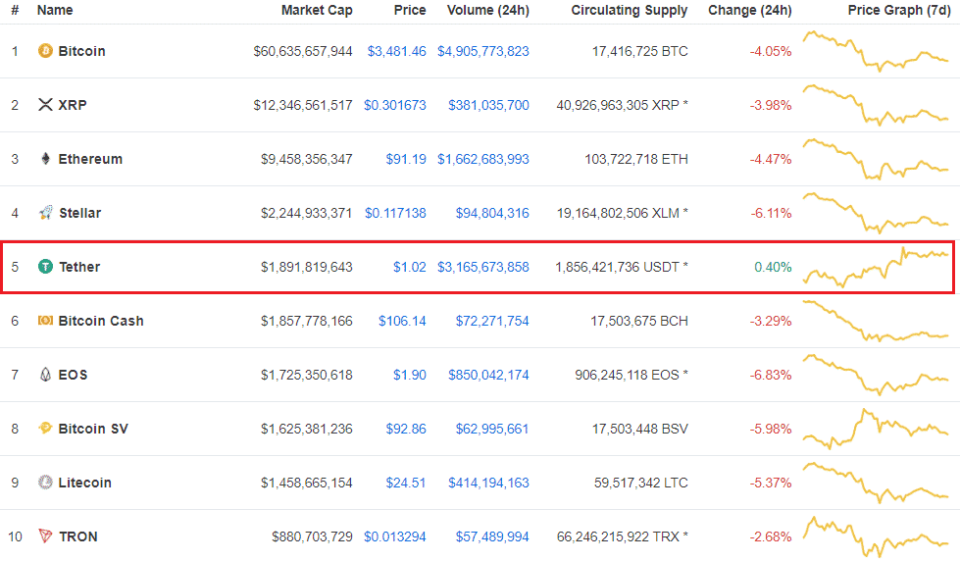

Crypto Downturn Thrusts Tether into Top 5 in Market Cap Rankings

Tether (USDT) has recently found itself among the top five cryptocurrency assets by market cap – despite its own declining capitalization – due in part to the dramatic demise of other top currencies such as Bitcoin Cash and EOS.

That’s particularly notable since Tether has shed around $700 million in assets since September – which in USDT means actual units of issuance, not just changing crypto tides. That much has actually exited in this span of time – at the time being $2.5 billion and today being around $1.8 billion. This is an incredible loss, and if Tether’s network were a company, investors would be running for the hills. But instead, it’s more like customers are heading for the hills.

One could speculate on why Tether is retaining so much, rather than why it’s lost so much. One possible contributing factor is the high cost of exiting Tether directly as opposed to other stablecoins. Paxos Standard, USD Coin, and Gemini Dollar all have much friendlier exit terms than Tether, which charges a minimum in the several thousands of dollars to convert back to US dollar.

This time 90 days ago, Litecoin had more than double its present market cap, which stood at more than $3.4 billion. Today it’s $400 million behind Tether. EOS was also around 200% of its present state, then being at over $4 billion, but today being just over $2 billion and downward pressure possibly pushing it further. Tokenized platforms rely on demand from their associated tokens, and EOS will have to see the launch of new projects or renewed interest in old ones to recover its past glory.

But there’s no sadder story in this range than Bitcoin Cash, which has lost roughly 75% of its former glory. 90 days ago it had a market capitalization of over $8 billion whereas today it’s actually behind Tether by more than $100 million. It wouldn’t be fair not to note here that it’s much easier for Bitcoin Cash to add capitalization than it would be for Tether. There’s fewer gates to pass through, so if either is to recover in a quick and dramatic fashion, BCH would probably go first.

But will Tether retain its hold on the stablecoin sphere? Paxos Standard and USDC are rapidly gaining over the past 30 days, PAX more so than USDC, although USDC retains a higher overall capitalization by about $22 million. Combined they have a market capitalization of around $372 million.

If you add in TrueUSD‘s $210 million and Gemini Dollar’s $90 million, you’re pushing toward $700 million between them. Then, if you add in Dai, you’re close to three-quarters of one billion dollars.

So all told, the competitor stablecoins have a ways to go. But if trends continue, with newer entrants gaining and Tether losing, the day may not be terribly far off when Tether is the outlier and one of the later pegged coins is king.

Featured Image from Shutterstock

The post Crypto Downturn Thrusts Tether into Top 5 in Market Cap Rankings appeared first on CCN.

Yahoo Finance

Yahoo Finance