Corcept (CORT) Q1 Earnings & Revenues Surpass Estimates

Corcept Therapeutics Incorporated CORT reported first-quarter 2024 earnings of 25 cents per share, which beat the Zacks Consensus Estimate of 21 cents. The company had reported earnings of 14 cents per share in the year-ago quarter.

Revenues increased 39% year over year to $146.8 million. The figure beat the Zacks Consensus Estimate of $138 million. The top line solely comprises product sales of Cushing’s syndrome drug, Korlym.

Quarter in Detail

Revenues from Korlym beat our model estimate of $129.8 million.

Research and development expenses surged 43% year over year to $58.5 million.

Selling, general and administrative expenses increased around 15.8% year over year to $56.3 million.

Consequently, operating expenses increased to $117.3 million, up 29.2% from the year-ago quarter’s level, owing to higher expenses to support ongoing clinical studies.

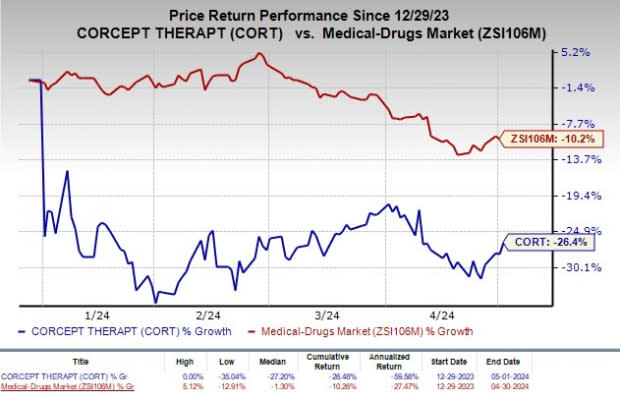

Corcept’s shares have lost 26.4% so far this year compared with the industry decline of 10.2%.

Image Source: Zacks Investment Research

Cash and investments, as of Mar 31, 2024, totaled $451 million compared with $425.4 million as of Dec 31, 2023.

2024 Guidance

Corcept increased its revenue guidance for 2024.

The company now expects total revenues in the range of $620–$650 million compared with the earlier projection of $600-$630 million. The Zacks Consensus Estimate for revenues is pegged at $606.8 million.

Pipeline Updates

CORT’s lead pipeline candidate, relacorilant, is being evaluated in phase III of the GRACE study to treat Cushing’s syndrome.

Last month, the company announced positive data from one part of the pivotal phase III GRACE study, which evaluated relacorilant for treating patients with all etiologies of endogenous Cushing’s syndrome.

Data from the open-label phase of the study showed that treatment with relacorilant led to clinically meaningful and statistically significant improvements in hypertension, hyperglycemia as well as other key secondary and exploratory endpoints.

A new drug application for relacorilant in Cushing’s syndrome is likely to be submitted later in the second quarter of 2024.

Also, during the same time, CORT completed enrollment in the GRADIENT study, which is evaluating relacorilant for treating patients whose Cushing’s syndrome is caused by adrenal adenoma. Data from the same is expected in the fourth quarter of 2024.

Also, in April 2024, the company completed enrollment in the phase III ROSELLA study, which is investigating relacorilant in combination with Abraxane (nab-paclitaxel) for treating patients with recurrent, platinum-resistant ovarian cancer. Data from the ROSELLA study is expected by 2024-end.

Meanwhile, a phase Ib study is evaluating relacorilant in combination with Merck’s PD-1 checkpoint inhibitor, Keytruda (pembrolizumab), for treating patients with adrenal cancer with cortisol excess completed enrolment. Data from the study is expected in mid-2024.

This apart, Corcept completed enrollment in the phase II DAZALS study, which is evaluating its selective cortisol modulator, dazucorilant, for treating patients with amyotrophic lateral sclerosis (ALS), a degenerative neurologic disorder. Data from the same is expected by 2024-end.

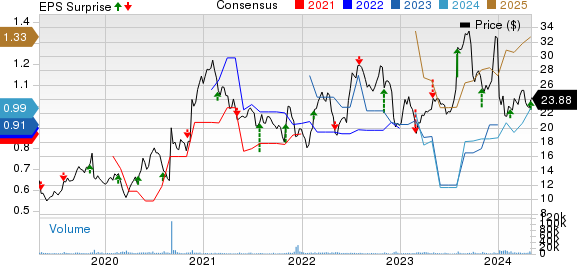

Corcept Therapeutics Incorporated Price, Consensus and EPS Surprise

Corcept Therapeutics Incorporated price-consensus-eps-surprise-chart | Corcept Therapeutics Incorporated Quote

Zacks Rank & Other Stocks to Consider

Corcept currently sports a Zacks Rank #1 (Strong Buy).

Some other top-ranked stocks in the healthcare sector are Voyager Therapeutics, Inc. VYGR, Ligand Pharmaceuticals Incorporated LGND and ANI Pharmaceuticals, Inc. ANIP, each sporting a Zacks Rank #1 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for Voyager Therapeutics’ 2024 loss per share have narrowed from $1.89 to $1.64. Year to date, shares of VYGR have decreased 1%.

VYGR’s earnings beat estimates in three of the trailing four quarters and missed the same once, the average surprise being 545.93%.

In the past 60 days, estimates for Ligand’s 2024 earnings per share have improved from $4.42 to $4.56. Year to date, LGND stock has failed to deliver any returns to investors.

Earnings of LGND beat estimates in each of the trailing four quarters, the average surprise being 84.81%.

In the past 60 days, estimates for ANI Pharmaceuticals’ 2024 earnings per share have improved from $4.25 to $4.44. Year to date, shares of ANIP have jumped 20.7%.

Earnings of ANIP beat estimates in each of the trailing four quarters, the average surprise being 109.06%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

Corcept Therapeutics Incorporated (CORT) : Free Stock Analysis Report

ANI Pharmaceuticals, Inc. (ANIP) : Free Stock Analysis Report

Voyager Therapeutics, Inc. (VYGR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance