyed

U.S. holiday to impact global markets for remainder of week

Check out our webinar calendar for a full list of all upcoming live events.

In Monday's post, we looked at pattern set-ups in the DAX on the hourly chart, which could have potentially worked out one of a couple of different ways – a head-and-shoulders or triangle. So far, it is working out to be nothing at all, which is always the third scenario, as the market continues to chop around between support and resistance. We’ll revisit the short-term chart at a later time.

The DAX is caught between its inability to find the buyers needed to push through major resistance surrounding the 10800 level and not enough selling pressure to post a closing daily bar below support. General global risk appetite for stocks is helping keep Europe buoyed – Asian and U.S. markets are humming along.

Provided there remains a bid-tone in global risk and the consolidation holds up below the important 10800 area, the probable scenario is for the DAX to eventually take out resistance and trade to new heights for the year. We will be patient in waiting for a closing daily bar well into the 10800s before allowing conviction to grow. A drop below the 11/10 low at 10576 would be considered a solid negative.

DAX: Daily

Created with Tradingview

Head’s up, tomorrow global markets will be without the influence of U.S., as their markets will be closed for the Thanksgiving holiday. Expect participation to be low on Friday, too, as the weekend becomes extended. Holiday trading conditions, barring an unforeseen news event, will likely spill over to other global financial markets.

Slower market conditions are always a good time to brush up and develop new skillsets, check out our Trading Guides designed for traders of all experience levels.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinonFX.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from IG.

Yahoo Finance

Yahoo Finance