Commodity Technical Analysis: Gold Probably Faces Resistance at 1727

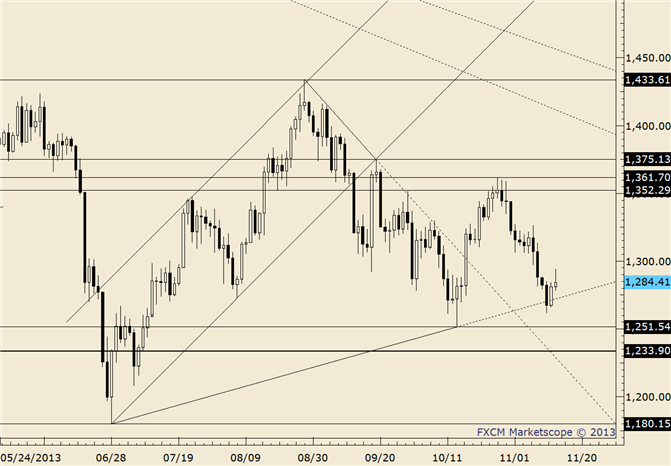

Daily Bars

Chart Prepared by Jamie Saettele, CMT

Commodity Analysis: “Viewed in light of the 3 wave advance from 1672.50, the trend is lower.” Friday’s JS Spike right at mentioned support (1685) will probably propel gold to at least the 61.8% retracement of the decline from the 11/12 high at 1727. There is trendline resistance to keep an eye on as well.

Commodity Trading Strategy: Look to short strength from 1727 to 1738 with a 1754 stop.

LEVELS: 1673 1683 1704 1727 1738 1754

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance