Crude Oil Price Update – Traders Not Too Impressed with Partial Trade Deal

U.S. West Texas Intermediate crude oil futures are trading sharply higher on Friday. A combination of events helped provide the fuel for the rally. Early in the session, the market was underpinned by a report that OPEC was considering cutting production further when it meets in early December. Buying was also driven by renewed optimism over U.S.-China trade talks. Later, prices rose sharply after Iranian state media said that two rockets had struck an Iranian tanker traveling through the Red Sea.

At 20:05 GMT, December WTI crude oil is trading $54.75, up $1.19 or +2.22%.

Although the attack on the tanker is grabbing the headlines, it was the three events that put prices up over 2.00%. The reaction to the attack was mild compared to the spike to the upside following the attack on Saudi Arabian oil production facilities. This is understandable since the amount of oil that leaked from the tanker was small.

Nonetheless, the attack raises concerns about an escalation of violence in the region. However, the price action suggests traders are hedging against the risk. In other words, if it was a surprise attack, prices would’ve jumped much higher.

Furthermore, traders are more focused on the outcome of U.S.-China trade talks.

Daily Technical Analysis

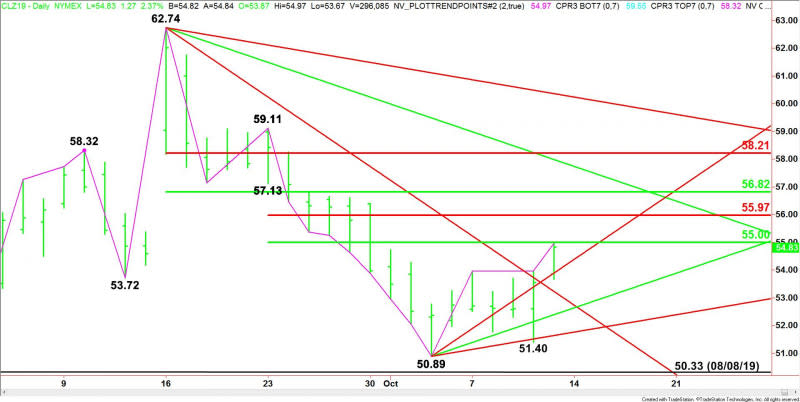

The main trend is down according to the daily swing chart. The trend won’t change to up until the swing top at $59.11 is violated. This usually means a support base has to form before prices will rise substantially. A trade through $50.89 will signal a resumption of the downtrend.

The minor trend is up, which means momentum is trending higher. A trade through $51.40 will change the minor trend to down. This will also change investor sentiment.

The short-term range is $59.11 to $50.89. Its retracement zone at $55.00 to $55.97 is the first upside target. Since the main trend is down, sellers are likely to come in on the first test of this zone.

The main range is $62.74 to $50.89. Its retracement zone at $56.82 to $58.21 is the major resistance.

Near-term Outlook

Friday’s rally stopped at the minor 50% level at $55.00. This is the first resistance. Overcoming this level will indicate the buying is getting stronger. This could lead to a test of the minor Fibonacci level at $55.97. Sellers could come in again on a test of this level.

On the downside, a break through the uptrending angle at $53.89 will indicate the return of sellers. This could trigger an even steeper break into $52.39.

Side Notes

Keep in mind that even if there is partial trade deal between the U.S. and China, it won’t mean much until all the tariffs are lifted. In the meantime, demand is likely to continue to suffer. And this could keep a lid on prices.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance