CRISPR (CRSP) to Report Q1 Earnings: What's in the Cards?

We expect investors to focus on the initial sales numbers of CRISPR Therapeutics AG’s CRSP newly approved gene therapy, Casgevy (exa-cel), when the company reports first-quarter 2024 results.

Factors to Note

CRISPR Therapeutics’ top line comprises grants and collaboration revenues from its partnership with large-cap biotech Vertex Pharmaceuticals VRTX.

Revenues in the to-be-reported quarter are likely to have been driven by collaboration revenues from Vertex. The Zacks Consensus Estimate for total revenues stands at $8.31 million.

Casgevy is the first marketed product in CRISPR Therapeutics’ portfolio. Vertex leads the global development and commercialization of Casgevy under the terms of a 60/40 profit-sharing agreement with CRISPR Therapeutics.

In December 2023, the FDA approved CRSP and VRTX’s gene therapy, Casgevy, for treating sickle cell disease (SCD) in patients aged 12 years and older. Consequently, the FDA has expanded Casgevy’s label to treat transfusion-dependent beta thalassemia (TDT) in patients aged 12 years and older in early 2024.

The European Commission approved Casgevy for the treatment of patients aged 12 years and older with severe SCD and TDT in February 2024.

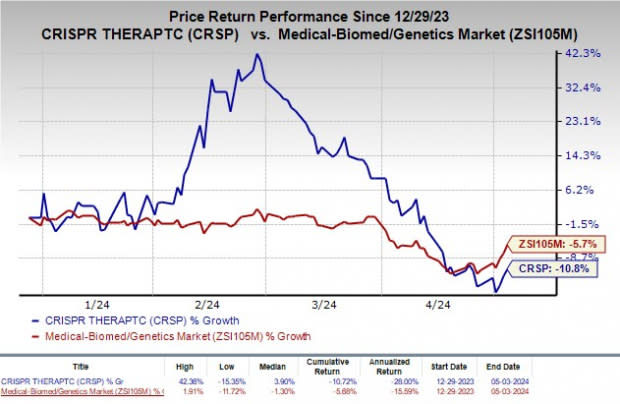

Shares of CRISPR Therapeutics have declined 10.8% so far this year compared with the industry’s decrease of 5.7%.

Image Source: Zacks Investment Research

As Casgevy launch activities are already underway in several countries, we expect management to announce the first sales numbers of Casgevy on the first-quarter conference call.

CRISPR Therapeutics is developing next-generation CAR-T therapy candidates — CTX112 (targeting CD19-positive B-cell malignancies) and CTX131 (targeting relapsed or refractory solid tumors) in separate phase I/II studies.

CRSP is currently studying its first two in-vivo candidates, CTX310 and CTX320, in separate phase I clinical studies targeting ANGPTL3 and lipoprotein(a), respectively.

Updates related to the progress on the pipeline candidates are expected on the upcoming earnings call. Activities related to developing CRSP’s pipeline candidates are likely to have escalated operating expenses in the to-be-reported quarter.

Earnings Surprise History

CRISPR Therapeutics has a positive earnings surprise history. The company beat estimates in each of the trailing four quarters, delivering an average earnings surprise of 129.68%. In the last reported quarter, CRISPR Therapeutics’ earnings beat estimates by 375.00%.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for CRISPR Therapeutics this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That is not the case here, as you will see below. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Earnings ESP: CRISPR Therapeutics has an Earnings ESP of 0.00% as both the Most Accurate Estimate and the Zacks Consensus Estimate are pegged at a loss of $1.63 per share.

Zacks Rank: CRISPR Therapeutics currently carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks to Consider

Here are a few stocks worth considering from the healthcare space, as our model shows that these have the right combination of elements to beat on earnings this reporting cycle.

ANI Pharmaceuticals, Inc. ANIP has an Earnings ESP of +9.74% and a Zacks Rank #2.

Shares of ANI Pharmaceuticals have gained 22% in the year-to-date period. Earnings of ANI Pharmaceuticals beat estimates in each of the last four quarters, delivering an earnings surprise of 109.06%. ANIP will report first-quarter results on May 10.

2seventy bio, Inc. TSVT has an Earnings ESP of +31.94% and a Zacks Rank #3.

Shares of 2seventy bio have rallied 11.5% in the year-to-date period. Earnings of 2seventy bio beat estimates in each of the last four quarters, delivering an earnings surprise of 15.53%. TSVT will report first-quarter results on May 8.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vertex Pharmaceuticals Incorporated (VRTX) : Free Stock Analysis Report

ANI Pharmaceuticals, Inc. (ANIP) : Free Stock Analysis Report

CRISPR Therapeutics AG (CRSP) : Free Stock Analysis Report

2seventy bio, Inc. (TSVT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance