Will Copart's (CPRT) Q2 Earnings Suffer From Cost Pressure?

Copart, Inc. CPRT is set to release second-quarter fiscal 2023 results today, after the closing bell. The Zacks Consensus Estimate for the quarter’s earnings per share and revenues is 56 cents and $934.4 million, respectively.

The Zacks Consensus Estimate for quarterly revenues indicates a 7.7% rise year over year. The Zacks Consensus Estimate for fiscal second-quarter earnings has remained stable over the past 30 days. The bottom-line forecast calls for an increase of 1.82% year over year.

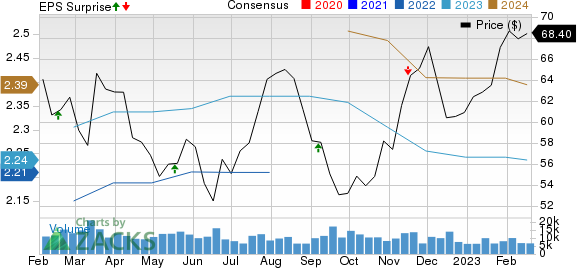

In the last reported quarter, this Texas-based online vehicle auctioning company missed earnings estimates on lower-than-anticipated service revenues and high costs. The bottom line also inched down 5.6% year over year. Over the trailing four quarters, Copart surpassed the Zacks Consensus Estimate thrice and missed once, the average surprise being 1.22%.

Copart, Inc. Price, Consensus and EPS Surprise

Copart, Inc. price-consensus-eps-surprise-chart | Copart, Inc. Quote

Factors at Play

Salvage auction volumes are likely to have remained elevated amid increased vehicle miles traveled and higher collision frequency. Additionally, aging vehicles and technologically-advanced auto parts may have also positively impacted Copart’s results. The costs of replacing such sophisticated components are extremely high, prompting insurance agencies to declare the vehicles as total loss. An expected increase in total loss rates is expected to have aided Copart’s top line.

Copart’s active presence in the United States and international markets is likely to have bolstered the firm’s performance in the to-be-reported quarter. The Zacks Consensus Estimate for service revenues is pegged at $764 million, indicating an uptick of 7.5% year over year. Also, the consensus mark for vehicle sales is $169 million, implying a rise from $156 million reported in the prior-year quarter.

On the flip side, rising operating expenses and high storage and labor costs are expected to have dented margins. Operating costs have also been the rise since several quarters amid increasing G&A expenditure. In fiscal 2022, the company’s G&A expenditure increased 18.2% year over year. Escalating G&A costs are likely to have dented margins in the to-be-reported quarter.

Also, increased investments due to business expansion are likely to have clipped Copart’s bottom line to some extent. The company has been doubling down on storage-capacity expansion. In the first quarter of fiscal 2023, capex amounted to $152.7 million (more than double the prior-year quarter), 80% of which was related to capacity expansion. Copart’s continued efforts to prioritize expansion are likely to have clipped cash flows.

What the Zacks Model Says

Our proven model does not conclusively predict an earnings beat for Copart this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That is not the case here.

Earnings ESP: It has an Earnings ESP of -1.79%. This is because the Most Accurate Estimate of earnings is pegged a penny lower than the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Copart currently carries a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Earnings Whispers for Peers

KAR Auctions Services Inc. KAR is set to report fourth-quarter 2022 results tomorrow, after the closing bell. Our model doesn’t conclusively predict an earnings beat for KAR Auctions this time around. The company has an Earnings ESP of 0.00% and a Zacks Rank #5 (Strong Sell)

The Zacks Consensus Estimate for KAR’s fourth-quarter earnings per share and revenues is pegged at 18 cents and $361 million, respectively. This Indiana-based provider of auction services and technologies for the auto market missed earnings estimates in three of the trailing four quarters and beat once, with the average negative surprise being 52.5%.

IAA, Inc. IAA is set to release fourth-quarter fiscal 2022 results tomorrow, after the closing bell. Our model doesn’t conclusively predict an earnings beat for IAA this time around. The company has an Earnings ESP of +4.35% and a Zacks Rank #4 (Sell)

The Zacks Consensus Estimate for IAA’s fourth-quarter earnings per share and revenues is pegged at 58 cents and $524 million, respectively. This Illinois-based auto auction company beat earnings estimates in three of the trailing four quarters and missed once, with the average surprise being 6.38%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Copart, Inc. (CPRT) : Free Stock Analysis Report

KAR Auction Services, Inc (KAR) : Free Stock Analysis Report

IAA, Inc. (IAA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance