Coronavirus update: US case count shows signs of leveling as analysts fear new depression

The coronavirus pandemic showed tentative signs of waning on Thursday, but its economic impact was as destructive as ever, with 4.4 million newly jobless Americans filing unemployment claims as Congress advanced more stimulus for hard-hit small businesses.

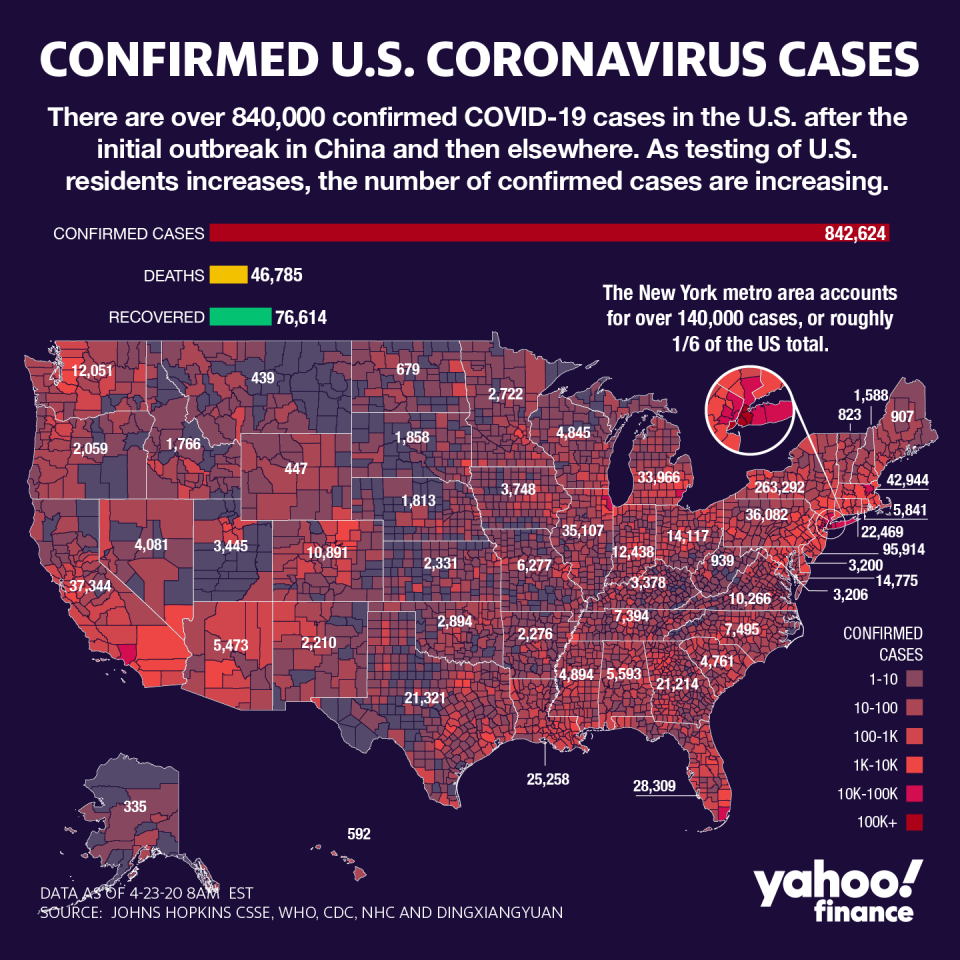

Global cases were nearing 2.7 million, and the death toll surpassed 186,000 Thursday. The U.S. now has over 845,000 cases and more than 47,000 deaths, amid a widening debate about whether certain states were pushing too quickly to end restrictions on public movement.

In both New York and New Jersey, the country’s two hottest spots of COVID-19 infections, hospitalizations and new diagnoses have been slowly declining. However, the Garden State is on pace to record its 100,000 case by the weekend, making it the second state to cross that milestone.

In recent days, investors have been mollified by the prospect of new stimulus measures, and hopes for a coronavirus treatment. The U.S. House of Representatives on Thursday is slated to vote on the second phase of the Paycheck Protection Program, which cleared the Senate earlier this week.

The fresh infusion of cash arrives at a time when the economic picture has grown increasingly dire, and at a time when state and local government officials continue to push for phased re-starts of their economies. Some states have been criticized for opening where it may be hard to maintain social distancing, while protests have erupted over the aggressive lockdowns keeping people at home.

Johns Hopkins Biocontainment Unit medical director Dr. Brian Garibaldi told Yahoo Finance’s The Ticker this week that he’s “really worried” about reopening the economy too soon because of how it could interfere with “our ability to try to limit the spread of this infection.”

Garibaldi added that the U.S. has “a long way to go before we can start thinking about getting back to business as usual. If we’re not careful about how we stage relaxing some of these restrictions that have led to a slowing of the infection rate, we’re going to be in a lot of trouble.”

Separately, the ranks of the jobless surged anew in the latest week, sparking fears of a deeper than expected recession and an uncertain recovery.

“At this point it would take a miracle to keep this recession from turning into the Great Depression II,” Chris Rupkey, MUFG managing director and chief financial economist, wrote in a note on Thursday.

“It is going to take years not months to put these pandemic jobless workers back to work at the shops and malls and factories and restaurants across the country,” he added.

Gilead under pressure

Gilead Sciences (GILD), the most closely-watched company for a coronavirus treatment, tumbled more than 6% Thursday after an accidental release of the Chinese clinical trials— which were terminated early due to low enrollment — suggested that its antiviral drug remdisivir was a disappointment.

Markets have been rallying on hopes that Gilead’s treatment was promising enough to effectively treat COVID-19 patients. However, Gilead pushed back on the leak, which was first reported by the Financial Times, calling the study’s results “inconclusive.”

In a statement to Yahoo Finance, the company said the World Health Organization “prematurely posted information regarding the study, which has since been removed” and that it “included inappropriate characterizations of the study.”

Gilead added that there were “multiple ongoing Phase 3 studies that are designed to provide the additional data needed to determine the potential for remdesivir as a treatment for COVID-19. These studies will help inform whom to treat, when to treat and how long to treat with remdesivir.”

The developments come on the heels of a leaked report this month about one of the U.S. clinical trials in Chicago that suggested the drug showed effectiveness among a small test group.

While Gilead is far from the only company with a treatment candidate, it is the furthest along in clinical trials. Eli Lilly (LLY) has multiple treatment candidates in Phase 2 clinical trials, with results expected in the next couple of months.

[Click here for more of Yahoo Finance’s coronavirus coverage: Personal finance tips, news, policy, graphics & more from Yahoo Finance]

Anjalee Khemlani is a reporter at Yahoo Finance. Follow her on Twitter: @AnjKhem

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Find live stock market quotes and the latest business and finance news.

Yahoo Finance

Yahoo Finance