Cytek Biosciences Inc (CTKB) Q1 2024 Earnings: Revenue Surges, Yet Net Loss Persists

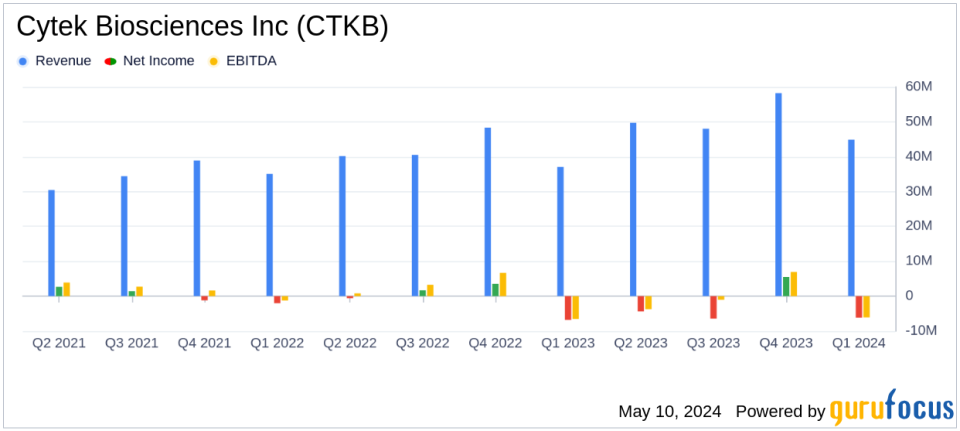

Revenue: Reported $44.9 million, a 21% increase year-over-year, falling short of estimates of $49.34 million.

Net Loss: Recorded at $6.2 million, an improvement from a net loss of $6.8 million in the same quarter last year, but above the estimated net loss of $4.16 million.

Earnings Per Share (EPS): Reported a loss of $0.05 per share, below the estimated loss of $0.03 per share.

Gross Profit Margin: Decreased to 51% from 57% year-over-year, with adjusted gross profit margin at 55%.

Operating Expenses: Slightly increased to $33.7 million from $33.2 million in the previous year.

Cash and Marketable Securities: Ended the quarter with $270.4 million, up from $262.7 million at the end of the previous quarter.

2024 Full-Year Revenue Guidance: Reaffirmed in the range of $203 million to $213 million, indicating expected growth of 5% to 10% over the full year 2023.

On May 8, 2024, Cytek Biosciences Inc (NASDAQ:CTKB) disclosed its financial outcomes for the first quarter of 2024 through its 8-K filing. The company, a pioneer in cell analysis solutions, reported a significant 21% year-over-year increase in total revenue, reaching $44.9 million. This growth was bolstered by both organic gains and recent acquisitions, underscoring a robust demand for Cytek's innovative offerings in the medical devices and instruments sector.

Company Overview

Cytek Biosciences Inc is at the forefront of advancing cell analysis with its cutting-edge Full Spectrum Profiling (FSP) technology. The company's flagship products, including the Cytek Aurora and Northern Lights systems, deliver high-resolution, high-content, and high-sensitivity cell analysis. These technologies are crucial for the medical and research communities, providing detailed cellular insights at reduced costs. Cytek's primary market is the United States, where it continues to expand its influence and market share.

Financial Performance Analysis

The first quarter saw Cytek achieving a gross profit of $23.0 million, a 9% increase from the previous year, although the gross margin slightly declined due to higher costs associated with scaling operations and integrating new acquisitions. Notably, the adjusted gross profit margin stood at 55%, slightly down from 59% in the prior year, reflecting the ongoing adjustments in the business structure.

Operating expenses were slightly up by 2% to $33.7 million, primarily due to increased personnel costs associated with expanding the company's workforce. Research and development expenses showed a marginal decrease, indicating a slight shift in spending towards marketing and administrative capacities to support growing operations.

The net loss for the quarter was $6.2 million, an improvement from a net loss of $6.8 million in the first quarter of 2023. This reduction in net loss is a positive indicator of Cytek's improving operational efficiency and cost management strategies. The company also reported a healthier cash position with $270.4 million in cash, restricted cash, and marketable securities, providing a solid foundation for future investments and growth.

Strategic Initiatives and Market Outlook

Cytek Biosciences reaffirmed its revenue guidance for 2024, projecting total revenues to be between $203 million and $213 million. This forecast suggests confidence in continued revenue growth and market expansion. The management's commentary highlighted ongoing efforts to enhance service offerings and expand the installed base of instruments, which are expected to drive sustainable growth and profitability in the upcoming periods.

The company's strategic acquisitions, such as the recent purchase from Luminex, have not only expanded its product line but also contributed to a more diversified revenue stream. This aligns with Cytek's goal to cement its position as a leader in the high-growth cell analysis market.

Conclusion

Despite the persistent net losses, Cytek Biosciences Inc's first quarter results for 2024 reflect a company that is growing and evolving in a competitive landscape. With increased revenue, a strong cash position, and strategic investments in technology and market expansion, Cytek is poised to leverage its innovative platform to capture further market share and possibly achieve profitability as projected by the end of 2024.

Investors and stakeholders will likely keep a close watch on how Cytek manages its operational costs and integrates its acquisitions moving forward, as these factors will be crucial in turning the company's increased revenue into bottom-line profits.

Explore the complete 8-K earnings release (here) from Cytek Biosciences Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance