CTS Corp (CTS) Q1 2024 Earnings: Misses on Revenue and Earnings Estimates

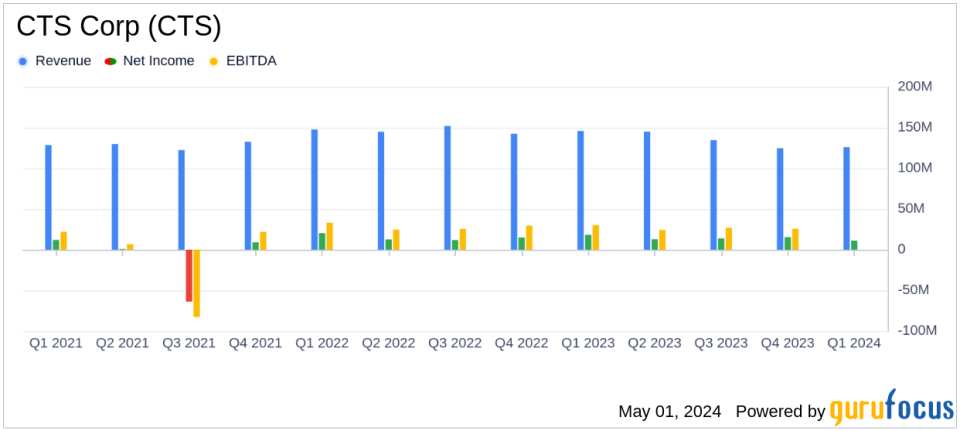

Revenue: Reported at $125.7 million, down 14% year-over-year, falling short of estimates of $126.75 million.

Net Income: Totaled $11 million, representing a decrease from $18 million in the prior year, and fell short of the estimated $15.37 million.

Earnings Per Share (EPS): Recorded at $0.36, below the estimated $0.41 and down from $0.58 year-over-year.

Adjusted Earnings Per Share: Came in at $0.47, a decrease from $0.61 in the first quarter of 2023.

Operating Cash Flow: Increased to $18 million from $11 million in the first quarter of the previous year.

Adjusted EBITDA Margin: Recorded at 20.3%, a decrease from 21.9% in the same quarter last year.

2024 Guidance: Maintained with expected sales between $530 million and $570 million and adjusted diluted EPS ranging from $2.10 to $2.35.

On May 1, 2024, CTS Corp (NYSE:CTS), a prominent player in the electronics industry specializing in sensors, electronic components, and actuators, released its first-quarter financial results through its 8-K filing. The company reported a decline in both revenue and earnings, falling short of analyst expectations for the quarter.

Company Overview

CTS Corp operates primarily in the United States, with additional operations in China, Singapore, the Czech Republic, Taiwan, and other countries. The company serves a diverse range of markets including aerospace and defense, industrial, IT, medical, telecommunications, and transportation.

Financial Performance Summary

For Q1 2024, CTS reported sales of $125.7 million, a 14% decrease from the previous year, and below the estimated $126.75 million. This decline was attributed to a 17% decrease in sales to non-transportation end markets and a 10% decrease in the transportation sector. Net income for the quarter was $11 million, or $0.36 per diluted share, significantly lower than the estimated $0.41 per share and down from $18 million, or $0.58 per share in Q1 2023.

Despite these challenges, the company saw an improvement in operational efficiencies which helped mitigate the impact of lower volumes. Adjusted EBITDA margin slightly decreased to 20.3% from 21.9% in the previous year. Operating cash flow showed a positive movement, increasing to $18 million from $11 million in Q1 2023.

Strategic Initiatives and Market Challenges

CEO Kieran OSullivan highlighted the company's strategic focus on diversifying its customer base and enhancing its opportunity pipeline. CTS is also maintaining a disciplined capital structure to support organic growth, strategic acquisitions, and shareholder returns. However, the company faces ongoing challenges such as market volatility and competitive pressures.

Future Outlook

CTS has reaffirmed its full-year 2024 guidance, projecting sales between $530 million and $570 million and adjusted diluted EPS in the range of $2.10 to $2.35. This guidance reflects the management's confidence in the company's strategic initiatives despite the current economic uncertainties.

Investor Considerations

While CTS's Q1 performance fell short of expectations, its strategic measures to improve operational efficiency and diversify its market presence may provide a foundation for future growth. Investors should consider both the risks associated with the current economic environment and the potential benefits of the company's long-term strategies.

For more detailed information, including future earnings calls and presentations, investors are encouraged to visit the CTS Corp website or directly access the financial reports and supplemental materials provided by the company.

As CTS continues to navigate through market fluctuations and strategic realignments, it remains to be seen how these efforts will translate into financial performance in the upcoming quarters.

Explore the complete 8-K earnings release (here) from CTS Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance