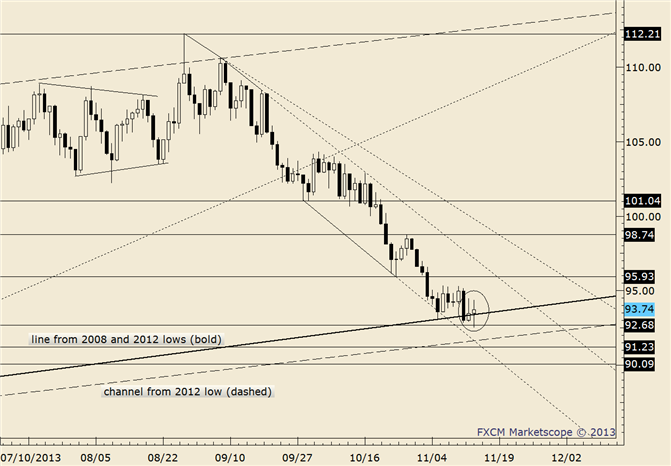

Commodity Technical Analysis: Crude Inching Towards Fibonacci Resistance

Daily Bars

Chart Prepared by Jamie Saettele, CMT

Commodity Analysis: “The trend has been down since September and it’s probably best to look lower since the November low as nothing more than consolidation before additional weakness.” IF crude can sustain a downside break then focus (probably later in the month) would shift to the 78.6% retracement of the rally from 7726 and channel support. Also keep an eye on former trendline resistance, which indicated support on 11/28.

Commodity Trading Strategy: 8835/89 is estimated resistance to short into against 9031.

LEVELS: 8363 8454 8565 8835 8889 9031

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance