Cummins (CMI) to Report Q1 Earnings: Here's What to Expect

Cummins Inc. CMI is slated to release first-quarter 2024 results on May 2, before market open. The Zacks Consensus Estimate for the to-be-reported quarter’s earnings per share (EPS) and revenues is pegged at $5.11 and $8.36 billion, respectively.

For the first quarter, the consensus estimate for CMI’s EPS has moved up by a penny in the past 30 days. Its bottom-line estimates imply a decline of 7.93% from the year-ago reported number.

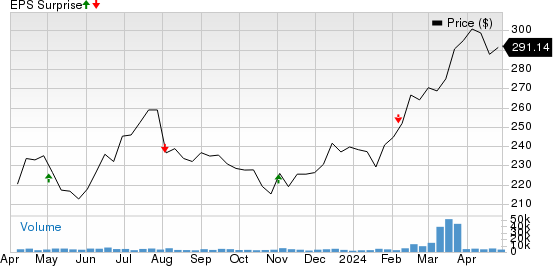

The Zacks Consensus Estimate for its quarterly revenues suggests a year-over-year decline of 1.13%. Over the trailing four quarters, CMI surpassed earnings estimates on two occasions and missed twice, the average surprise being 2.81%. This is depicted in the graph below:

Cummins Inc. Price and EPS Surprise

Cummins Inc. price-eps-surprise | Cummins Inc. Quote

Q4 Highlights

In fourth-quarter 2023, the company’s adjusted earnings per share of $4.14 fell from $4.52 reported in the prior-year quarter. The figure also missed the Zacks Consensus Estimate of $4.41.

Cummins’ revenues totaled $8.54 billion, up from $7.77 billion recorded in the year-ago quarter. The top line beat the Zacks Consensus Estimate of $8.08 billion.

Factors to Shape Q1 Results

Cummins is making significant strides in inorganic growth through the acquisitions of Jacobs Vehicle Systems, Meritor and the Siemens Commercial Vehicles business. The buyout of Meritor has positioned CMI as a leading provider of integrated powertrain solutions across internal combustion and electric power applications. The acquisition added products to the company’s components business.

The buyout of Hydrogenic Corp., investment in Loop Energy and partnership with NPROXX have expanded Cummins’ fuel cell and hydrogen-processing technology capabilities. Also, the acquisition of a 50% stake in Momentum Fuel, a joint venture with Rush Enterprises and alliances with Sinopec, Isuzu Motors, Werner Enterprises, Chevron and Iberdrola augur well. Strategic acquisitions and partnerships are likely to have bolstered the company’s performance in the to-be-reported quarter.

CMI has a growing pipeline of electrolyzer orders. In 2023, Cummins’ electrolyzer backlog totaled more than $500 million. The growing demand for electrolyzer is likely to have boosted the company’s top-line performance in the first quarter.

Key Predictions

Here’s a brief look at the revenues and EBITDA estimates for Cummins’ segments.

For the first quarter, our estimate for quarterly sales of the Engine segment is pegged at $2.8 billion, suggesting a decline from $2.99 billion reported in first-quarter 2023. Our estimate for the segment’s EBITDA is $389.9 million, implying a decline from $457 million recorded in the first quarter of 2023.

For the first quarter, our estimate for sales from the Distribution segment is $2.51 billion, indicating a rise from year-ago sales of $2.4 billion. Our forecast for the segment’s EBITDA is $323.5 million, suggesting a fall from $335 million reported in the first quarter of 2023.

For the quarter under discussion, we expect net sales from the Power System segment to be $1.42 billion, suggesting a rise from $1.34 billion recorded in first-quarter 2023. Our forecast for the segment’s EBITDA is $231 million, implying a rise from $219 million generated in the first quarter of 2023.

Our projection of $3.3 billion for the Components segment’s quarterly net sales implies a decline from $3.56 billion reported in the first quarter of 2023. Our estimate for the segment’s EBITDA is pegged at $489 million, indicating a decline from $507 million recorded in first-quarter 2023.

We expect quarterly sales from the Accelera segment to be $111.7 million, indicating an increase from $85 million reported in the year-ago quarter.

Earnings Whispers

Our proven model predicts an earnings beat for Cummins for the quarter to be reported, as it has the right combination of the two key ingredients. A combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That is the case here, as elaborated below.

Earnings ESP: CMI has an Earnings ESP of +2.81%. This is because the Most Accurate Estimate is higher than the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: It currently carries a Zacks Rank #3.

Earnings Whispers for Other Auto Stocks

Lucid Group, Inc. LCID has an Earnings ESP of -8.00% and a Zacks Rank #3 at present. It is scheduled to post first-quarter 2024 earnings on May 6. The Zacks Consensus Estimate is pegged at a loss of 25 cents per share. You can see the complete list of today’s Zacks #1 Rank stocks here.

LCID missed earnings estimates in each of the trailing four quarters, the average negative surprise being 7.96%.

Rivian Automotive, Inc. RIVN has an Earnings ESP of -1.77% and a Zacks Rank #3 at present. The company is slated to post first-quarter 2024 earnings on May 7. The Zacks Consensus Estimate is pegged at a loss of $1.13 per share.

RIVN surpassed earnings estimates in each of the trailing four quarters, the average surprise being 13.82%.

Nikola Corporation NKLA has an Earnings ESP of 0.00% and a Zacks Rank #3 at present. The company is scheduled to post first-quarter 2024 earnings on May 7. The Zacks Consensus Estimate is pegged at a loss of 9 cents per share.

NKLA surpassed earnings estimates in three of the trailing four quarters and missed once, the average negative surprise being 11.24%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cummins Inc. (CMI) : Free Stock Analysis Report

Nikola Corporation (NKLA) : Free Stock Analysis Report

Lucid Group, Inc. (LCID) : Free Stock Analysis Report

Rivian Automotive, Inc. (RIVN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance