Comstock Resources Inc (CRK) Q1 2024 Earnings: Challenges with Natural Gas Prices Impact Results

Revenue: Reported at $336 million, including realized hedging gains, falling short of the estimated $351.26 million.

Net Loss: Recorded at $14.5 million, or $0.05 per share, compared to an estimated net loss of $19.27 million, thus performing better than expected.

Adjusted Net Loss: Stood at $8.5 million, or $0.03 per share, indicating a narrower loss than the unadjusted figure.

Operating Cash Flow: Generated $182 million, demonstrating strong cash flow management.

Adjusted EBITDAX: Amounted to $230 million, showcasing robust earnings before interest, taxes, depreciation, amortization, and exploration expenses.

Liquidity Enhancement: Increased by $100.5 million through a private placement equity offering to a majority stockholder.

Operational Highlights: Drilled 16 operated horizontal Haynesville/Bossier shale wells with significant initial production rates, enhancing operational efficiency.

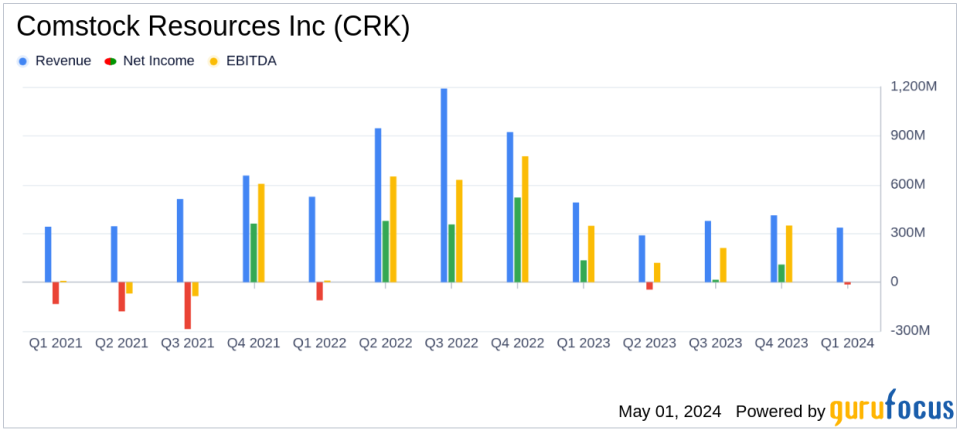

On May 1, 2024, Comstock Resources Inc (NYSE:CRK) released its financial and operating results for the first quarter of 2024 through its 8-K filing. The independent energy company, which focuses on the exploration and production of natural gas and oil in the Haynesville shale, reported a net loss of $14.5 million, or $0.05 per share, which is slightly better than the analyst's estimated loss of $0.07 per share. However, the reported revenue of $336 million fell short of the estimated $351.26 million.

Overview of Financial Performance

Comstock's financial results were significantly impacted by weak natural gas prices, which continued to challenge the sector. The company's total natural gas and oil sales amounted to $336.0 million, including $48.0 million from realized hedging gains. Despite these challenges, Comstock demonstrated operational resilience. The company added $100.5 million of liquidity through a private placement equity offering and expanded its leasehold in the Western Haynesville to over 450,000 net acres.

The company's production cost averaged $0.76 per Mcfe, with an unhedged operating margin of 63% and 68% after hedging. These figures highlight Comstock's efficient cost management in a challenging price environment.

Operational Highlights and Strategic Moves

During the quarter, Comstock drilled 16 operated horizontal Haynesville/Bossier shale wells and turned 18 wells to sales. The company's focus on the Haynesville shale is strategic, given its superior economics and proximity to major markets. Notably, the latest four Western Haynesville wells achieved impressive initial production rates between 35 to 38 MMcf per day, showcasing the high potential of these assets.

Moreover, Comstock's reaffirmed $2.0 billion borrowing base under its $1.5 billion revolving credit facility underscores financial stability and lender confidence.

Financial Statements Insights

The detailed financial statements reveal a net loss of $14.474 million for Q1 2024, compared to a net income of $134.503 million in the same period last year. This downturn is primarily due to lower natural gas prices and higher depreciation, depletion, and amortization costs, which totaled $190.689 million. The adjusted net loss was $8.538 million when excluding non-cash unrealized losses on hedging and other adjustments.

Adjusted EBITDAX stood at $229.583 million, reflecting the company's ability to generate earnings before interest, taxes, depreciation, amortization, and exploration expenses, despite lower revenues.

Conclusion

While Comstock Resources faced significant headwinds from weak natural gas prices in the first quarter of 2024, the company's strategic acquisitions, efficient operations, and strong hedging position have helped mitigate some of the impacts. The ongoing development in the Haynesville shale and the increased liquidity position Comstock to navigate the volatile energy market effectively. Investors and stakeholders will likely watch closely how these strategies unfold in subsequent quarters.

For further details, investors are encouraged to join Comstock's upcoming earnings call on May 2, 2024, or access the call's web replay available for twelve months thereafter.

Explore the complete 8-K earnings release (here) from Comstock Resources Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance