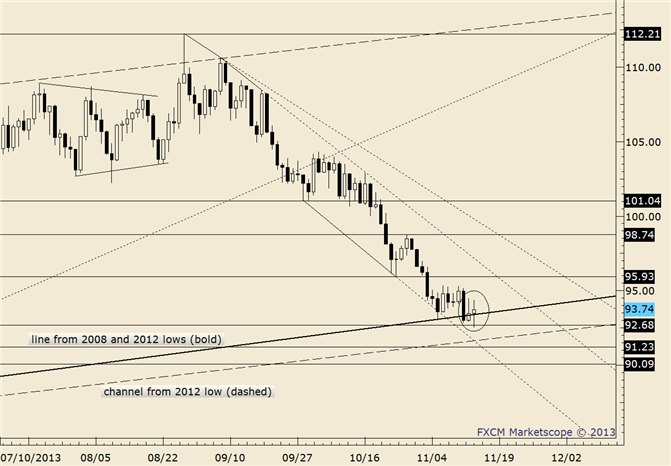

Commodity Technical Analysis: Crude Fails at Fibonacci Level Again

Daily Bars

Chart Prepared by Jamie Saettele, CMT

Commodity Analysis: “The trend has been down since September and it’s probably best to look lower since the November low as nothing more than consolidation before additional weakness.” The rally from 8519 (12/11 low) took out the November high before reversing again at Fibonacci resistance. The false break higher is bearish in its own right.

Commodity Trading Strategy: The pop above the November high stopped us out of shorts. It’s best to wait until next week before attempting anything again.

LEVELS: 8404 8519 8765 9051 9125 9200

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance