CNG Vehicles Aid Republic Services (RSG) Amid Low Liquidity

Republic Services RSG has had an impressive run in the year-to-date period, wherein its shares have gained 13.8%, outperforming the 10.6% rally of the industry it belongs to and the 12.4% rise of the Zacks S&P 500 Composite.

RSG reported mixed first-quarter 2024 results. Earnings per share (excluding 1 cent from non-recurring items) of $1.5 beat the Zacks Consensus Estimate by 5.8% and increased 16.9% from the year-ago quarter. Revenues of $3.9 billion missed the consensus mark by a slight margin but increased 7.8% year over year.

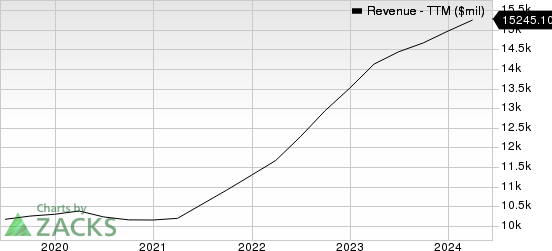

Republic Services, Inc. Revenue (TTM)

Republic Services, Inc. revenue-ttm | Republic Services, Inc. Quote

How Is RSG Doing?

Republic Services is focused on improving its operational efficiency and lowering fleet operating costs by shifting to compressed natural gas (CNG) collection vehicles. In 2023, CNG was used to operate around 20% of the company’s recycling and solid waste collection fleet. About 13% of the company’s replacement recycling and solid waste vehicle purchases were CNG vehicles.

We anticipate the ongoing trends, such as increasing environmental concerns, rapid industrialization, increased population and active government measures to reduce illegal dumping, to continue benefitting Republic Services. The company remains focused on expanding its recycling volume via enhanced material handling processes and programs. RSG opened its first Polymer Centre last year to ramp up the recycling of plastics across North America. The company’s top line increased 10.8% year over year in 2023.

In 2023, 2022 and 2021, Republic Services paid out $650 million, $592.9 million and $552.6 million in dividends and repurchased shares worth $261.8 million, $203.5 million and $252.2 million, respectively. Such moves indicate the company’s commitment to creating value for shareholders and boosting their confidence in its business. These initiatives not only instill investor confidence but also positively impact the bottom line.

Republic Services' current ratio (a measure of liquidity) at the end of first-quarter 2024 was 0.53, lower than the preceding quarter's 0.56 and the year-ago quarter's 0.74. A current ratio of less than 1 indicates that the company may have problems paying off its short-term obligations.

RSG may encounter challenges in completely offsetting rising fuel expenses through fuel recovery fees due to contractual or market constraints. In 2023, the company's fuel costs amounted to $541.6 million, making up 3.6% of its revenues. In contrast, it spent $631.1 million in 2022, which represented 4.7% of its top line. The company experiences high seasonality in its revenues, resulting in reduced profit and rising operational risks.

Zacks Rank & Stocks to Consider

RSG currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Zacks Business Services sector are Aptiv APTV and Amplitude AMPL.

Aptiv currently carries a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

APTV has a long-term earnings growth expectation of 20.7%. It delivered a trailing four-quarter earnings surprise of 12.2%, on average.

Amplitude has a Zacks Rank of 2 (Buy) at present. It has a long-term earnings growth expectation of 32.6%.

AMPL delivered a trailing four-quarter earnings surprise of 61.1%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Republic Services, Inc. (RSG) : Free Stock Analysis Report

Aptiv PLC (APTV) : Free Stock Analysis Report

Amplitude, Inc. (AMPL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance