Copart (CPRT) Q2 Earnings Beat Estimates, Increase 11% Y/Y

Copart, Inc. CPRT reported second-quarter fiscal 2023 (ended Jan 31, 2023) adjusted earnings per share of 61 cents, beating the Zacks Consensus Estimate of 56 cents. The outperformance was due to higher-than-anticipated service revenues. The bottom line also increased 10.9% year over year. The online auto auction leader generated revenues of $956.7 million, beating the Zacks Consensus Estimate of $934 million. The top line also increased 10.3% from the year-ago reported figure.

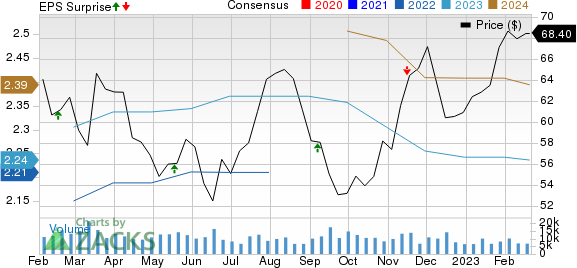

Copart, Inc. Price, Consensus and EPS Surprise

Copart, Inc. price-consensus-eps-surprise-chart | Copart, Inc. Quote

Key Tidbits

Fiscal second-quarter service revenues came in at $789.8 million, up from $711.1 million recorded in the year-earlier period as well as outpacing the consensus mark of $764 million. Service revenues accounted for 82.5% of the total revenues. Vehicle sales totaled $166.9 million in the quarter, up from the prior-year level of $156.4 million. The figure, however, lagged the consensus mark of $169 million.

Gross profit was up 5.7% year over year to $426.5 million. Total operating expenses flared up 13.7% to $591.2 million. General and administrative expenses rose 11.9% from the prior-year quarter to $47.8 million. Operating income rose to $365.5 million from $347.3 million recorded in the year-ago quarter. Net income also inched up 2.2% year over year to $293.6 million.

Copart had cash, cash equivalents and restricted cash of $1,660.9 million as of Jan 31, 2023, compared with $1,384.2 million as of Jul 31, 2022. Long-term debt reduced to $1,946,000 at the end of the reported quarter from $1,996,000 as of Jul 31, 2022.

CPRT currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

How are Peers Placed Ahead of Earnings?

Copart’s peers include KAR Auctions Services Inc. KAR and IAA, Inc. IAA.

KAR Auctions is set to report fourth-quarter 2022 results today, after the closing bell. Our model doesn’t conclusively predict an earnings beat for KAR Auctions this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That is not the case here. KAR has an Earnings ESP of 0.00% and a Zacks Rank #5 (Strong Sell). You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

The Zacks Consensus Estimate for KAR’s fourth-quarter earnings per share and revenues is pegged at 18 cents and $361 million, respectively. This Indiana-based provider of auction services and technologies for the auto market missed earnings estimates in three of the trailing four quarters and beat once, with the average negative surprise being 52.5%.

IAA is set to release fourth-quarter fiscal 2022 results today, after the closing bell. Our model doesn’t conclusively predict an earnings beat for IAA this time around. The company has an Earnings ESP of +4.35% and a Zacks Rank #4 (Sell)

The Zacks Consensus Estimate for IAA’s fourth-quarter earnings per share and revenues is pegged at 58 cents and $524 million, respectively. This Illinois-based auto auction company beat earnings estimates in three of the trailing four quarters and missed once, with the average surprise being 6.38%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Copart, Inc. (CPRT) : Free Stock Analysis Report

KAR Auction Services, Inc (KAR) : Free Stock Analysis Report

IAA, Inc. (IAA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance