Coupang Inc (CPNG) Q1 2024 Earnings: Substantial Revenue Growth Amidst Farfetch Integration ...

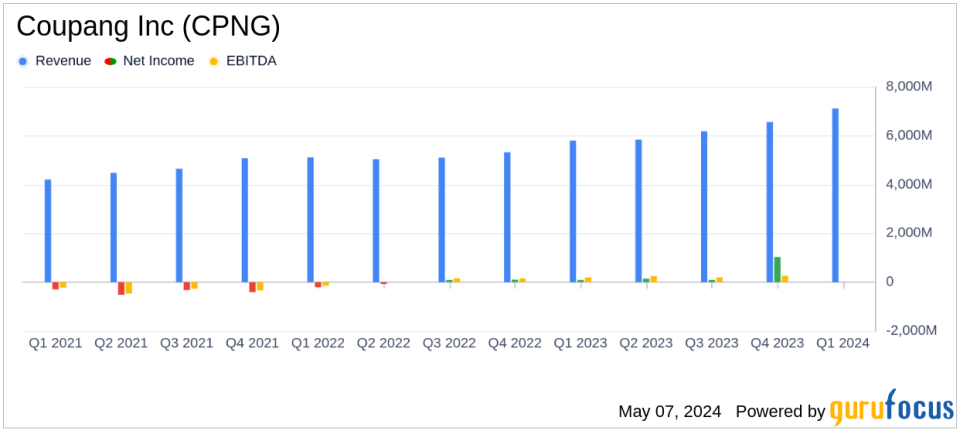

Revenue: Reported $7.1 billion, a 23% increase year-over-year, surpassing estimates of $6.925 billion.

Net Income: Achieved $5 million, significantly below the expected $85.66 million.

Earnings Per Share (EPS): Recorded at $0.00, falling short of the estimated $0.06.

Gross Profit: Grew to $1.9 billion, up 36% year-over-year, with a gross margin improvement of 260 basis points to 27.1%.

Free Cash Flow: Increased to $1.5 billion for the trailing twelve months, indicating robust operational efficiency.

Operating Cash Flow: Rose to $2.4 billion for the trailing twelve months, reflecting strong cash generation capabilities.

Adjusted EBITDA: Reached $281 million for the quarter, with a slight margin contraction of 20 basis points to 3.9%.

Coupang Inc (NYSE:CPNG), a leading e-commerce giant, disclosed its first quarter results for 2024 on May 7, revealing a notable increase in revenue and cash flows, contrasted by a dip in net income primarily due to its recent Farfetch integration. The detailed financial outcomes can be explored in the company's 8-K filing.

Coupang Inc operates primarily through its Product Commerce segment, which includes a vast array of offerings from apparel to electronics and groceries, significantly contributing to its revenue stream. The Developing Offerings segment, though smaller, includes international expansions and services like Coupang Eats and Fintech.

Financial Performance Overview

The company reported a robust increase in net revenues, reaching $7.1 billion, marking a 23% rise year-over-year (YoY) and 28% on an FX-neutral basis. This growth is particularly impressive considering the operational challenges posed by the integration of Farfetch, a luxury fashion retail platform acquired by Coupang. Excluding Farfetch, the revenue growth was 18% YoY on a reported basis.

Gross profit saw a significant jump, increasing 36% YoY to $1.9 billion, with the gross margin improving by 260 basis points to 27.1%. This margin enhancement underscores Coupang's improving efficiency and cost management strategies.

Challenges Impacting Earnings

Net income for the quarter stood at a modest $5 million, a sharp decline from $91 million in the prior year, largely due to losses associated with Farfetch. The diluted earnings per share (EPS) was $0.00, down from $0.05 a year earlier. Adjusted EBITDA was reported at $281 million, with a slight decrease in margin by 20 basis points to 3.9%, reflecting the financial impact of integrating Farfetch into Coupang's broader business framework.

Operational and Segment Highlights

The Product Commerce segment continued to be a strong performer with revenues of $6.5 billion, up 15% YoY. The segment's adjusted EBITDA rose significantly by 62% YoY to $467 million, indicating robust operational efficiency. On the other hand, the Developing Offerings segment, which now includes Farfetch, grew its revenues by 337% YoY to $620 million. However, this segment recorded a negative adjusted EBITDA of $186 million, reflecting the initial costs and challenges of integrating new operations.

Strategic Moves and Future Outlook

According to Gaurav Anand, CFO of Coupang, the company remains committed to enhancing customer experience and operational excellence. Despite the financial drag from Farfetch, Coupang anticipates this acquisition to reach near break-even in terms of adjusted EBITDA by the end of 2024, highlighting potential future profitability.

The company's strategic focus on expanding its customer base and enhancing per-customer revenue is evident from the increase in Product Commerce Active Customers to 21.5 million, a 16% increase YoY.

Conclusion

While the integration of Farfetch presents short-term financial challenges, Coupang's strong revenue growth and cash flow improvements reflect a resilient underlying business capable of sustaining growth. The company's strategic investments and expanding market presence in Korea and beyond suggest a positive trajectory, provided it can effectively manage the integration challenges associated with its newer segments.

Investors and stakeholders will likely watch closely how Coupang navigates these challenges while maintaining its growth momentum in the competitive e-commerce space.

Explore the complete 8-K earnings release (here) from Coupang Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance