CPF Investment Scheme (CPFIS) – Everything You Need to Know About Investing with CPF

One of the biggest complaints that Singaporeans have about their CPF savings is that we never actually see the money we’ve saved.

Then there’s the other complaint — that the interest rates of the CPF accounts are too low to combat inflation. This is where the CPF Investment Scheme (CPFIS) comes in to save the day.

Wait a minute, don’t I already get interest on my CPF?

Yes, you do. While the returns aren’t insanely high, they’re still a lot better than leaving your cash in a bank account. And the interest is risk-free!

Here are the current interest rates on CPF accounts:

Account type | Annual interest rate | Bonus interest |

Ordinary Account (OA) | 2.5% | +1% on first $60,000 (capped at $20,000 for OA) +2% on first $30,000 for 55 years old and up (capped at $20,000 for OA) |

Special Account (SA) | 4% | |

Medisave Account | 4% | |

Retirement Account | 4% |

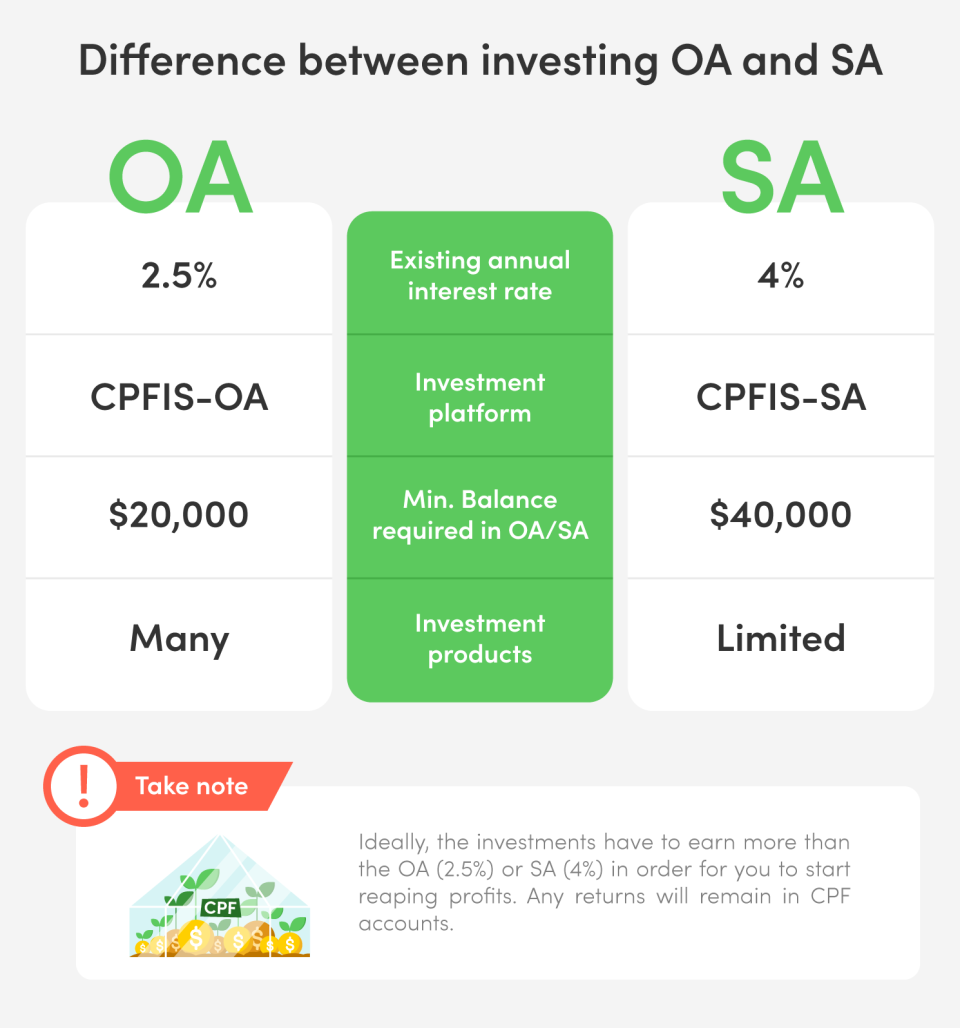

(Since CPFIS directly relates to OA and SA, we’ll talk a little more about these 2 accounts.)

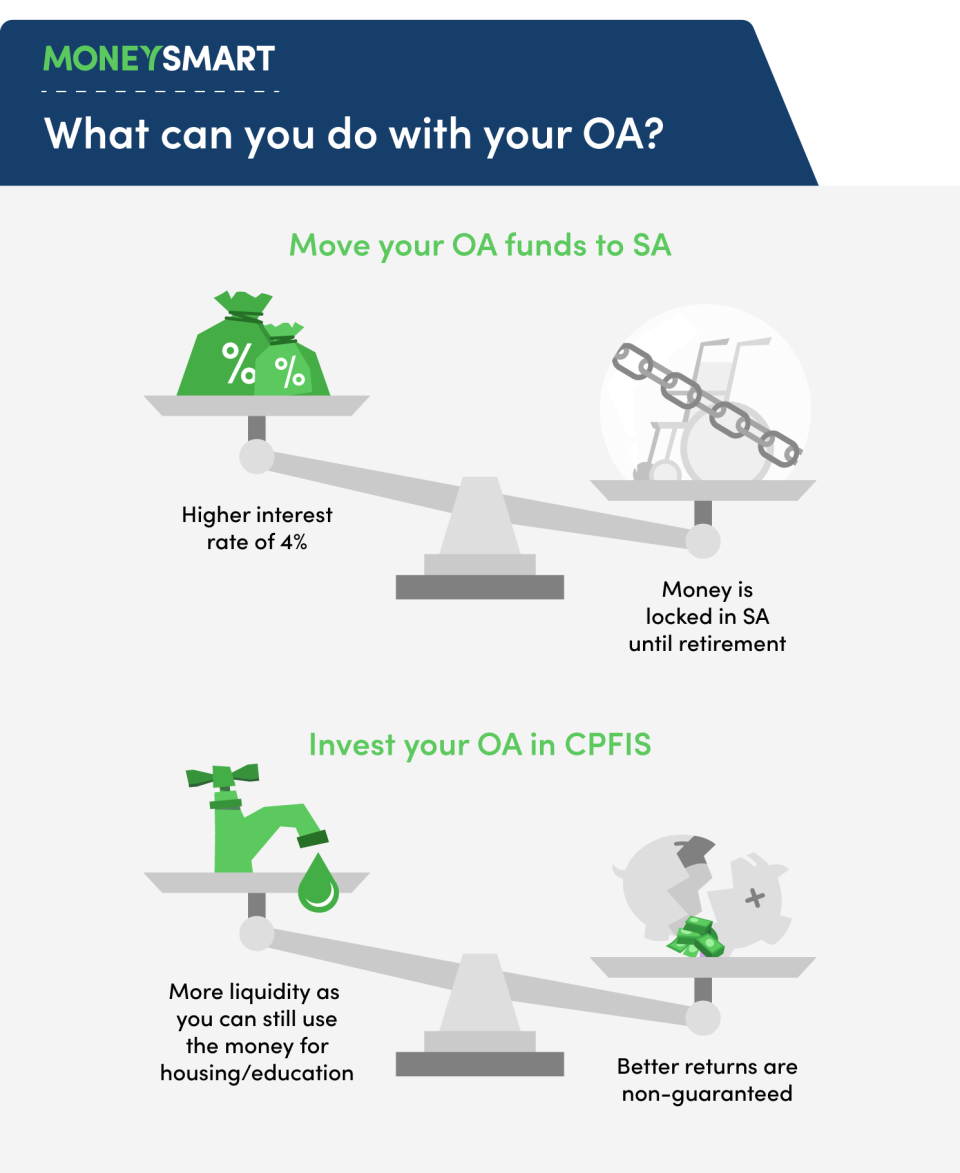

Obviously, the interest rate for SA is a lot more attractive than that of OA. So one way to get better returns from your CPF is simply to move your OA funds to your SA.

The problem is, this is a one-way street — you can’t transfer your SA funds back into your OA where you can spend it on housing or education. It’s just going to get locked up there until retirement. That’s why CPFIS is so attractive. You can get better returns than 2.5% on your OA savings without locking it up.

All that said, it’s wise to bear these interest rates in mind when you think about investing your CPF funds. It’s perfectly possible for investors to get <2.5% returns, in which case you’ll rue the day you signed up for CPFIS.

If you are unaware of the risks and costs of investing your funds, it’s probably wiser to let sleeping dogs lie and leave your money where it is. Or maybe consider moving some excess OA funds (that you definitely won’t need for education/housing) to your SA.

Who is eligible for the CPF Investment Scheme?

If you’re interested in CPFIS, there are a few requirements you need to meet (apart from having a CPF account, duh):

Factor | Minimum requirement |

Age | 18 years old |

Legal status | Not undischarged bankrupt |

CPF (OA) balance | $20,000 (for CPFIS-OA) |

CPF (SA) balance | $40,000 (for CPFIS-SA) |

There are two different requirements for the CPF account balance because there are actually two CPF investment schemes, one for OA and one for SA.

Broadly speaking, using your OA savings to invest under CPFIS-OA will give you more investment product options to choose from, including shares, gold and higher-risk ETFs and unit trusts.

These investments aren’t allowed under CPFIS-SA. (It’s also harder to beat the 4% interest rate on your SA, remember.)

What do you need to know before using your CPFIS?

The most important thing to remember about CPFIS is that any returns you get will go back to your CPF accounts. That means you should ideally be investing with the future in mind.

You don’t want to risk squandering all your available CPF funds on a risky product if you’re still not going to be able to enjoy the fruits of your investments for another 20 to 30 years.

That being said, CPF has already shortlisted investment products that are less volatile, which is good given Singaporeans’ penchant for.. um.. “risk-taking” (we mean gambling).

What can I use my CPF to invest in?

I know what you’re thinking. But no, unfortunately you can’t just withdraw your funds and go berserk with the latest cryptocurrency.

You can only invest in very specific products, the full details of which (down to the specific product names) are helpfully provided on the CPF website — see this complete list of CPFIS investments.

In summary, here’s a table of products ranked from least to most restricted:

Type of investment | CPFIS-OA | CPFIS-SA |

Singapore Government Bonds | Yes | Yes |

Yes | Yes | |

Annuities | Yes | Yes |

Endowment policies | Yes | Yes |

ETFs | Yes | Yes but not the higher-risk ones |

Unit trusts | Yes | Yes but not the higher-risk ones |

Investment-linked insurance products | Yes | Yes but not the higher-risk ones |

Fund management accounts | Yes | No |

Corporate bonds | Up to 35% of investible savings | No |

Shares | Up to 35% of investible savings | No |

Property funds | Up to 35% of investible savings | No |

Gold ETFs | Up to 10% of investible savings | No |

Other gold products | Up to 10% of investible savings | No |

Note: “Investible savings” refers to your account balance + whatever you’ve withdrawn for housing and education.

For example, if you’ve withdrawn $30,000 for housing and you now have $70,000 in your OA, your investible savings are $70,000 + $30,000 = $100,000. That means you can invest up to $35,000 (35%) in shares and property funds, and up to $10,000 (10%) in gold.

What are the potential returns of CPFIS investments?

This isn’t an easy question to answer, of course, because of the range of products available. For example, bonds tend to be lower risk, lower returns, while unit trusts are generally higher risk, higher returns.

Ideally, you’d want your investments to at least earn more than the risk-free interest rates of the CPF Ordinary Account (2.5%) and Special Account (4%).

Sounds doable, yes? But it’s not that easy in practice.

Because almost every investment involves some kind of extra cost — ranging from investment brokerage commission fees to hefty unit trust management fees — you need to make sure your returns earn enough to pay for those as well. Otherwise, these costs basically erode your returns.

In fact, these pitfalls (in tandem with some irresponsible financial advisors’ aggressive sales tactics) have left some Singaporeans worse off than if they had never touched the money in the first place!

… But the Gahmen will help us, right?

Of course lah. This is Singapore. The Government has already recognised that, left to our own devices, Singaporeans might fall prey to poor investment decisions under CPFIS.

According to a Q3 2019 report, only 60% of CPFIS-OA investors managed to beat the OA returns of 2.5%. And that’s pre-COVID, mind you. Sheesh.

This is partly because of a conflict of interest between Singaporeans and our financial advisors (FAs). In the past, FAs could earn fat commission fees when they successfully talk you into plunging your CPF savings into a unit trust or investment-linked insurance policy.

Back then, as much as 4% of your investment would’ve gone into FAs’ pockets. You’d have been better off putting your money in your SA, huh?

Since 2018, the gov has been applying “cooling measures” to discourage FAs from irresponsible selling, and to lower the costs of investment for all CPF investors.

From Oct 2020, they can no longer charge sales fees. “Wrap fees” (admin fees, basically) are also now capped at 0.4%. Of course, FAs can get around the lower fees by selling more expensive unit trusts to blur investors. There are many ways for FAs to make money, so let the buyer beware.

Sponsored Message

Want to always be on top of what’s happening in the market and get up-to-date news? You can now do it easily all in one place with SGX’s new Telegram Channel (ID: SGX Invest). Just simply click here to find out more!

Got it! How do I start investing under CPFIS-OA?

Provided you meet the eligibility criteria and understand the potential pitfalls, it’s easy to get started with CPFIS.

We recommend starting with CPFIS-OA as the interest rate of 2.5% is lower and therefore easier to beat through investing than your SA’s 4%. Here are the next steps.

Step 1: Open CPF Investment Account with DBS, OCBC or UOB

Open an account with your favourite local bank. Fees and charges are the same for all three, so it doesn’t matter which. This account is purely to allow your bank to administer the funds. You will still need a brokerage account to actually invest the money.

(FYI, for CPFIS-SA, there’s no need to open an Investment Account. Just approach the investment product providers directly.)

Step 2: Open investment brokerage account

The next step is to open an account with one of the CPFIS eligible investment brokerages. You can compare fees and apply for an account through MoneySmart.

DBS Vickers

More Details

Key Features

Backed by DBS, one of the safest and largest financial groups in Asia

Zero brokerage fees for first 5 DBS Vickers online trades

Complimentary access to real time stock prices, comprehensive research reports and diverse online investment tools

Trade with Central Provident Fund (CPF)

Zero account maintenance fee

Trade conveniently online though DBS Vickers Online Trading Platform and DBS mTrading Mobile Application or by phone call

OCBC Securities

More Details

Key Features

Leading securities and futures brokerage firm in Singapore with over 20 years of financial expertise

Offer global market access to over 15 securities exchanges across shares, ETFs, bonds, forex, futures and warrants

Earn interest rebate of 2.68% when financing Marginable Bonds (Promotion valid till 31st December 2020)

Provides reliable and secure online trading services through iOCBC Trading Platforms on desktop and mobile

Enjoy 24/5 customer service via phone call

UOB Kay Hian

More Details

Key Features

Back by United Overseas Bank (UOB), one of Asia's leading financial institutions

Gain access to competitive rates across a comprehensive range of investment products, including Stocks, CFDs, Leveraged FX, Unit Trust

Get trading tips from experts through regular seminars and UTRADE's dedicated trading assistance

Trade conveniently through UTRADE's user friendly platforms on tablet, desktop and mobile

The below fees (excl. CFD Commission Fees) refer to the UTRADE Edge Account. For other accounts, please refer to UOB Kay Hian.

If you wish to trade shares listed on SGX using UOB Kay Hian Trading Account, a CDP account is required for account opening. CDP account is to hold your Singapore shares. Apply for a CDP account via SGX website here

PhillipCapital (POEMS)

More Details

Key Features

Singapore broker with over 45 years of financial expertise and a global presence in over 15 countries

Access to over 40,000 products across more than 26 global exchanges

Available financial products include: stocks, ETFs, CFDs, DLC, warrants, bonds, unit trusts, FX, futures, share financing, securities borrowing and lending, excess funds management, IPO financing, HK Pre-IPO, regular saving plans, Robo Advisory, managed accounts, and insurance

Offers CDP linked account, cash management account, and margin account for stock and bond financing at 3.08% p.a.

POEMS 2.0: Online trading platform available on both web and mobile

POEMS 2.0 desktop trading tools include Advanced Order Types, Chart-Live, ChartWhiz, News, Research Reports, Account Management, Stock Analytics, Stock Screener, Trading Central, Web TV, Live Order Notifications, Time and Sales, Enhanced SGX Market Depth, Ticker Streamer, Market Watch, FXInvest, Economic Calendar, Live Positions (Beta)

POEMS 2.0 mobile trading tools include Advanced Order Types, Advanced Charting Tools, Watchlists, Smart News, Top Movers Heatmap, Integrated Account Management, Transaction History, price, order, account, announcements alert, Stock Analytics, Time ans Sales, Enhanced SGX Market Depth, UT Basket, FX Invest, Economic Calendar, Stock Discovery

Provides 24/5 dealing and advisory support and 24/7 ChatBot support

Offers specialist service and financial education across 15 Island-wide Phillip Investor Centre branches in Singapore

CGS-CIMB Securities

More Details

Key Features

Leading provider of choice for institutional and retail clients.

Enjoy lower cash outlays for retailers when purchasing CFD Bonds, in contract denomination of 50K notional.

Intuitive and interactive investment brokerage platforms that offers best in class trading experience on desktop, mobile and tablet.

Complimentary access to exclusive trading tools: iScreener, iFilter, Stock Filter.

Unrivalled expertise in Asia, with over 70 market analysts and 800 stocks covered in the region.

Enjoy dedicated service.

If you wish to trade shares listed on SGX using Cash Trading Account, a CDP account is required for account opening. CDP account is to hold your Singapore shares. Apply for a CDP account via SGX website here.

Your brokerage doesn’t necessarily have to be with the same bank as your CPF Investment Account. For example, you can open a CPF Investment Account with DBS, and invest in ETFs with Phillip Securities. Phillip will liaise with DBS to execute the purchase.

Read more: How to Buy Stocks in Singapore: Start Investing in 5 Easy Steps

Alternatively: Go through a (robo) advisor

If you have no wish to get all DIY with your CPF investments, you can invest through an advisor — human or otherwise.

There’s only one robo advisor that does CPFIS, and that’s Endowus. You can sign up for an account through MoneySmart and follow the instructions provided on investing your CPF.

Endowus

More Details

Key Features

Invest your CPF, SRS, and cash savings better, all on the Endowus platform, at the lowest cost possible.

No hidden fees, no sales charges and 100% trailer fee rebates.

Endowus has one all in, transparent access Fee, which includes advice, investment, rebalancing, transfers, and brokerage, at a fraction of the industry average.

Endowus work with asset managers to access their lowest fees possible and rebate 100% of any sales commissions and trailer fees.

Through partnerships with UOB and UOB Kay Hian, you can set up your Endowus account and CPF investment account completely online in under 10 minutes.

Found this article useful? Share it with anyone who wants to invest their CPF.

The post CPF Investment Scheme (CPFIS) - Everything You Need to Know About Investing with CPF appeared first on the MoneySmart blog.

MoneySmart.sg helps you maximize your money. Like us on Facebook to keep up to date with our latest news and articles.

Compare and shop for the best deals on Loans, Insurance and Credit Cards on our site now!

The post CPF Investment Scheme (CPFIS) – Everything You Need to Know About Investing with CPF appeared first on MoneySmart.sg.

Original article: CPF Investment Scheme (CPFIS) – Everything You Need to Know About Investing with CPF.

© 2009-2018 Catapult Ventures Pte Ltd. All rights reserved.

Yahoo Finance

Yahoo Finance