Dallas Fed's Kaplan: Yield curve was a 'reality check' for supporting earlier rate cuts

Dallas Fed President Robert Kaplan said Thursday that he supported both of the Federal Reserve’s 25 basis point cuts this year to insure the U.S. economy against a recession. Kaplan said an inverting yield curve was a “reality check” that those rate cuts were needed.

“For me, these moves in market-determined rates are a reality check that suggests the setting of the federal funds rate was tighter than appropriate prior to the July and September [Federal Open Market Committee] meetings,” Kaplan wrote in a blog post.

Kaplan pointed to falling yields on U.S. Treasuries, safe assets that investors tend to load up on during times of uncertainty. Kaplan said lower Treasury yields have reflected slowing global growth, heightened trade tensions, and “a more pessimistic view regarding the prospects for U.S. economic growth.”

In August, yields on the 10-year Treasury dipped below the yield on the 2-year Treasury for the first time since 2007. An “inverted” yield curve has preceded each of the last seven recessions dating back to 1969.

But Kaplan still described U.S. economic growth for the time being as “resilient.” He said he expects GDP growth to slow down to 1.7% in the second half of this year, a slower pace than the 2.5% growth logged for the first half of the year. Slower growth does not necessarily mean recession; Kaplan said lower growth is the new normal because of structural changes like an aging U.S. population and sluggish labor productivity.

Kaplan wrote that the biggest threats to U.S. GDP growth right now are slowing global growth and weakening U.S. investment. Kaplan worries that these risks could crack the health of the U.S. consumer, which Fed officials have described as the driver of the economy during the longest economic expansion in American history.

Kaplan said the consumer, however, is a hard factor to measure and said he has therefore supported pre-emptive cuts.

“This is why I’ve repeatedly said that if we wait to see weakness in the consumer before taking action, we will have likely waited too long,” Kaplan wrote. “From a risk-management point of view, that is a mistake I prefer not to make.”

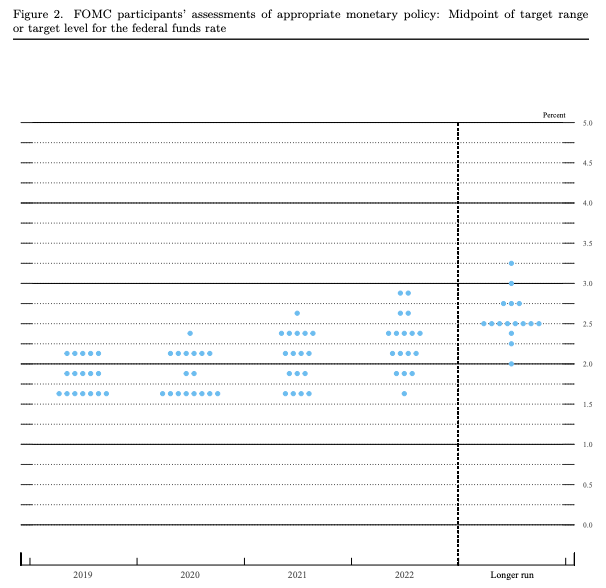

Kaplan did not pre-commit to any future move, saying he would “remain highly vigilant” ahead of the next meeting on Oct. 30.

Kaplan is not a voting member of this year’s committee but will rotate into a voting role next year, per the Fed’s rules.

Brian Cheung is a reporter covering the banking industry and the intersection of finance and policy for Yahoo Finance. You can follow him on Twitter @bcheungz.

Central banks say negative interest rates have been 'effective'

Boston Fed's Rosengren: US economy 'consistent with staying where we are'

New Wells Fargo CEO will again run a West Coast-based company from NYC

‘The weirdest place in the world’: What the Fed missed in Jackson Hole

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance