CommVault Systems Inc (CVLT) Fiscal 2024 Earnings Overview: Outperforms Revenue Estimates, ...

Q4 Revenue: Reported at $223.3 million, marking a 10% increase year-over-year, surpassing the estimated $212.51 million.

Q4 Earnings Per Share (EPS): Non-GAAP EPS was $0.79, exceeding the estimated $0.73.

Annual Revenue: Reached $839.2 million for the fiscal year, a 7% increase from the previous year, exceeding the estimated $828.47 million.

Annual Earnings Per Share: Non-GAAP EPS for the year was $2.98, slightly above the estimate of $2.94.

Subscription Revenue: Grew by 23% year-over-year to $429.2 million, indicating strong recurring revenue growth.

Operating Cash Flow: Generated $203.8 million in the fiscal year, highlighting robust cash generation capabilities.

Share Repurchases: Spent $184.0 million on share repurchases during the fiscal year, buying back approximately 2.479 million shares.

CommVault Systems Inc (NASDAQ:CVLT) released its 8-K filing on April 30, 2024, disclosing its financial results for the fourth quarter and the full fiscal year ended March 31, 2024. The company reported a significant revenue growth, surpassing analyst expectations and aligning closely with earnings per share (EPS) estimates.

CommVault Systems Inc, a leader in cyber resilience, offers a comprehensive platform combining data security and rapid recovery at scale. The company serves over 100,000 organizations worldwide, providing solutions that are crucial in the face of increasing cyber threats.

Fiscal 2024 Performance Highlights

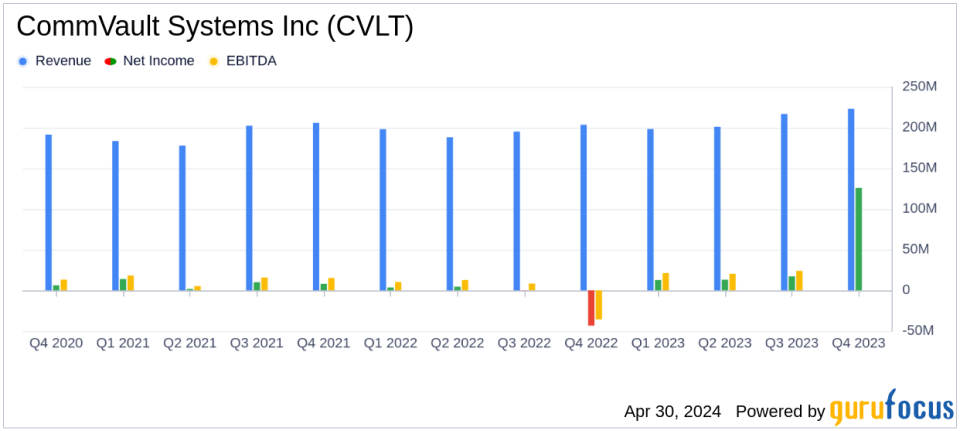

The fourth quarter showed robust performance with total revenues reaching $223.3 million, marking a 10% increase year-over-year and surpassing the estimated $212.51 million. This growth was driven by a 27% increase in subscription revenue, which totaled $119.9 million. The annual figures were also strong, with total revenues for the fiscal year amounting to $839.2 million, a 7% increase from the previous year, and slightly above the estimated $828.47 million.

CommVault's earnings per share (EPS) for the fiscal year stood at $2.98 on a non-GAAP basis, closely aligning with the analyst projection of $2.94. The company's operational efficiency is reflected in its non-GAAP operating margin of 21.1% for the year.

Operational and Financial Metrics

Income from operations (EBIT) was reported at $18.2 million for the quarter, with a non-GAAP EBIT of $45.2 million, demonstrating a healthy operating margin of 20.2%. The annual income from operations reached $75.4 million. Notably, the company's operating cash flow was robust, totaling $80.0 million for the quarter and $203.8 million for the year.

CommVault has been active in returning value to shareholders, repurchasing approximately 547,000 shares for $50.4 million during the quarter and about 2,479,000 shares for $184.0 million over the fiscal year.

Strategic Initiatives and Market Position

President and CEO Sanjay Mirchandani highlighted the resonance of the Commvault Cloud platform with customers, emphasizing its role in data security and resilience. The company's strategic focus on subscription-based models has paid off, with subscription Annual Recurring Revenue (ARR) growing by 25% year-over-year.

Looking ahead, CommVault provided guidance for fiscal year 2025, projecting total revenues between $904 million and $914 million and expecting a 14% growth in total ARR. The company also anticipates maintaining a strong non-GAAP operating margin between 20% and 21%.

Conclusion

CommVault's fiscal 2024 results not only demonstrate its ability to exceed revenue expectations but also highlight its strategic positioning for sustained growth. The alignment of its EPS with analyst projections and its forward-looking guidance suggest a stable financial trajectory, reinforcing its role as a pivotal player in the cyber resilience space.

For investors and stakeholders, CommVault's consistent performance and strategic market positioning offer a promising outlook, making it a noteworthy entity in the technology sector.

Explore the complete 8-K earnings release (here) from CommVault Systems Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance