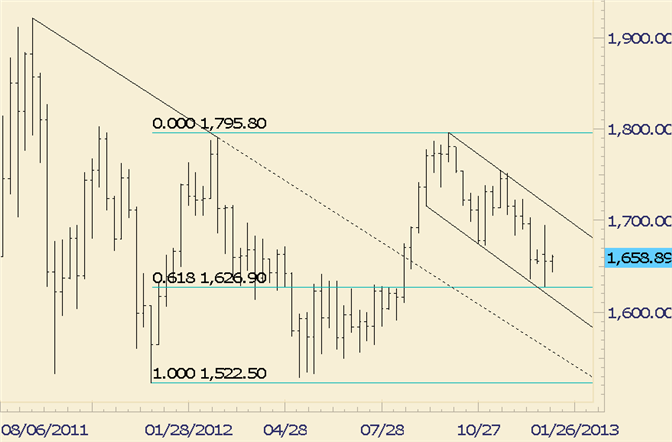

Commodity Technical Analysis: Gold Holding Fibonacci Level is Constructive

Weekly Bars

Chart Prepared by Jamie Saettele, CMT

Commodity Analysis: Gold is holding HUGE support. The level in question is defined by the 61.8% retracement of the rally from the 2011 low (lowest level of the move from the record high) and former resistance (top of congestion from June to August 2012). The response at the level has been impressive. By the same token, a break of this well-defined support level could lead to a rush for the exits and extension of weakness.

Commodity Trading Strategy: Given the strong bounce from support, I’m inclined to look higher but weakness below Friday’s low negates anything bullish. Near term resistance is being tested now (1660).

LEVELS: 1585 1610 1626 1660 1670 1684

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance