Costco's (COST) Q3 Earnings Beat, Comparable Sales Up 14.9%

Costco Wholesale Corporation COST came out with decent third-quarter fiscal 2022 results, wherein both the top and the bottom lines not only came ahead of the Zacks Consensus Estimate but also improved year over year. This operator of membership warehouses maintained its impressive comparable sales run. The company’s e-commerce sales continued to exhibit strength. However, supply chain bottlenecks and higher labor and freight costs remain concerns.

Q3 Earnings & Sales Picture

Costco posted third-quarter adjusted earnings of $3.17 per share that handily beat the Zacks Consensus Estimate of $3.00. Including a one-time $77 million pretax charge (or 13 cents a share) for incremental benefits awarded under the new employee agreement effective Mar 14, quarterly earnings came in at $3.04 per share. The company had reported earnings of $2.75 per share in the year-ago period.

Total revenues, which include net sales and membership fees, were $52,596 million, up 16.2% from the prior-year quarter. The metric surpassed the Zacks Consensus Estimate of $52,277 million.

Costco’s growth strategies, improved price management, decent membership trends, and increasing penetration of the e-commerce business have been contributing to its performance. In the reported quarter, the company’s comparable e-commerce sales rose 7.4% year over year. Excluding the impact of gasoline prices and foreign exchange, the same exhibited an improvement of 7.9% year over year.

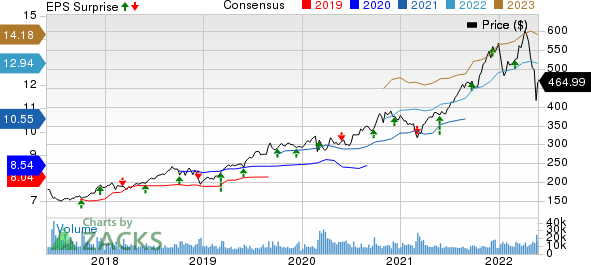

Costco Wholesale Corporation Price, Consensus and EPS Surprise

Costco Wholesale Corporation price-consensus-eps-surprise-chart | Costco Wholesale Corporation Quote

Delving Deeper

Costco’s net sales grew 16.3% year over year to $51,612 million, while membership fees increased 9.2% to $984 million in the reported quarter. Comparable sales climbed 14.9% from the prior-year quarter, reflecting an improvement of 16.6%, 15.2% and 5.7% in the United States, Canada, and Other International locations, respectively. We note that traffic or shopping frequency rose 6.8% globally and 5.6% in the United States. Average transaction or ticket was up 7.6% globally and 10.4% in the United States.

Excluding the impact of foreign currency fluctuations and gasoline prices, the company witnessed comparable sales growth of 10.8% in the quarter. The United States, Canada and Other International locations registered a comparable sales increase of 10.7%, 12.8%, and 9.1%, respectively.

Operating income in the quarter increased 7.7% year over year to $1,791 million, while operating margin (as a percentage of total revenues) contracted 20 basis points to 3.5%.

Store Update

Costco currently operates 830 warehouses — 574 in the United States and Puerto Rico, 105 in Canada, 40 in Mexico, 30 in Japan, 29 in the U.K., 16 in Korea, 14 in Taiwan, 13 in Australia, four in Spain, two each in France and China and one in Iceland.

During the quarter under discussion, Costco opened one net new warehouse plus two relocations. In the fourth quarter, the company plans to open 10 new warehouses. This will take the total count to 27 for the fiscal year, including three relocations.

Financial Aspects

Costco ended the reported quarter with cash and cash equivalents of $11,193 million and long-term debt (excluding the current portion) of $6,507 million. The company’s shareholders’ equity was $19,968 million, excluding non-controlling interests of $545 million. Management incurred capital expenditures of $854 million during the third quarter. The company anticipates capital expenditures for fiscal 2022 to be just shy of approximately $4 billion.

Shares of this Zacks Rank #3 (Hold) company have gained 22.9% in the past year compared with the industry’s rise of 0.1%.

3 Picks You Can’t Miss Out On

We have highlighted three better-ranked stocks, namely McCormick & Company MKC, Kroger KR and Sysco Corporation SYY.

McCormick, a manufacturer, marketer and distributor of spices, seasoning mixes and condiments, currently carries a Zacks Rank #2 (Buy). The company has an expected EPS growth rate of 6.1% for three-five years. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for McCormick’s current financial-year sales and EPS suggests growth of nearly 5% and 3.9%, respectively, from the year-ago reported figure. MKC has a trailing four-quarter earnings surprise of around 7.3%, on average.

Kroger, the renowned grocery retailer, carries a Zacks Rank #2 at present. The company has an expected EPS growth rate of 9.9% for three-five years.

The Zacks Consensus Estimate for Kroger’s current financial-year sales and EPS suggests growth of 3.2% and 4.1%, respectively, from the year-ago reported numbers. KR has a trailing four-quarter earnings surprise of 22.1%, on average.

Sysco Corporation, the leading global foodservice distribution company, carries a Zacks Rank #2. The company has a trailing four-quarter earnings surprise of 9.1%, on average.

The Zacks Consensus Estimate for Sysco Corporation’s current financial year sales and EPS suggests growth of 32.6% and 124.3%, respectively, from the year-ago period. Sysco has an expected EPS growth rate of 11% for three-five years.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Kroger Co. (KR) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

McCormick & Company, Incorporated (MKC) : Free Stock Analysis Report

Sysco Corporation (SYY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance