Service Corporation (SCI) Stock Gains More Than 10% in 3 Months

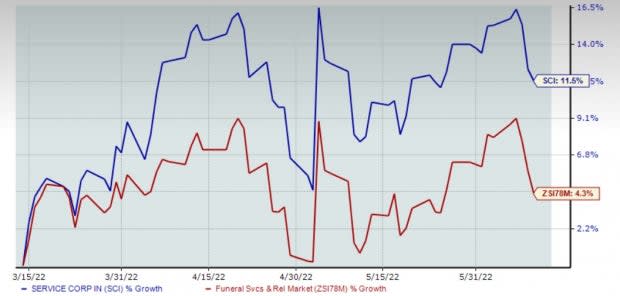

Service Corporation International SCI has been benefiting from solid revenues in the Funeral segment and a focus on expansion. Additionally, the company’s commitment to shareholders becomes evident from its dividend payouts and share repurchases. Shares of this Zacks Rank #2 (Buy) company have increased 11.5% in the past three months compared with the industry’s rise of 4.3%.

Funeral Segment Seems Strong

Revenues in the Funeral segment have been increasing for quite some time now. In the first quarter of 2022, consolidated Funeral revenues rose to $649.1 million from the $619.4 million reported in the year-ago quarter, indicating a 4.8% rise. Total comparable funeral revenues grew 2.9%, led by growth in core funeral revenues and recognized preneed revenues. Growth in core funeral revenues (of 1.7%) was driven by an increase in the core average revenue per service. Comparable preneed funeral sales production increased by 16.7%.

The upside can be attributed to a rise in velocity and sales averages as the company continues to gain on elevated leads. Management stated that the percentage of families opting to have funerals reverted to pre-pandemic levels. Also, the funeral sales average is being boosted by a rise in other revenues, including flowers and catering. The continuation of such trends bodes well for the segment.

Image Source: Zacks Investment Research

Focus on Expansion

Service Corporation remains committed to pursuing strategic buyouts for its segments and building new funeral homes to generate greater returns. During the three months ended Mar 31, 2022, SCI incurred capital expenditures of $56.7 million, which included higher investments in technology and associated infrastructure projects at the company’s cemetery and funeral locations. The company also invested in cemetery property development. Management expects capital improvements at existing locations and cemetery development expenditures in the band of $270-$290 million in 2022. In 2018, the company deployed approximately $200 million for acquisitions. Some notable acquisitions made by the company in the past include Alderwoods Group, Keystone North America, The Neptune Society and Stewart Enterprises. Also, buyouts in the cemetery segment are aimed at exploiting increased opportunities to cater to Baby Boomers.

Shareholder-Friendly Moves

Service Corporation is focused on enhancing shareholders’ returns. The company recently raised its repurchase authorization to nearly $394 million. This represents the total share repurchase authorization of about $600 million, effective May 4. Additionally, management announced a quarterly dividend of 25 cents per share. Service Corporation currently has a dividend payout of 21.8%, a dividend yield of 1.5% and a free cash flow yield of 5.7%. With an annual free cash flow return on investment of 11.1%, the dividend is likely to be sustainable.

Service Corporation International Price, Consensus and EPS Surprise

Service Corporation International price-consensus-eps-surprise-chart | Service Corporation International Quote

Raised View

On its first-quarter earnings release, management raised its bottom-line and adjusted cash flow guidance for 2022, reflecting robust first-quarter earnings, mainly related to escalated funeral services and increased preneed cemetery sales. Apart from this, management increased its estimates for preneed cemetery sales production and cemetery revenues for the remainder of 2022. The company expects the midpoint of the adjusted earnings per share (EPS) to come at $3.50 compared with the earnings of $3.00 projected earlier. The company envisions the adjusted EPS in the range of $3.00-$3.70 in 2022 compared with the earlier view of the $2.80-$3.20 band. We note that SCI’s earnings came in at $4.57 per share in 2021.

Hence, Service Corporation appears to be well-placed for growth. The consensus mark for 2022 earnings has gone up from $3.00 to $3.52 per share in the past 60 days.

Other Solid Bets From the Consumer Staple Space

Some other top-ranked stocks are Carriage Services, Inc. CSV, Sysco Corporation SYY and Medifast MED.

Carriage Services, the provider of funeral and cemetery services and merchandise, currently carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Carriage Services’ current financial-year sales and EPS suggests growth of 2.9% and 19.2%, respectively, from the year-ago reported figure. CSV has a trailing four-quarter earnings surprise of around 17.4%, on average.

Sysco, which engages in the marketing and distribution of various food and related products, carries a Zacks Rank #2 at present.

The Zacks Consensus Estimate for Sysco’s current financial-year sales and EPS suggests growth of 32.6% and 124.3%, respectively, from the year-ago reported number. SYY has a trailing four-quarter earnings surprise of 9.1%, on average.

Medifast, which manufactures and distributes weight loss, weight management, healthy living products, and other consumable health and nutritional products, currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Medifast’s current financial-year sales and EPS suggests growth of nearly 19% and 13.4%, respectively, from the year-ago reported figure. MED has a trailing four-quarter earnings surprise of 12.9%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance