It would cost you £5 TRILLION to buy all the land in the UK

Britain’s overall wealth has soared to almost £10 TRILLION – fuelled by the spiralling value of land.

In fact, if you wanted to buy all the available land in the UK, you would need to part with £5 trillion.

The value of land has climbed by 412% over the past 20 years – almost double the rate of other assets which have increased by 211%.

Figures released by the Office for National Statistics show the country’s net wealth rose by £803bn last year- an increase of 8.9% and the largest recorded annual increase since 2004.

Daniel Groves, a statistician at the ONS, said land is now the UK’s most valuable asset, increasing fivefold since 1995.

Mr Groves said: “At over £800 billion, the rise in the nation’s total net worth is the largest annual increase on record.

“At £5 trillion, it (land) accounts for just over half of the total net worth of the UK at end-2016.”

The ONS’s annual bulletin provides estimates of the market value of financial and non-financial assets in the UK for the period 1995 to 2016.

MORE: Foreign buyers in £40bn race for London property

The national balance sheet is a measure of the wealth, or total net worth, of the UK.

It shows the estimated market value of financial assets, such as loans and non-financial assets, such as dwellings.

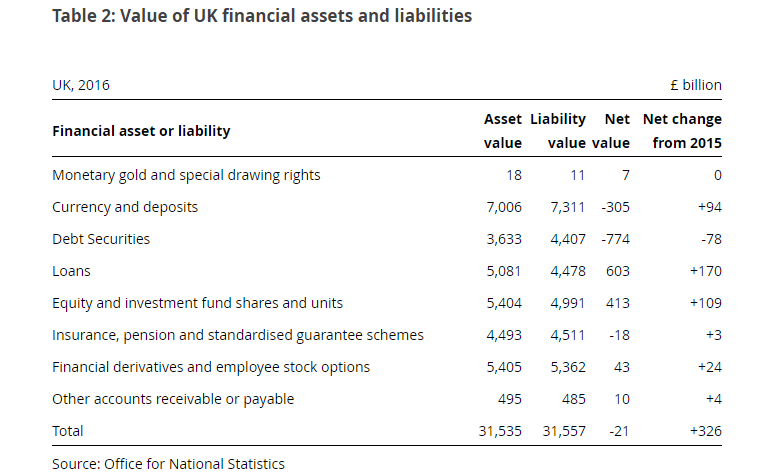

Financial net worth has risen by £326 billion in a year – with loans accounting for the largest net increase.

Land increased in value by £280 billion from 2015, a 5.9% increase. This is a notably smaller increase than in 2014 and 2015, when it increased by 15% and 10%, respectively.

The ONS report adds: “While land has seen strong growth in the latest years, this is still lower than growth prior to the economic downturn.

“During 1999 to 2004, land value increased at an average rate of 18.3%, compared with an average of 8.1% in 2014 to 2016.”

MORE: National Savings brings back Growth and Income Bonds paying up to 2.2pc

However, while the nation’s value and wealth is climbing, it’s not such a rosy picture for central government.

Those in power continue to rack up debt, as they have done since the financial crisis of 2008.

General government was valued at negative £845 billion in 2016, making it the sector with the lowest net worth.

Yahoo Finance

Yahoo Finance